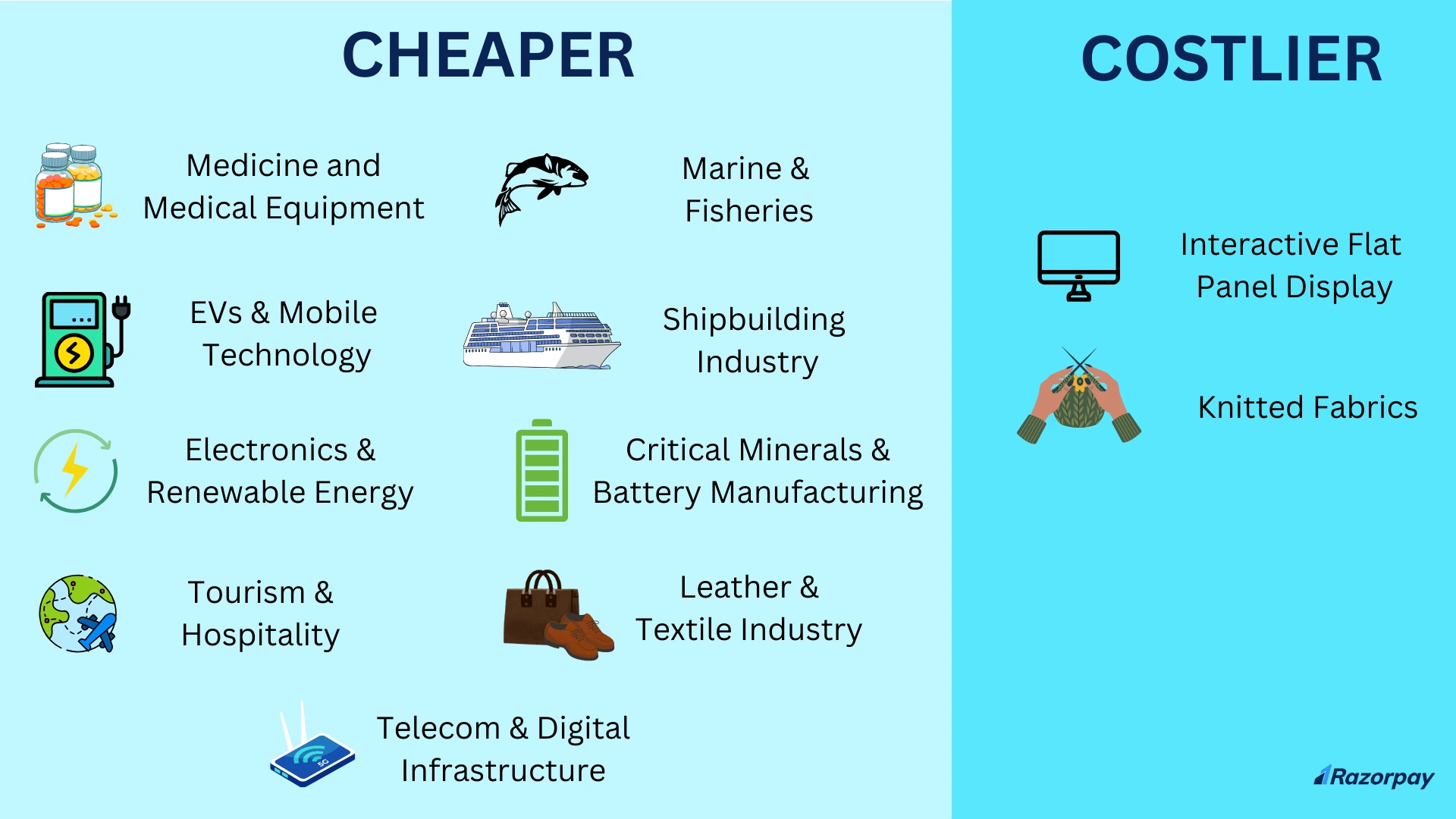

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, focuses on accelerating economic growth and driving India’s aspirations toward becoming a ‘Viksit Bharat’ (Developed India). As part of this vision, the budget introduces key tax revisions that make certain essential goods more affordable while increasing duties on others. Items like life-saving drugs, EV batteries, and renewable energy components are set to become cheaper, while electronics and textiles may see a price hike. Here’s a detailed breakdown of what’s getting cheaper and costlier this year.

Things Becoming Cheaper As per Union Budget 2025-26 Announcements

Things Becoming Cheaper As per Union Budget 2025-26 Announcements

The Union Budget 2025-26 has introduced several tax cuts and exemptions to make essential goods and emerging technologies more affordable. Here’s a breakdown of what’s getting cheaper:

1. Medicines & Medical Equipment

- 36 life-saving cancer drugs are now fully exempt from customs duty.

- Six other essential drugs will have a reduced basic customs duty (BCD) of 5%, making healthcare more affordable.

2. Critical Minerals & Battery Manufacturing

- Exemption on cobalt powder, lithium-ion battery waste, and 12 other critical minerals to support battery manufacturing and electric vehicle (EV) production.

3. Leather & Textile Industry

- BCD exemptions on wet blue and crust leather imports to support leather and footwear production.

- New incentives for textile sustainability and cotton farming reforms.

- This will result in cheaper leather belts, leather shoes, leather jackets

4. EVs & Mobile Technology

- 35 goods for EV battery manufacturing and 28 goods for mobile phone battery manufacturing added to the exempted capital goods list, reducing costs and promoting domestic production.

5. Electronics & Renewable Energy

- LCD and LED components: BCD on open cells and key components reduced to 5%, lowering the cost of LED and LCD screens.

- Clean energy tech: Tax incentives for solar PV cells, wind turbines, motors, and batteries to boost green energy adoption.

6. Marine & Fisheries

- Fish pasteur and frozen fish: Duties reduced from 30% to 5%, benefiting the seafood industry.

- Fish hydro licences: Reduced duties from 15% to 5% to encourage sustainable fishing practices.

7. Tourism & Hospitality

- Visa-free waivers for select countries to boost inbound tourism and travel.

8. Shipbuilding Industry

- Raw materials for ship manufacturing will be exempt from BCD for the next 10 years, fostering industry growth.

9. Telecom & Digital Infrastructure

- Carrier-grade Ethernet switches: BCD reduced from 20% to 10%, aligning costs with non-carrier-grade switches.

Things Becoming Costlier As per Union Budget 2025-26 Announcements

Alongside tax cuts on certain essential items, the Union Budget 2025-26 has also increased duties on select products, making them costlier. Here’s what will see a price hike:

1. Electronics

- Flat panel displays: Basic Customs Duty (BCD) increased from 10% to 20%, making TVs, monitors, and similar electronic devices more expensive for consumers.

2. Knitted Fabrics

- Import duties on knitted fabrics have risen from 10% to 20%, leading to higher production costs for textile manufacturers and ultimately increasing clothing prices.

FAQs

1. Which items have become cheaper after Budget 2025?

The budget has reduced duties on essential medicines, renewable energy components, EV batteries, and certain electronics, making them more affordable.

2. Which products are getting costlier in Budget 2025?

Items like flat panel displays and knitted fabrics will see a price hike due to increased customs duties.

3. Why has the government reduced taxes on some items and increased them on others?

The tax revisions aim to promote domestic manufacturing, support key industries, and align with India’s ‘Viksit Bharat’ development goals.

4. How will the price changes in Budget 2025 affect consumers?

Consumers will benefit from lower prices on essential goods like medicines and EVs, while electronics and textiles may become more expensive.

5. When will these new GST and customs duty changes take effect?

The revised tax rates and duties typically come into effect from April 1, 2025, unless stated otherwise in the budget announcement.

6. Are there any benefits for businesses in Budget 2025?

Yes, sectors like renewable energy, EV manufacturing, and pharmaceuticals will benefit from reduced duties, encouraging growth and investment.

7. How does Budget 2025 impact the electronics industry?

While some electronics like LED components have seen tax cuts, others like flat panel displays will become costlier due to increased duties.

8. What is the government’s focus in Budget 2025?

The budget prioritizes economic growth, infrastructure development, and domestic manufacturing while supporting India’s transition to a developed economy.