Table of Contents

What is a Balance Sheet?

A balance sheet is one of the final financial statements prepared by a business. It includes important information about the business’s assets, liabilities, and capital.

Balance sheets help the founder and finance team of a business understand the business’s performance over a period of time.

It also helps in the creation of certain accounting ratios, which give an in-depth understanding of the various dimensions of the business, like debt and receivables.

How Balance Sheets Work

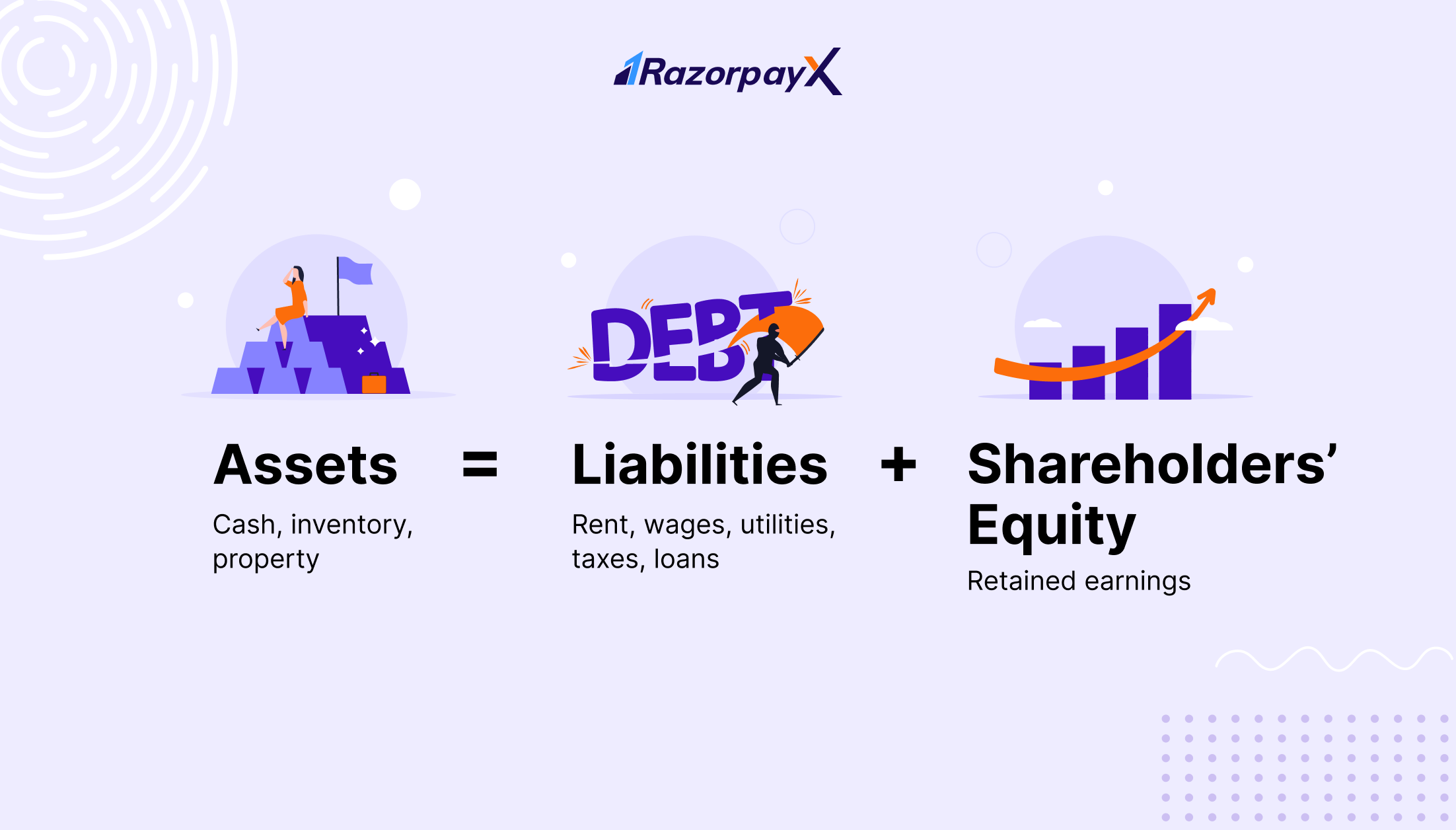

A balance sheet is divided into three overall categories:

- Assets

- Liabilities

- Shareholder’s Equity

These three categories are arranged in the balance sheet as such:

The Balance Sheet, like all other financial statements, follows the double entry system of accounting, where every transaction has two equal and opposite effects.

Read more: Double Entry System of Accounting

This means that every Balance Sheet adheres to the accounting equation:

This is because when a business buys something (asset) it pays for it by either deducting an asset (cash) or increasing a liability (credit). In this way, the accounting equation always remains balanced.

Note: A balance sheet is a snapshot of the business’s position at a particular point in time, and not over a period of time. This is why a balance sheet should always be used compared to previous periods.

Preparing a Balance Sheet

For bigger businesses and publicly held companies, the balance sheet is typically prepared by a Chartered Accountant or the company’s finance team.

In the case of smaller startups or newly established small businesses, the balance sheet and all other financial statements are typically prepared by the founder or a company bookkeeper.

If the founder takes it upon herself to prepare the balance sheet, it might be a bit of a challenge if she does not have accounting knowledge.

Here is a template for Balance Sheet that you can download and edit as per your requirements!

Download FREE Balance Sheet Template!

Video Explanation of Balance Sheets

Components of a Balance Sheet

Assets

Everything that a business owns is classified as an asset. These can include cash, machines, computers, desks, chairs; even things we cannot touch, like patents and trademarks.

Assets in the balance sheet are divided into two categories: current assets and non-current assets.

Current Assets

Current Assets are those assets that are very easily liquidated, or converted to cash. Assets are organized under this category in order of most liquid to least liquid. They include:

Cash and cash equivalents

These are the most liquid assets, which already exist as cash.

Cash equivalents include:

- Hard currency

- Short-term certificates of deposit

- Treasury bills

They are called “cash equivalents” because they can be converted into cash in a very short time, so they might as well be considered equal to cash.

Businesses with healthy amounts of cash and cash equivalents will be able to meet their short-term debt obligations with ease.

“Short-term debt obligation” here means debt that businesses have to pay off in a short period of time. For example, accounts payable.

Inventories

Inventory refers to the stock of goods that a business has at any point in time. This is included under current assets since it is expected to be sold and converted into cash within the coming year.

Marketable Securities

These are liquid financial instruments that can be easily and quickly converted into cash. Their maturity is usually less than a year, which is why marketable securities are considered to be highly liquid.

Instead of letting liquid cash sit idle in a bank account, businesses might choose to invest this cash into short-term liquid securities. These securities earn a small amount of interest and are very easily converted back into liquid cash.

Accounts Receivable or Trade Receivables

Accounts Receivable, or Receivables, is the amount that the customers owe to a business.

Businesses will provide customers with an invoice, expecting to collect the amount owed within a certain period of time, which may be days or a month at most.

Since this amount is also likely to convert into cash within a very short time, it is considered to be liquid.

Non-current Assets

These assets are those which cannot, or will not be liquidated – or converted into cash within the next year. They include:

Fixed Assets

Assets like property, equipment, and land are those that the business purchases without the expectation of selling off within a year.

These fixed assets are capital-intensive (which means they are expensive) and are generally used by the business in revenue-generating operations.

Note: Some fixed assets lose value over time and use. This loss in value is called depreciation and is subtracted from the value of the fixed asset.

Read more: Depreciation

Intangible Fixed Assets

These are assets that cannot be touched, i.e., non-physical assets which are still of high value to the company. Some examples are patents, goodwill, and trademarks.

While tangible assets lose value in the form of depreciation, intangible assets losing value is called amortization.

Read more: Amortization

Liabilities

Liability is any value that the business owes to outside parties. These can include loans, payables, and others.

Like assets, liabilities are also divided into current liabilities and non-current liabilities.

Current Liabilities

A current liability is something that the business owes to its creditors within a short period of time. This “time” could be one year or within one cash conversion cycle.

A cash conversion cycle or an operating cycle is the amount of time it takes for a business to convert its inventory into sales. A healthy business should be measuring this time in days.

A few commonly seen current liabilities are:

Accounts Payable

This is the amount that the business owes to its suppliers. Sometimes, the business might purchase goods or services from outside vendors when it is not able to pay with cash at the time of purchase.

In this case, the supplier will draw up an invoice against the sale, and the business will be liable to pay the supplier within a few days, or a month at most.

Commercial Papers

This is a kind of unsecured, short-term debt instrument used to finance other short-term liabilities like payroll and inventories. They typically mature within a month, and are for smaller denominations than regular bank loans.

Some other current liabilities include:

- Current maturities of long-term debt

- Dividends payable

- Interest payable

- Income taxes owed within the next year

Non-Current or Long Term Liabilities

Non-Current, Long Term, or Fixed Liabilities include debt that does not mature within the coming year. These can include:

- Long-term loans like any interest and principal on bank loans

- Deferred tax liability

- Pension Fund Liability

If a business has a lot of liabilities, but very little cash and cash equivalent balance, it means that it will not be able to pay off its debts without taking on more debt.

Shareholder Capital

This is the money that the owners have invested into the business. This is also the business’s net worth.

Shareholder Equity is an important figure because it helps determine if business management is doing a good job at investing and spending the business’s capital.

Format of Balance Sheet

There are many different ways a business can present its balance sheet. Regardless of the structure, all balance sheets have the same line items.

ABC Business

Unaudited Condensed Consolidated Balance Sheet as of 31st March 2022

(₹ in lakhs)

| Particulars | As of March 31st, 2022 | As of December 31st, 2022 |

| ASSETS | ||

| Current Assets | ||

| Cash & Cash Equivalents | ||

| Trade Receivables | ||

| Inventory | ||

| Marketable Securities | ||

| Non-current Assets | ||

| Property, Plant and Equipment | ||

| Goodwill | ||

| Investments | ||

| LIABILITIES | ||

| Current Liabilities | ||

| Trade Payables | ||

| Short-term debt | ||

| Borrowings | ||

| Deferred Tax Liability | ||

| Non-current Liabilities | ||

| Loans | ||

| Lease liability | ||

| Shareholder Capital |

Importance of Balance Sheet

A business with a strong balance sheet will find it easier to secure capital – investors and banks delve deep into the financials of a company, most specifically its balance sheet, before deciding to invest in the business.

Lenders and investors assess the creditworthiness of a business in order to determine if the company is a valuable investment or not.

Internal stakeholders of the company, like managers or executives can also use the Balance Sheet extensively to measure the financial health of the company.

Read more: Accounting Ratios

Here are some important metrics that can be assessed from the balance sheet by both internal and external stakeholders.

Liquidity

This metric is used to measure how quickly a business is able to convert existing assets into hard cash. The higher a company’s liquidity, the more cash it has to use on an immediate basis.

Typically, the liquidity of a company is measured using the quick ratio, or the liquidity ratio. This ratio is a measure of a company’s ability to pay off its current liabilities.

On the other hand, if a company has very high liquidity, it could mean that the management is not putting liquid cash to good use. Liquid cash could be used to acquire other businesses or could be parked in high-return investments, instead of sitting idle.

Profitability

Profitability is a measure of a business’s ability to generate profits from its revenue. High profitability means that the business is able to balance revenue and expenses, to translate into profit.

A company is profitable if its revenue exceeds its expenses. The main factors that affect profitability, therefore, are revenue, expenses, demand, competition and general economic conditions.

Being able to keep expenses in check and maintain high profits even in times of economic downturn is an important measure of a business’s financial health.

Solvency

Solvency is an important measure of financial health – it indicates that the company is able to meet its long term debt obligations. A good solvency metric means that the company expects to be able to manage operations into the future with no risk of dissolution or bankruptcy.

Low solvency means that the business is at risk of not being able to pay back long-term loans and in extreme cases may have to declare bankruptcy.

Limitations of Balance Sheet

A balance sheet is not a solve-all statement – it has certain limitations that stakeholders have to keep in mind when reading a Balance Sheet.

One major limitation of a balance sheet is its staticity. A balance sheet shows the financial position of a business at a particular point in time, and not over a period of time. This means that the person reading the balance sheet only gets a very static view of the company’s financials.

A balance sheet can only be read in context – we need the previous quarter’s values as well in order to better understand the current values.

For example, a cash and cash equivalents value of Rs 50,00,000 this quarter would mean nothing if we didn’t have the context of the previous quarter. If we know that last quarter’s cash and cash equivalents stand at Rs 30,00,000, we can deduce that the company has increased its cash reserves over the last quarter.

Small Business Balance Sheet

Small business and startup founders typically find finances to be the hardest part of management. From vendor management to payroll, having to manage all the facets of business finance can be challenging for startup founders.

Today, there are many solutions on the market for startup founders to simplify business finances – RazorpayX is one such solution.

- Automate invoice management with Vendor Payments

- Easily acquire foreign capital with RazorpayX’s new Forex funding facility

- Integrate with accounting software to easily track every expense and income your business makes.

Glossary

- Assets: Anything that a business owns is called an asset

- Non-current assets: Items owned by the company likely to stay with it for more than a year.

- Current assets: Items owned by the company that are likely to be encashed within a year.

- Liabilities: Anything that a business owes to someone is called a liability

- Non-current liabilities: Debts that the business has more than one year to repay

- Current liabilities: Debts that the business has to clear within a year’s time

- Total current assets: All current assets added together

- Net assets: Assets minus liabilities

- Shareholder capital: The value of shareholders’ funds invested into the company