A payment schedule is a critical tool for organising and tracking financial obligations, ensuring timely payments, and streamlining financial planning for individuals and businesses alike. It serves as a roadmap, outlining the agreed-upon terms for making payments over a specified period. By having a clear and well-structured payment schedule, both parties can manage their cash flow effectively and avoid potential misunderstandings or disputes.

In this article, we will delve into the world of payment schedule formats, providing you with valuable insights, samples, and examples. We will explore the key components of a payment schedule, the various types of templates available, and how businesses can benefit from using these tools. By using a standardised pay schedule template, businesses can maintain consistency and clarity in their payment structures, saving time and minimising errors in calculations and due dates.

Additionally, we will guide you through calculating a payment schedule and address some frequently asked questions to help you master this essential aspect of financial management.

Table of Contents

Payment Schedule Format

A typical payment schedule follows a structured format that clearly presents all the necessary information. Here’s a breakdown of the key components:

1. Header

The header includes the title of the payment schedule, the date it was created, and the parties involved (e.g., lender and borrower, service provider and client).

2. Table Format

The main body of the payment schedule is usually presented in a table format, making it easy to read and understand. The table includes columns for:

- Payment due dates

- Amount to be paid

- Payment methods (e.g., bank transfer, check, credit card)

- Status (e.g., paid, pending, overdue)

3. Notes Section

A dedicated section for additional terms, conditions, or explanations related to the payment schedule. This may include late payment penalties, early payment discounts, or any other relevant information.

Downloadable Sample: For reference

By adhering to this standardised format, payment schedules become more accessible and easier to understand for all parties involved.

By adhering to this standardised format, payment schedules become more accessible and easier to understand for all parties involved.

Key Components of a Payment Schedule

To ensure that your payment schedule is comprehensive and effective, it should include the following essential elements:

1. Payment Due Dates

Clearly specify the exact dates when each payment is expected to be made. This helps both parties plan their finances accordingly and avoid any confusion or delays.

2. Amount to be Paid

Include the precise amount that needs to be paid on each due date. Be sure to account for any applicable taxes, fees, or additional charges.

3. Payment Methods

Clearly state the acceptable methods of payment, such as bank transfer, check, credit card, or any other agreed-upon means. This ensures a smooth and hassle-free payment process.

4. Terms and Conditions

Outline any specific terms and conditions related to the payment schedule, including late payment penalties, grace periods, or any other relevant clauses.

5. Milestones

If the payment schedule is tied to specific project milestones or deliverables, make sure to include these details. This helps align payments with progress and ensures that both parties are on the same page.

By incorporating these key components, your payment schedule will serve as a comprehensive and reliable tool for managing financial obligations.

Types of Payment Schedule Templates

Payment schedule templates come in various forms, each designed to cater to specific needs and scenarios. Here are some of the most common types:

1. Loan Payment Schedule Template

This template is used to track and manage loan repayments over a specified period. It includes details such as the loan amount, interest rate, payment frequency, and the breakdown of each payment into principal and interest portions.

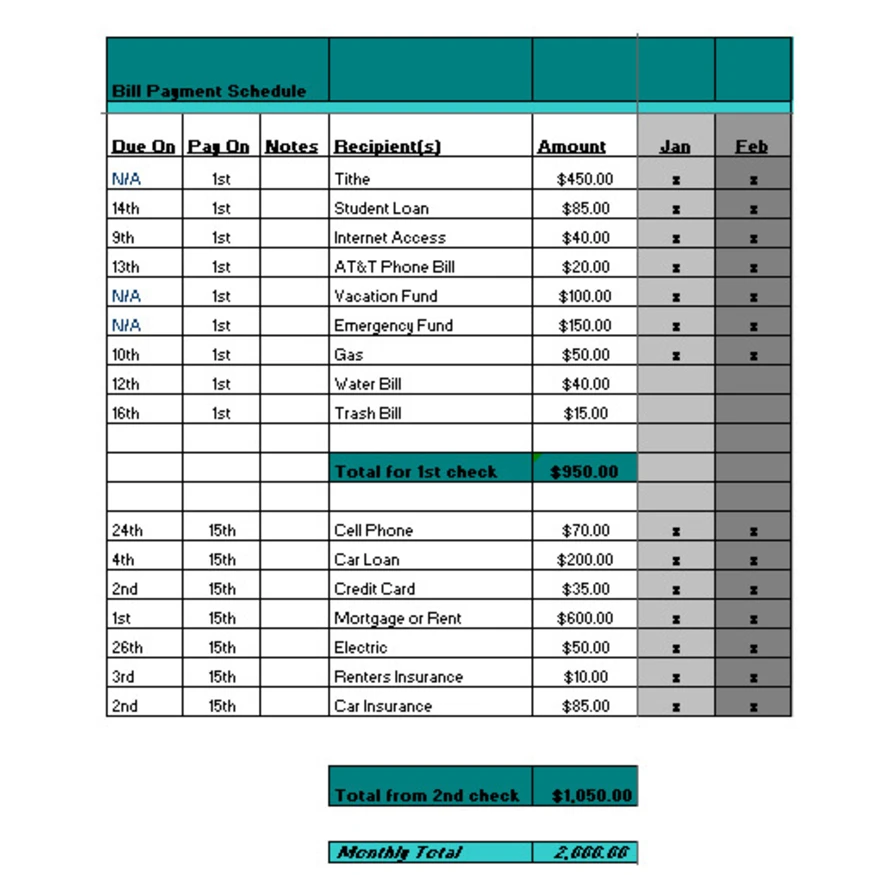

2. Bill Payment Schedule Template

Businesses can use this template to organise and keep track of their recurring monthly expenses, such as utility bills, rent, or subscription services. It helps ensure that all bills are paid on time and provides a clear overview of the company’s financial obligations.

3. Project Payment Schedule Template

This template is particularly useful for freelancers, contractors, or businesses involved in project-based work. It outlines the payment terms agreed upon in the contract, including the total project value, payment milestones, and any associated deliverables.

4. Construction Payment Schedule Template

Contractors and construction companies often use this template to manage payments throughout the various phases of a construction project. It ties payments to specific project milestones or stages, ensuring that cash flow aligns with the progress of the work.

5. Milestone payment schedule template

A milestone payment schedule template helps create a payment timeline that aligns payments with project milestones, which is ideal for projects with specific completion checkpoints.

6. Invoice payment schedule template

An invoice payment schedule template helps businesses manage multiple outstanding invoices by organising and budgeting for all upcoming payments to vendors.

Top 5 Payment Schedule Templates with Samples and Examples

1. Loan Payment Schedule Template

Purpose: This template is used to track and manage loan repayments over a specified period.

Components:

- Loan Amount

- Interest Rate

- Payment Frequency (monthly, quarterly, etc.)

- Breakdown of each payment into principal and interest

Sample Format:

| Payment Number | Due Date | Principal Amount | Interest Amount | Total Payment | Remaining Balance |

| 1 | 01/15/2024 | $200 | $10 | $210 | $9,800 |

| 2 | 02/15/2024 | $200 | $9.80 | $209.80 | $9,600 |

| 3 | 03/15/2024 | $200 | $9.60 | $209.60 | $9,400 |

2. Bill Payment Schedule Template

Purpose: This template helps businesses organise and track recurring monthly expenses like utility bills, rent, or subscriptions.

Components:

- Service Provider

- Due Date

- Amount Due

- Payment Status

Sample Format:

| Bill Type | Service Provider | Due Date | Amount Due | Payment Status |

| Electricity | ABC Energy | 01/05/2024 | $150 | Paid |

| Internet | XYZ Internet | 01/10/2024 | $60 | Pending |

| Rent | Landlord | 01/01/2024 | $1,200 | Paid |

3. Project Payment Schedule Template

Purpose: This template is particularly useful for freelancers or contractors involved in project-based work, outlining payment terms as per contract.

Components:

- Total Project Value

- Payment Milestones

- Associated Deliverables

Sample Format:

| Milestone | Due Date | Amount Due | Deliverable Description |

| Initial Deposit | 01/01/2024 | $1,000 | Project kick off meeting |

| Phase One | 02/15/2024 | $2,000 | First draft submission |

| Final Payment | 03/30/2024 | $1,500 | Final project delivery |

4. Construction Payment Schedule Template

Purpose: Used by contractors to manage payments throughout various phases of a construction project.

Components:

- Project Phases

- Payment Amounts

- Due Dates

Sample Format:

| Phase | Due Date | Amount Due |

| Foundation | 02/01/2024 | $10,000 |

| Framing | 03/15/2024 | $15,000 |

| Completion | 05/30/2024 | $20,000 |

5. Corporate Payroll Payment Schedule Template

Purpose: This template helps HR departments manage employee salary payments efficiently.

Components:

- Employee Name

- Pay Period

- Gross Salary

- Net Salary

- Payment Date

Sample Format:

| Employee Name | Pay Period | Gross Salary | Net Salary | Payment Date |

| John Doe | Jan 1 – Jan 15 2024 | $3,000 | $2,400 | 01/16/2024 |

| Jane Smith | Jan 1 – Jan 15 2024 | $3,500 | $2,800 | 01/16/2024 |

These examples demonstrate how payment schedule templates can be tailored to fit different industries and scenarios. By using these templates as a starting point, you can create payment schedule formats that meet your specific needs and ensure smooth financial transactions.

Why Businesses Should Use a Payment Schedule Template

Implementing payment schedule templates in your business operations offers several significant advantages:

1. Consistency and Clarity

One of the primary advantages of using standardised payment schedule templates is the promotion of consistency and clarity. By ensuring that all payment schedules within your organisation follow a uniform format, you significantly reduce the chances of misinterpretation among stakeholders. This clarity is essential for maintaining trust and ensuring that everyone understands their financial obligations.

2. Time-Saving

From my perspective, time is one of the most valuable resources for any business. Instead of starting from scratch each time you need to create a payment schedule, leveraging pre-designed templates allows you to save valuable time and effort. This efficiency enables you to redirect focus toward more strategic initiatives, such as improving customer relations or enhancing product offerings.

3. Error Reduction

One of the most critical aspects of financial management is accuracy. Payment schedule templates help minimise errors in calculations and due dates. With structured formats that include predefined fields, you can avoid costly mistakes that could lead to financial discrepancies or delays. Automated calculations built into these templates further enhance precision, ensuring timely and correct payments.

4. Enhanced Communication

Effective communication is vital in any business transaction. When all parties involved in a payment agreement utilise the same template, it fosters clear communication and ensures everyone is aligned. This shared understanding is especially important when dealing with external stakeholders, such as clients and suppliers, as it helps prevent misunderstandings that could lead to disputes.

5. Professionalism

Using well-crafted payment schedule templates reflects positively on your business’s image. It signals a commitment to accuracy and timely payments, which can help build trust with partners and clients. A professional approach to financial documentation enhances your reputation in the marketplace, showcasing your organisation as reliable and trustworthy.

6. Streamlined Financial Processes

By adopting payment schedule templates, businesses can streamline their financial processes significantly. These templates not only reduce administrative burdens but also encourage a culture of financial discipline and accountability. This structured approach aids in better cash flow management, ensuring that funds are allocated appropriately for upcoming payments.

How is the Payment Schedule Calculated?

Creating an accurate payment schedule involves several key steps to ensure all relevant information is captured and organised effectively. Here’s a step-by-step guide on how to calculate a payment schedule:

1. Gather Payment Details

The first step is to collect all necessary payment information:

- Names of parties involved: Identify all individuals or entities receiving payments.

- Payment amounts: Document the agreed amounts for each party.

- Specific terms or conditions: Note any special agreements affecting payments, such as performance bonuses or penalties for late payments.

2. Determine Payment Frequency

Next, decide on the frequency of payments based on your business needs:

- Weekly: Ideal for businesses with regular cash inflows.

- Bi-weekly: Common in many payroll systems.

- Monthly: Suitable for long-term contracts or loans.

This decision will help establish the structure of your payment schedule.

3. Set Payment Due Dates

Assign specific due dates for each payment based on the agreed-upon frequency. Consider factors such as weekends, holidays, or other special circumstances that may impact the timeline. For example:

- For monthly payments, select a consistent date each month (e.g., the 1st or 15th).

- For weekly payments, determine which day of the week will be used (e.g., every Friday).

4. Calculate Payment Amounts

If you know the total amount to be paid:

- Divide it by the number of payments to determine individual amounts.

- If amounts vary, accurately record each amount against its corresponding due date within your template.

5. Include Additional Details

Incorporate any additional details relevant to the payment schedule:

- Late payment penalties: Specify any fees incurred for missed deadlines.

- Grace periods: Outline any leeway allowed before penalties apply.

- Other specific terms: Include conditions related to adjustments or changes in payments.

6. Review and Finalize

Once you have populated the payment schedule template with all the necessary information:

- Review it carefully for accuracy and completeness.

- Double-check calculations, dates, and any critical details before finalising the schedule.

A well-calculated payment schedule serves as a roadmap for both parties involved, providing clarity and transparency throughout the payment process. It helps avoid disputes, ensures timely payments, and contributes to maintaining healthy financial relationships.

By following these steps diligently, businesses can create effective payment schedules that not only meet their operational needs but also enhance overall financial management practices.

Pros and Cons of Payment Schedules

Each payment method has its advantages and disadvantages. Let’s explore the pros and cons of each approach.

1. Weekly Payments

This method is common among wage earners, freelancers, and contract workers who prefer frequent paychecks. It’s especially favoured by workers who enjoy receiving payments often. However, it can be costly for employers, as processing payments every week can incur higher administrative expenses. Many online companies opt for weekly payments due to the large number of workers with varied schedules, requiring different payment amounts.

2. Bi-Weekly Payments

Bi-weekly payments are popular with hourly workers, as their total work hours can fluctuate week to week—sometimes reaching 40 hours and other times fewer. For employers, the challenge lies in managing the processing costs and calculating payments for each employee. To offset these costs, some companies may charge workers a processing fee, which can be included in the payment schedule template.

3. Bi-Monthly Payments

Salaried employees often prefer bi-monthly payments, as they don’t have to wait a full 30 days to receive their pay. Payments are typically made on the 1st and 15th of each month. Companies favour this schedule as it is more cost-effective compared to weekly or bi-weekly payments.

4. Monthly Payments

The monthly payment method is the most cost-effective for employers, as it incurs the lowest processing costs. However, it is typically the least favoured by employees who feel the 30-day waiting period is too long.

Conclusion

Payment schedule formats play a vital role in ensuring the smooth and efficient management of financial obligations. By utilising payment schedule templates, businesses and individuals can streamline their payment processes, reduce errors, and foster better communication with their partners and clients.

The key components of a payment schedule format, such as payment due dates, amounts, methods, and terms and conditions, provide a comprehensive framework for tracking and fulfilling financial commitments. Different types of payment planner templates cater to the specific needs of various industries and financial scenarios.

Whether you are a freelancer, a small business owner, or a large corporation, implementing a well-structured payment schedule format can help you stay organised, avoid financial disputes, and maintain healthy cash flow. By leveraging the power of payment schedule templates and following best practices for calculating and managing payments, you can take control of your financial obligations and focus on growing your business.

A clear and comprehensive payment schedule is not just a document; it is a powerful tool that can help you build trust, foster long-term relationships, and achieve your financial goals.

Frequently Asked Questions (FAQs)

1. What is a payment schedule template?

A payment schedule template is a pre-designed document that outlines the structure and format for organising and tracking payments over a specified period. It includes essential details such as payment due dates, amounts, and any relevant terms or conditions.

2. Are payment schedule templates free?

Many payment schedule templates are available for free online and are offered by various financial institutions, software providers, or business resources. However, some templates may come with a cost, particularly those that are part of larger financial management software packages or customised for specific industries.

3. Can I edit payment schedule templates?

Yes, most payment schedule templates are designed to be editable, allowing you to customise them based on your specific needs. You can modify the templates using spreadsheet software like Microsoft Excel or Google Sheets or even word processing applications like Microsoft Word or Google Docs.

4. What is a monthly payment schedule?

A monthly payment schedule is a type of payment plan where the total amount owed is divided into equal monthly instalments. This format is commonly used for recurring payments such as rent, loan repayments, or subscription services. It provides a predictable and manageable way to spread out payments over an extended period.