EMI Calculator

Loading EMI Calculator…

Check Razorpay products for your business

Razorpay POS

Collect payments swiftly in your store with Razorpay POS and its interesting offers.

Payment Pages

Easiest way to accept international and domestic payments with custom-branded online store.

How to use the EMI calculator

- Enter Loan Amount – Input the principal you wish to borrow.

- Enter Interest Rate – Use your lender’s annual rate in percentage.

- Select Loan Tenure – Choose your repayment period in months or years.

- Review Results – See your EMI, total interest, and total payable.

- Experiment – Adjust parameters to find the best balance between affordability and total cost.

Factors That affect EMI

- Principal Amount: Higher loans = higher EMIs.

- Interest Rate: Even small differences impact your payment significantly

- Loan Tenure: Longer tenure = smaller EMI but higher total interest.

- Interest Type: Fixed = stable EMI; Floating = EMI may vary

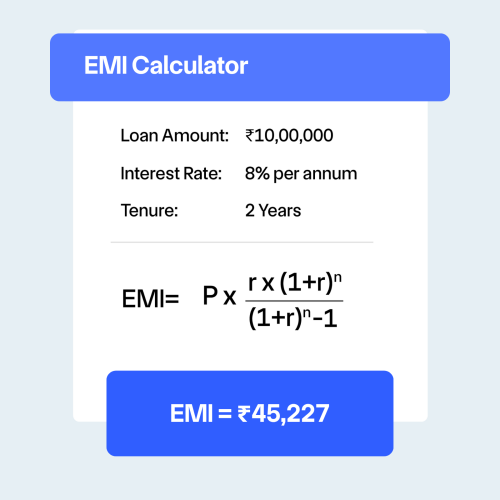

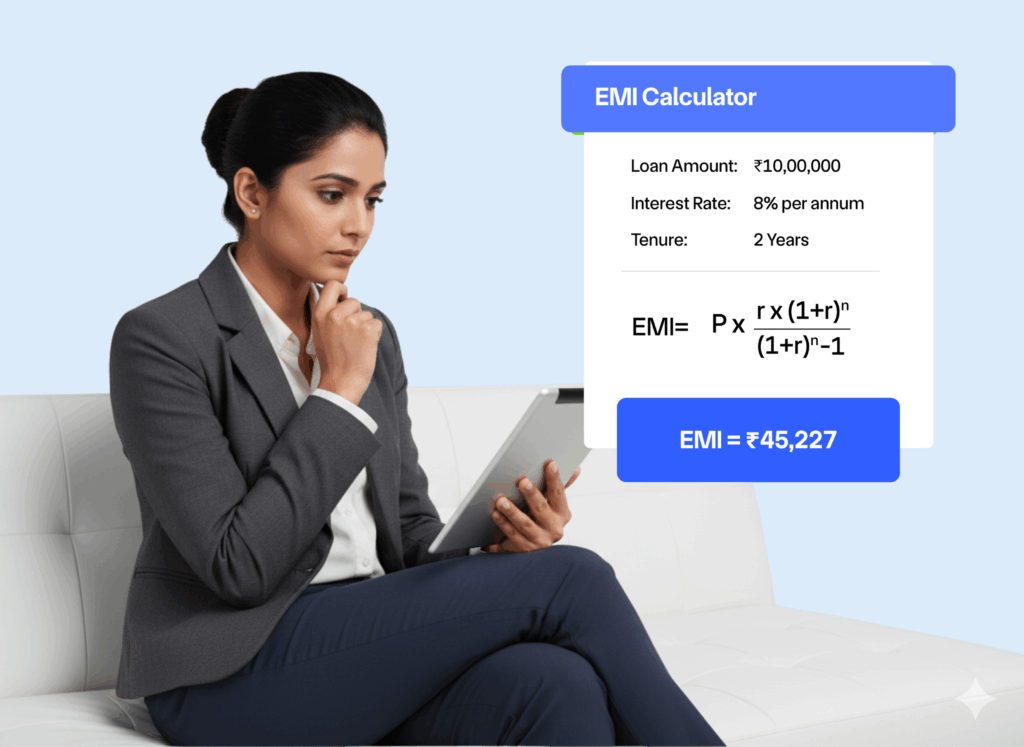

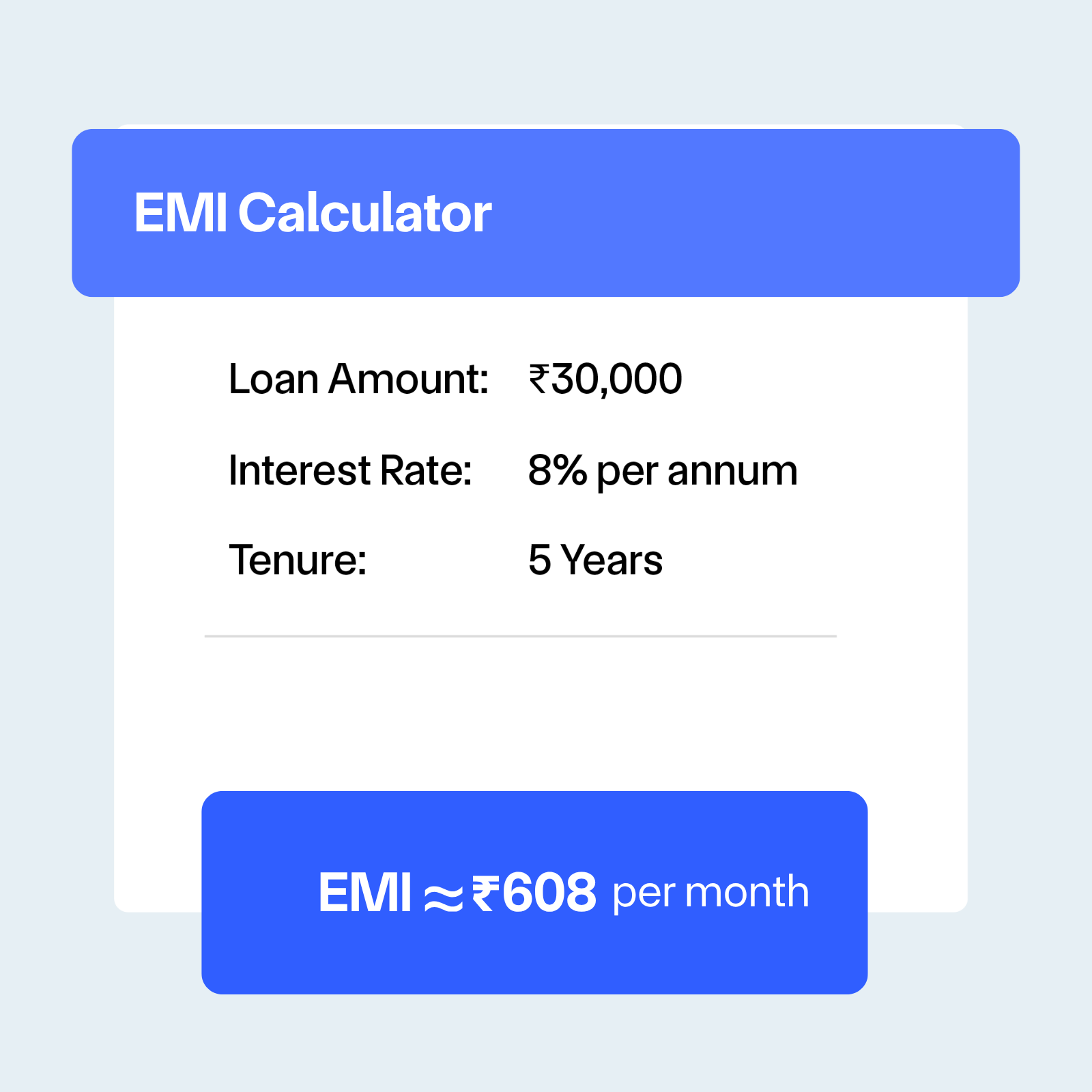

EMI formula with example

-

Use the formula:

EMI = [P × R × (1+R)N] ÷ [(1+R)N − 1] -

Where:

P = Principal loan amount

R = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

N = Number of monthly installments -

R = 0.00708, N = 240

EMI ≈ ₹21,879

Total Payable ≈ ₹52,50,960, Total Interest ≈ ₹27,50,960

Different types of EMI calculators

Home loan EMI calculator

Plan Your Home Purchase: Calculates your monthly EMI for housing loans, including property registration costs, insurance, and potential tax benefits

Car loan EMI calculator

Finance Your Vehicle: Helps determine EMIs for car loans, factoring in vehicle depreciation, insurance, and down payment options.

Personal loan EMI calculator

Manage Short-Term Borrowing: Tailored for unsecured personal loans with shorter tenures, providing clear monthly repayment insights.

Education loan EMI calculator

Support Educational Goals: Estimates EMIs for student loans, including moratorium periods and flexible repayment schedules after course completion.

Business loan EMI calculator

Plan Your Business Finances: Designed for commercial loans, helping entrepreneurs forecast repayments, manage cash flow, and plan working capital efficiently.

Prepayment calculator

Optimize Your Loan: Simulate balance transfers or prepayments to reduce EMIs, shorten tenure, and save on total interest.

Tips for reasonable EMI

- Keep EMIs ≤ 40% of monthly income for healthy cash flow

- First-time borrowers: Start with 25–30% of income for a safety buffer.

- Balance monthly affordability with total interest cost.

- Consider lifestyle, other commitments, and future income prospects when deciding EMI

Use cases for EMI calculation

Personal loans

Personal loans are often taken for short-term needs like medical emergencies, weddings, or vacations. Using an EMI calculator helps you assess the total repayment amount, monthly burden, and interest costs, ensuring that your loan fits comfortably within your budget.

Education loans

Education loans usually come with a moratorium period while the student is studying. An EMI calculator allows students and parents to plan ahead, estimating monthly repayments once the moratorium ends. This ensures smooth financial planning for both short-term and long-term obligations.

Business loans

Entrepreneurs often rely on loans to expand operations, purchase machinery, or manage working capital. EMI calculation helps forecast repayment schedules, align EMIs with cash flow cycles, and avoid overburdening the business, allowing for sustainable growth.

Frequently Asked Questions

Can EMI amounts change during the loan tenure?

For fixed-rate loans, EMIs remain constant throughout the tenure. Floating-rate loans may vary with market rate changes. Some lenders also offer step-up or step-down EMIs aligned with your income growth.

Is it better to choose a longer or shorter loan tenure?

Shorter tenures save money on interest but increase the EMI burden. Longer tenures lower monthly EMIs but increase overall interest costs. Choose based on your affordability and long-term financial goals.

How accurate are online EMI calculators?

Most online EMI calculators provide highly accurate estimates using standard formulas. However, actual EMIs may vary slightly due to processing fees, insurance, or lender-specific terms.

Can I prepay my loan to reduce EMI burden?

Yes, most lenders allow partial or full prepayment. Partial prepayments reduce either the EMI or the loan tenure, depending on your choice and lender’s policy.

Do EMI calculators consider processing fees and other charges?

Basic EMI calculators only compute principal and interest. Extra charges like processing fees, documentation costs, or insurance are not included and should be factored separately

What happens if I miss an EMI payment?

Missing EMIs can lead to penalties, increased interest costs, and a negative impact on your credit score. Consistently missed payments may even lead to loan default

Can I switch my loan to another bank for lower EMIs?

Yes, you can opt for a balance transfer to another lender offering better terms. This can reduce your EMI, but check for foreclosure charges and transfer fees before switching.

What percentage of my income should go toward EMIs?

Experts recommend keeping your total EMI obligations within 30–40% of your monthly net income to maintain healthy cash flow and avoid financial stress.