You must have heard this buzzing term, GST E-way bill in tax sectors. Before we discuss this, you need to know the basics of GST and the consequences which resulted in the compliance of the E-way bill mandating.

Indian government implemented the GST in July 2017 with the motto “One nation, One Tax, One Market, One E-Way Bill.” The basic logic is that the “X” amount of GST payable by you on the sales will get compensated from the “Y” amount of GST you already paid via purchase. But certain loopholes provoked the consumers to commit false entries and fraud, which boosts the purchase but leads to tax evasion.

Indian government implemented the GST in July 2017 with the motto “One nation, One Tax, One Market, One E-Way Bill.” The basic logic is that the “X” amount of GST payable by you on the sales will get compensated from the “Y” amount of GST you already paid via purchase. But certain loopholes provoked the consumers to commit false entries and fraud, which boosts the purchase but leads to tax evasion.

To curb this kind of tax evasion, the government implemented various rules and regulations. One such regulation was the necessity of an e-way bill on the transport of goods above Rs 50,000/- where the authority records the inventory of the goods and various other details like the transporter, buyer, seller, and create proper invoices. This way, the government tracks the movement of the goods and invoices booked against the same.

Table of Contents

What is an e-way bill?

An electronic-way bill or the e-way bill is a document generated online on the e-way portal to transport goods interstate or intrastate. The e-way is covered under Section 68 of the CGST Act & Rule 138 of the CGST Rules, 2017.

The government has mandated the e-way bill from 1st April 2018 for consignments above the value of INR 50,000 only. An e-way bill contains basic information such as the consignor, consignee, the point of origin of the consignment, place of supply and approximate distance of the transport, with the value of goods, invoice number, HSN code, etc.

Bill must generate the E-Way Bill if the transportation of goods (road, railway, air or by sea) is done where the consignor or consignee is a registered person under GST. However, you can choose to generate an E-way bill voluntarily even if the consignment value is less than Rs 50,000. But the government has mandated that if any goods are transported interstate, then it is necessary to generate the e-way bill irrespective of the consignment value.

The government also states that if the consigner or consignee fails to procure the e-way bill with several goods more than Rs 50,000, the transporter will be liable to generate it.

When the e-way is generated, a unique number, the e-way bill number (EBN), is made available to the supplier along with a copy to the transporter and receiver. The validity of said e-way bill starts from the time of creation. For less than 100 km distance, it is valid for one day, and for every additional 100 km, one day is added.

To find out how much GST is due for your goods or services, simply use Razorpay online GST calculator. You can also use our GST Search tool to check and verify the GST details of any taxpayer or company.

The objective of the e-way bill is to:

- Keep smooth movement of goods

- Abolition of VAT check posts

- Prevention of Tax Evasion

- Movement tracking of Goods

- Curbing bogus good entries

Types of e-way bill:

- Normal e-way bill: It is generated when there is single order or one HSN of the transported good.

- Bulk e-way bill: It is generated when there is a bulk order or more than one HSN of transported goods.

How to generate an e-way bill:

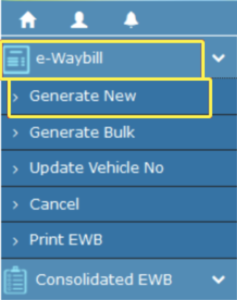

- Select the “Generate e-way bill” sub-category under the “E-way Bill” option on the portal.

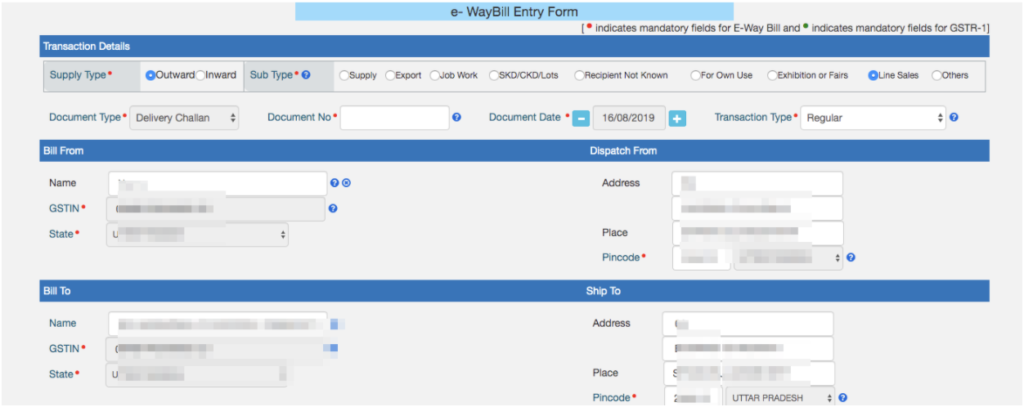

- Fill in the requested details in the form.

- Fill in the Invoice/Bill/Challan details with Transporter ID, through whom the registered person will transport the consignment with vehicle number.

- Select the type of transaction – Outward/Inward, where the outward indicates that the user is supplying the goods and inward suggests that the user is receiving the goods.

- Select the mode of transportation.

- Once the request is submitted, the system validates the entered values and pops up an appropriate message if there are any errors. Otherwise, the e-way bill in the EWB-01 form will be shown with a unique 12 digit number.

Consequences of non-compliance:

- Applicable tax and penalty equal to 100% (if the owner comes to claim the goods).

- Applicable tax and penalty equal 50% of the value of goods reduced by the tax amount paid (if no one comes to claim the goods).

- In the case of exempt goods, 2% or 5% of the value of goods if the owner claims the goods of Rs 25000/- whichever is less.

Exemptions from the e-way bill:

- Consignments below INR 50,000

- Transport of goods listed in Annexure to Rule 138 (14) such as live poultry, sheep, goats, birds, fish, and insects or their meat

- Goods transported by a non-motorized vehicle.

- Goods such as Alcohol for human consumption, petrol, diesel, aviation turbine fuel, and natural gas

- Goods movement caused by defense formation

- Transport of goods treated as no supply under Schedule III

- Empty cargo containers/ empty cylinders for LPG refilling

- Consignor is the Central/State government for the transport of goods by rail

- Goods transported under Customs bond from inland container depot to a customs port, airport, air cargo complex

- Goods transported from Port, Airport, or a land customs station to the inland container depot for clearance.

Latest amendments:

- Transporter on behalf of a registered person after taking authorization may furnish information in Part A of Form GST EWB.

- Courier agencies and eCommerce operators can showcase the information in part A of form GST EWB if goods are transported through courier services or eCommerce operators.

- One should exclude exempt supply value from total Consignment value for determining the limit of Rs 50,000.

- A registered supplier or recipient should generate an e-way bill if the consignment will be transported via railways, waterways, or airways. Otherwise, the transport service won’t deliver the goods without an e-way bill.

- If the approximate transportation of goods is below 50 km, one doesn’t need to generate a waybill. Previously this limit was 10 km.

- The EBN is valid for 15 days from the time of creation. This limit was updated in the Part B amendment.

Conclusion

GST e-way bill provisions remove bottlenecks compared to the km system, no waiting at the check posts with speedy movement and low cost of transportation. The rules are uniform throughout the country with a digital interface. This updated system improves tax compliance.