How do nano influencers with less than 10,000 followers create…

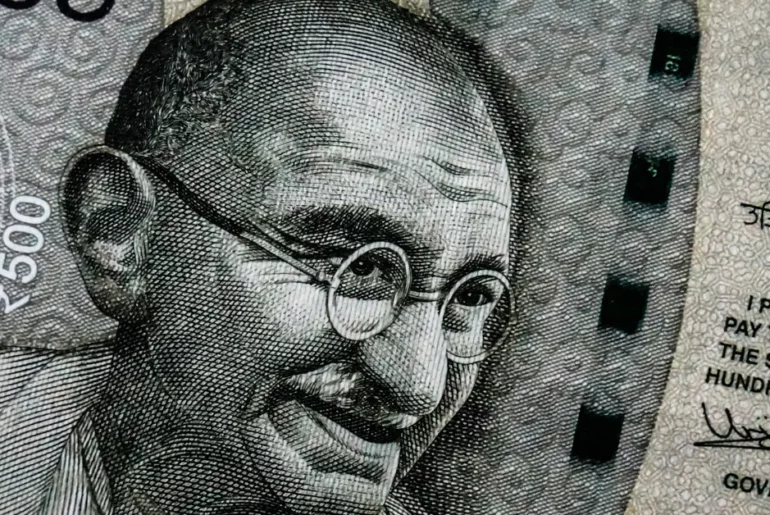

The characteristics of NEFT can help customers in spite of the dawn of faster payment solutions like IMPS in India.

One of the most important IMPS features is that it offers real-time transfers of funds that occur on an electronic platform.

NEFT allows people to transfer funds electronically from one bank account to another and is relevant to those who wish to transfer large sums of money.

Immediate Payments System (IMPS) is now one of the most widely-used forms of electronic payments across India.