IMPS and UPI are the most preferred modes for instant money transfer in India. However, there are times when you’ve tried to transfer money from your UPI app to a QR code or to your friend and a strange thing happens.

Your account is debited, but the transaction is stuck in “Payout Processing.” Or worse, you see a success message but the beneficiary has not received the payment.

The lifecycle of an IMPS or UPI payouts is usually around 180 seconds. If your transaction is in processing or if the receiver has not received the money after the 180 seconds, that means your transaction is mostly in a ‘Deemed Success’ or ‘Deemed Approved’ state.

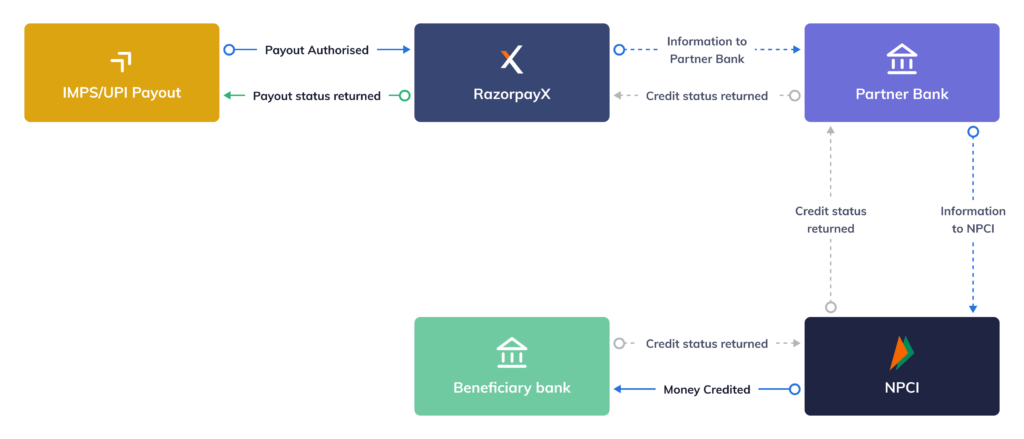

Before we get into what deemed success means, let us see how a payout works for businesses.

Making timely payouts is important for each and every business. As much as a business wants to focus on cash inflow, making payouts accurately and on time is critical in its financial management.

Again, there are times when you make a payout and you see that the money is debited, but the transaction status isn’t confirmed. This state is called Deemed Success.

Here’s an overview of how payouts work and what Deemed Success means for IMPS and UPI transactions.

How a payout works

A payout is a payment made by a business to its stakeholders from the business’s current or retained earnings. You can make a payout via IMPS, NEFT, RTGS, and UPI.

Once you have initiated a payout via RazorpayX, your account gets debited. Post that, there are three things that can happen

- Success – The amount has been successfully credited to the beneficiary

- Reversed – Due to issues at NPCI or at the beneficiary bank, the payout could not be processed and the money was reversed to your account

- Processing – This is a rare scenario, where Razorpay is not sure if the credit to the beneficiary was successful

From Payout Processing, a payout can attain the state “Deemed Success.”

Payout processing – Deemed success state

Although payouts made via IMPS and UPI are instantaneous, the actual transfer from the remitter bank to the beneficiary bank does not happen in real-time. This is because the settlement between banks happens via RTGS, at regular intervals.

For successful transactions, a settlement happens to the bene bank from the remitter bank. For a failed transaction, since the amount was never credited to the receiver, the settlement does not happen.

However, for transactions that say “payout processing”, a settlement happens from the remitter bank to the beneficiary bank. This means the money has reached the beneficiary bank, but not the beneficiary account. Hence the name ‘deemed success.’

In such cases, payouts made via IMPS and UPI can be in the “payout processing” state for up to T+7 working days. The reason this happens is, NPCI marks these payouts as Deemed Success or Deemed Approved.

In such cases, payouts made via IMPS and UPI can be in the “payout processing” state for up to T+7 working days. The reason this happens is, NPCI marks these payouts as Deemed Success or Deemed Approved.

What payout processing means for transactions

If NPCI successfully credits the money to your beneficiary account, it returns a success status to the partner bank, which in turn, returns it to us. Then, we mark the payout as processed.

If NPCI cannot credit money to your beneficiary account, it returns a failed status to the partner bank, which passes the status to us. We mark the payout as reversed.

But sometimes, technical problems like banks facing downtime or other intermittent issues can arise while crediting a payout to a beneficiary account. When this happens, it is difficult to be certain if the amount was credited to the beneficiary. In such cases, NPCI moves the payout to an intermediate state – Deemed Success.

Once the transactions in the Deemed Success state are reconciled by the beneficiary bank and NPCI, we receive the final status from the partner bank. Then, we move the payout to the terminal state (processed/failed/reversed).

The TAT by NPCI is generally T+7 working days, but it can vary depending on the beneficiary bank as well.

Most times, payouts get settled on T+1 or T+2 working days.

Next, the beneficiary bank performs reconciliation and updates the payout status on the NPCI portal. The status is then passed on to the partner bank, which in turn, passes it to RazorpayX.

To explain this further, let’s say you make a payout to your vendor. Here’s what happens next.

- The payout amount gets debited from your account

- The transaction request is sent to your vendor’s account for credit

- Further, the transaction waits for a confirmation message or response from your vendor’s account

In this case, your vendor’s bank is expected to send a response message to your bank within a specific turnaround time. If you don’t receive a response message from your vendor’s bank, then the payout is Deemed Successful.

And, for transactions like this, reconciliation would take place based on the settlement file shared between the payer and payee banks. Typically, the funds settle on T + 2 days.

Over to you!

So, if you find your payout taking longer than usual, chances are it is in the Deemed Success state. And, all you have to do is wait for a few days for the settlement to happen.

If you’d like to know more about Deemed Success, feel free to contact Swaroop Kuruvadi, our Product Manager at RazorpayX.