One sector that has flourished during the Covid lockdown is the Securities and Mutual Fund business. Discount brokerages have drastically lowered stock trading costs, and an industry-wide shift to online trading made it easy for individuals to trade from their bedrooms. This has allowed retail investors to start trading during the lockdown easily.

Earlier, Indian investors mainly relied on traditional investment instruments, including FD, RD, and real estate investments. Investment preferences have started changing of late with the infusion of digital technology in day-to-day lives. Retail investors even in tier 2 and 3 cities have now begun to tap advanced investment products such as Mutual Funds and stocks as it’s easier to invest using trading applications as well as robo-advisors.

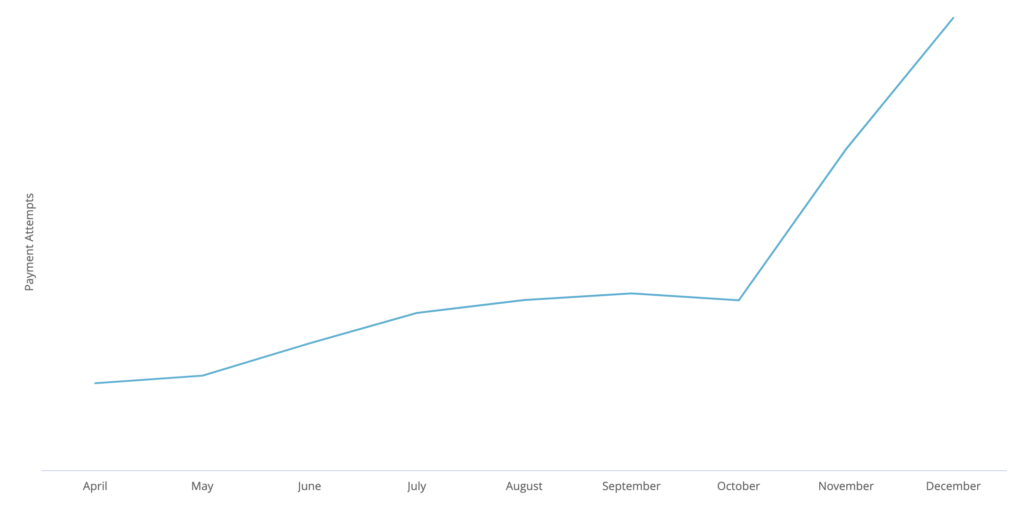

UPI transactions in the Securities business via Razorpay has shot up by 6-8x in 2020

But who is powering payments for these brokerages and fund houses?

Well, you have guessed it right 😉

All the famous names of the Indian Securities and Investment sector rely heavily on UPI payment method to accept payments from their customers. Zerodha, Groww, ET Money, Upstox, Axis Securities, Sharekhan, etc., are using Razorpay UPI payment to cater to this growing consumer demand.

Let me try to explain why UPI has turned out to be the preferred mode of payment for the BFSI sector:

Let me try to explain why UPI has turned out to be the preferred mode of payment for the BFSI sector:

Cost / Pricing

While the customer/merchant still needs to pay 2% or flat INR 10 on Card or Net Banking transactions, UPI is almost free. This is because the government has slashed MDR (Merchant Discount Rate) on UPI payments. MDR is a fee paid by the merchant to its bank for accepting payments via UPI.

Related Read: What is Recurring Billing? – Types, Advantages, and Examples

Per Transaction Limit increased to INR 2 Lacs

RBI has also increased the UPI transaction limit for the BFSI sector from the earlier INR 1 Lac limit to INR 2 Lac limit. This reform has also allowed customers to move entirely to UPI for their stock and mutual fund investments.

Third-Party Validation / Account Validation on UPI

Merchants in securities, broking, and mutual funds are prone to cases of cybercrimes, identity thefts, money laundering, accounting frauds, etc. To reduce the risk, the Securities and Exchange Board of India (SEBI) has mandated that all payments to such businesses must be made by their customers exclusively from the pre-registered bank accounts. Here a pre-registered bank account is the bank account of which the customer shares the details at the time of registration or enrolment with the businesses in these sectors.

Third-Party Validation (TPV) is essentially a process of making sure that the customer is paying only from the pre-registered bank account. All other payments (if initiated) are either failed or refunded back to the customer instantaneously. Razorpay, with its TPV functionality, ensures 100% SEBI compliance.

Related read: Types of UPI frauds and how to stay safe

Bank Coverage

UPI is now live for the customers of 200+ banks in India. Razorpay’s UPI TPV functionality works for the customers of all these banks without any extra integration. It’s not easy to get the same level of coverage on other payment methods. This is also one of the reasons why UPI is also turning out to be an alternative to Net Banking.

User Experience

User Experience

Because of the availability of Intent/Collect/QR flow, UPI can readily be accepted across all devices and OS. Also, there is no need to remember/save card details or wait for OTP.

Best in class Success Rate

In the last few months, banks and NPCI have invested heavily in the UPI payment infrastructure. These initiatives, coupled with Razorpay’s in-house Smart Routing technology, make sure that the businesses get the best in class Success Rate by selecting the best possible bank acquirer for the next transaction.

Customers and businesses are now more confident in accepting UPI payments than ever before.

UPI AutoPay for SIP or EMI collection

The newly launched feature of NPCI helps businesses to process Recurring payments on UPI. With this feature, customers can give a recurring mandate to the business to debit their SIP or EMI on a recurring basis. As Credit Card Recurring is not allowed by SEBI for the BFSI sector, UPI is turning out to be the best possible alternative.

Razorpay, being the first payment aggregator in the market to launch UPI AutoPay, has extended this feature to the BFSI sector as well with Third-Party Validation (TPV) functionality. Businesses can debit up to INR 5,000 per transaction using this feature.

Related Read: What Is The UPI Reference Number?

Real-Time Settlement functionality

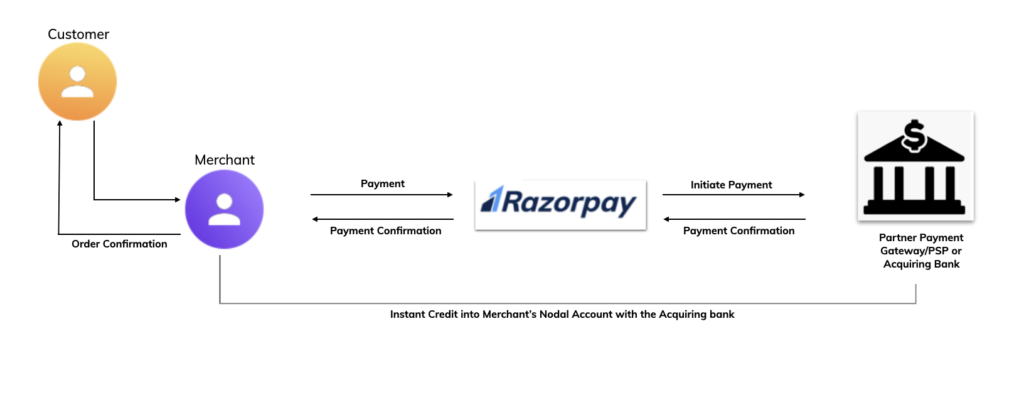

Razorpay offers real-time settlement functionality for this segment’s businesses as they need to further invest the money in the Securities market in real-time.

The Real-time Settlement process skips the flow of money into Razorpay bank accounts. It lets the partner payment gateway or an acquiring bank settle funds directly into the merchant’s account. The credits settled to the merchant’s bank account are authorized by Razorpay, regardless of the settlement. Transaction data is also made available in the Razorpay system.

Wondering how Refunds work in this case?

Worry not! Razorpay also takes care of the same.

If you are a business looking for a superior payments experience, Sign up today!

If you are a business looking for a superior payments experience, Sign up today!