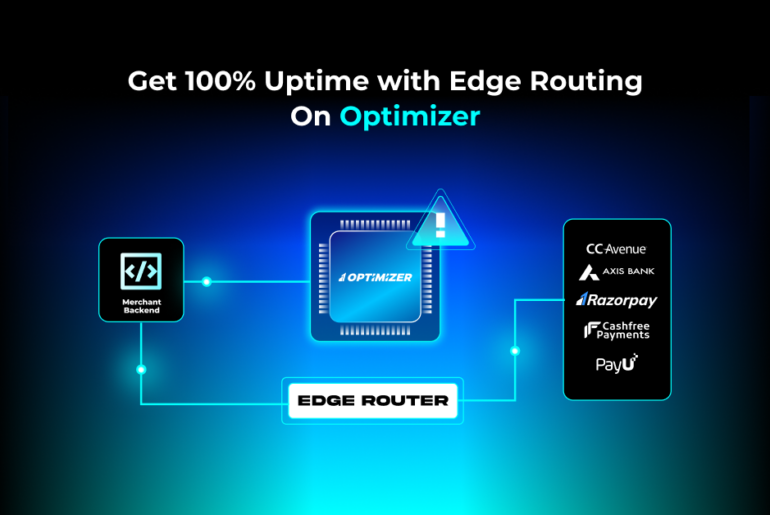

Seek 100% uptime in payments processing using Edge Routing on Optimizer! Get a 5% assured spike in revenue! You’ve just…

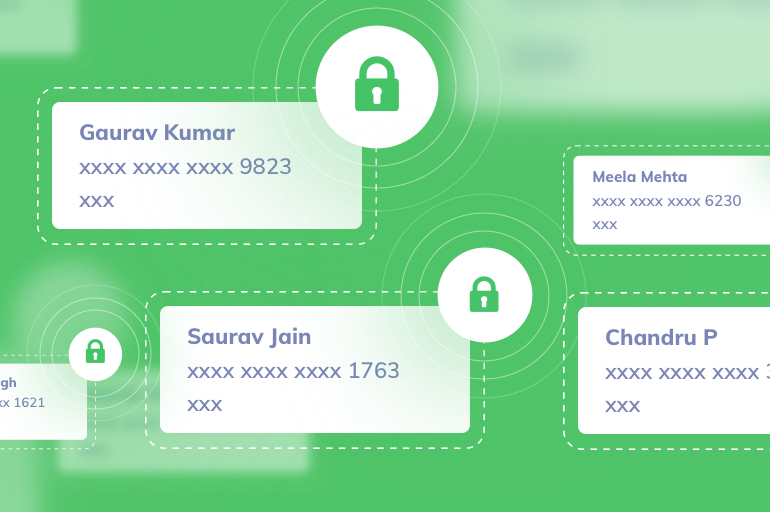

Payment gateways and online transactions are by and large secure in today’s world. Just ensure that you keep your eyes wide open to not fall into any traps.

About A.N. Fashions In the vibrant world of fashion, Nitika Gujral stands as a seasoned artisan, weaving a tale of…

As we kick off 2024, we’re thrilled to share some of the exciting feature enhancements we’ve made to get the…

Ever bought a pair of shoes online, only to find they never arrived? Or maybe your credit card was unexpectedly…

Winning customer trust is a fairly nuanced and long-term undertaking. New brands need to build trust in order to make…

Many online shoppers often come across brands that they know very little about. As a business you may have exactly…

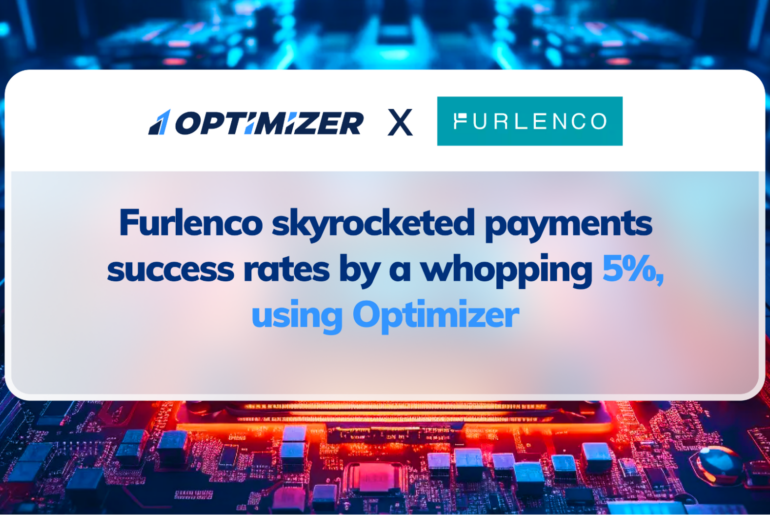

Payment transaction success is crucial to businesses in this day and age when most transactions are going digital. A failed…

In today’s digital era, businesses of all sizes rely heavily on digital payments to process transactions and generate revenue. However,…

It was a busy 2023, and we hope you ended the year and the holiday season on a festive high.…