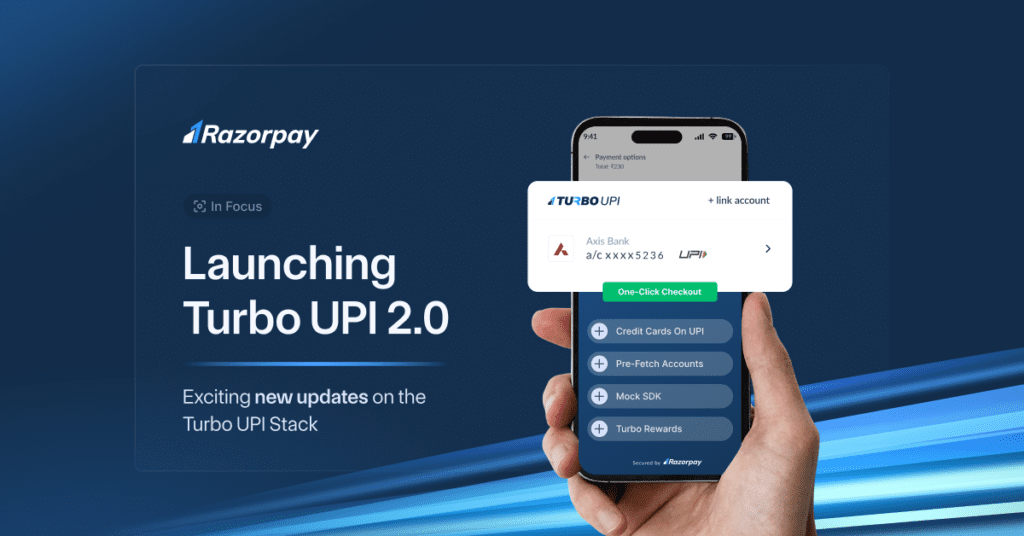

In the ever-evolving landscape of digital payments in India, Razorpay’s Turbo UPI stands out as a groundbreaking innovation. Developed in collaboration with the National Payments Corporation of India (NPCI) and Axis Bank, Turbo UPI offers the fastest one-step UPI payment solution for businesses.

This innovative service allows end-users to complete payments directly within the app, eliminating the need for redirections or third-party UPI apps. Not only does it reduce the time to transact for users by 60%, it also significantly improves success rate by ~10%. Now, we’ve given Turbo UPI an exciting upgrade, making it even more powerful and user-friendly. Here’s an in-depth look at these new features and why they’re game-changers.

Turbo UPI’s latest updates and features

Razorpay has recently announced several exciting updates to Turbo UPI, enhancing its functionality and expanding its capabilities. Let’s take a closer look at these new features:

Credit Cards on UPI

One of the most significant updates is the integration of RuPay credit cards with Turbo UPI, allowing users to leverage the full potential of UPI with their credit cards. This is a noteworthy upgrade in user experience as users no longer have to tediously type in their card details or bounce around between different apps. With Turbo UPI, the customer experience is a seamless, 1-click checkout process that makes transactions faster and more secure. This integration provides multiple benefits:

- Increased Touchpoints: Customers can now pay using their RuPay credit cards, providing more options for transactions.

- Simplified Payments: Users can make credit card payments without the need to enter card details or OTP, streamlining the payment process.

- Higher Customer Spend: Credit cards typically lead to higher average customer spends, benefiting businesses.

- Expanded Payment Options: Customers can use both their bank accounts and credit cards on Turbo UPI.

- Seamless Experience: Combining the ease of UPI with the benefits of short-term credit and credit card rewards.

- Enhanced Security: Reduces the need to carry physical credit cards, mitigating the risk of theft.

- Streamlined Checkout: Ensures faster and smoother online checkout for credit card transactions.

Pre-Fetch Bank Accounts

Turbo UPI has launched a Pre-fetch API to streamline the user onboarding process, offering a smoother and more intuitive experience. Using this API, customers won’t have to manually select their banks to retrieve their account information. Instead, the API will automatically fetch all top bank accounts linked to their mobile number and connect them to Turbo UPI in a single go.

- Faster Onboarding: The onboarding process for new users is now quicker and more efficient.

- Reduced Steps: By minimizing the number of steps required to start using Turbo UPI, Razorpay makes the onboarding process less intimidating for new users, ensuring a broader adoption of the platform.

- Higher Success Rate: Merchants benefit from a higher onboarding success rate, which means more users successfully complete the setup process and start transacting sooner.

Mock SDK

To make integration easier for merchants, Razorpay has introduced the Mock SDK, a tool designed to facilitate seamless integration with Turbo UPI. It will ensure that businesses can quickly and efficiently adopt Turbo UPI, thus bringing its benefits to their customers sooner.

- Streamlined Integration: The Mock SDK simplifies the process of integrating Turbo UPI into merchant apps on both Android and iOS. This ease of integration means businesses can adopt Turbo UPI without extensive technical hurdles.

- Reduced Dependency: Removes the dependency on partner banks and NPCI’s UAT environment stability. This independence means that merchants can develop and test their integrations at their own pace without waiting for external systems to be available.

- Faster Testing: Allows for quicker testing and reduced time to go live, enabling merchants to adopt Turbo UPI more swiftly. This acceleration is critical in a fast-paced market where being the first to offer new features can provide a competitive edge.

Turbo Rewards

Designed to expedite customer onboarding with strategic incentives, Turbo Rewards is yet another exciting update introduced on Turbo UPI. With this product feature, businesses can seamlessly run offers to those who qualify. Turbo Rewards offers several advantages:

- Boosts Onboarding Success Rates: By offering rewards for signing up, Turbo Rewards incentivizes customers to complete the registration process, leading to a higher number of active users.

- Reduces Cart Abandonment: Customers who are motivated by potential rewards are more likely to see their purchases through to completion, reducing the number of abandoned carts.

- Acquires New Customers: The promise of rewards can attract new customers who might not have otherwise considered a business for purchase, thereby helping expand the customer base.

- Drives Repeat Business: By rewarding customers for their purchases, Turbo Rewards encourages them to return and shop with a business again, fostering loyalty and repeat business.

Turbo UPI: Revolutionizing Digital Payments in India

Turbo UPI’s latest updates signify a major leap forward for UPI payments. By incorporating credit card payments and enhancing user onboarding, Razorpay is redefining a customer’s UPI experience by making digital transactions faster, more accessible, and even more convenient. The seamless integration process facilitated by the Mock SDK further ensures that businesses can quickly adapt to this new payment solution.

These advancements demonstrate Razorpay’s commitment to innovation and improving the user experience. By making digital payments more accessible and efficient, Turbo UPI is set to revolutionize the way payments are made in India, making it easier for both businesses and customers to engage in digital transactions.