Table of Contents

What is Open Banking?

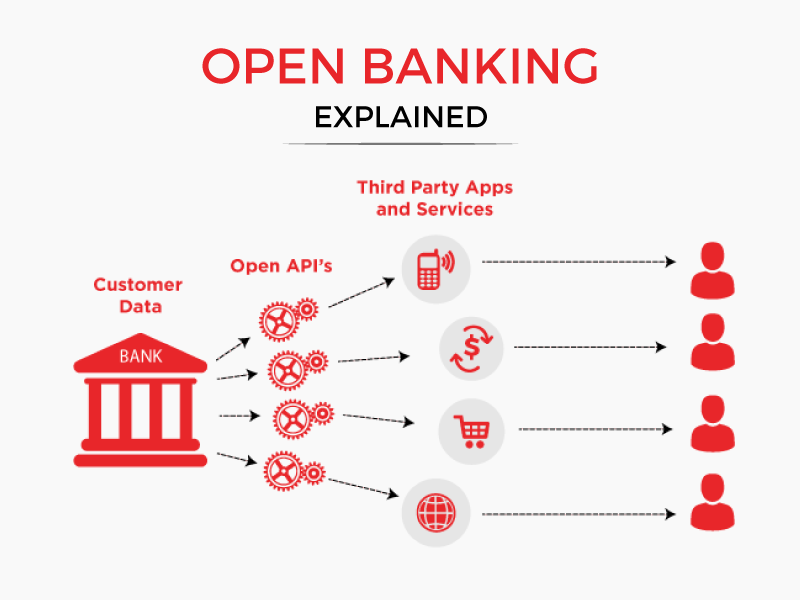

Open banking is a system where banks and other financial institutions share their customers’ financial data with other banks and other authorized institutions. Previously, customer information was kept closed and outside banks were not allowed to access internal data.

With Open Banking, the data shared can be used to create innovative financial services and products, such as comparison tools and personal finance management applications.

How does Open Banking Work?

Open banking begins with requesting consent from the customer to share their data. This data is then shared with authorized third-party service providers. These third-party businesses are typically fintechs or other banks. Information is shared with third parties via APIs (application processing interfaces).

Open banking is opening up three major parts of the financial ecosystem: account data, product data and payment initiation.

Account data: This includes basic account information like the account holder’s name, account type, and transaction information.

Product data: Today, information about the various products that a bank or fintech offers are openly available on their website. Open banking makes it possible for third-party businesses to recommend the perfect bank and the perfect financial product for you based on your financial history.

Payment initiation: The best example of this is UPI (United Payments Interface). UPI allows users to link multiple bank accounts to a single mobile app, and it provides a simplified platform for making payments and conducting various financial transactions.

Open Banking API

An API is a set of rules and tools that lets software applications share information and work together smoothly, even if they were made by different people or companies. Open Banking relies on these APIs to securely share information between financial institutions.

This allows banks to securely share customer financial data with authorized third-party providers such as fintech and other financial services providers.

This in turn allows customers to access more innovative financial services, such as budgeting tools, loan comparison and advice services, and other innovative services.

Uses of Open Banking

Financial institutions use open banking to create opportunities for innovation and promote healthy competition in the financial industry.

Personal Finance Management

Apps like Money View and Goodbudget use financial data from various banks to provide comprehensive insights into spending habits, savings, investments, and budgeting, helping users make informed financial decisions.

Lending & Credit Rating

With access to a wider range of financial data, fintechs can develop highly accurate credit scoring models. This can help individuals and small businesses access loans and credit facilities with better terms and rates.

Investing & Wealth Management

Wealth management fintechs use a customer’s financial data, risk tolerance, and goals to give personalised investment recommendations. This kind of information is only made available thanks to the open banking system.

Account Aggregation

Most people have multiple bank accounts – for salary, investments, savings. Open banking allows information on all these different accounts to be consolidated into one platform, which makes it so much easier to view and manage multiple accounts.

Open APIs for Developers

With access to these APIs, third-party developers can innovate and develop ecosystems on top of banking APIs. This is very important to move the financial industry forward and force existing players to compete and innovate.

Risks of Open Banking

Future of Open Banking

Open banking is quickly becoming the norm across banks and fintechs – and as regulation catches up to the world of open banking, we will soon live in a much more innovative and technologically-enabled world.

In India itself, the UPI framework has been a resounding success and has paved the way for innovative payments solutions like Google Pay. More and more banks are adopting fintechs and the innovative tech solutions that come as a result of open banking.

RazorpayX is one such fintech that was born to make banking for businesses as seamless as possible. The tech-enabled businesses of today need tech-enabled financial management, and RazorpayX is just that.

With just one current account, the top tech startups of India manage vendor payments, payroll, escrow, payouts and so much more.

Frequently Asked Questions

What is open banking?

Open banking is a financial service that describes the use of open APIs that enable third-party developers to build applications and services around the financial institution. It is an evolution of financial services that promote innovation, customer engagement and competition in the financial services sector.

What are the benefits of open banking?

Open banking has the potential to enable individuals and businesses to access a much wider range of financial services than ever before. It increases consumer choice by giving customers access to a variety of products and services from multiple providers. It also allows financial institutions to tap into new markets and develop new products and services, which can increase customer loyalty and create new revenue streams.

What are the risks involved with open banking?

Open banking introduces potential security risks, as data can be accessed by third parties, increasing the risk of data breaches. Additionally, open banking may expose customers to fraud if they are not aware of the potential risks involved in sharing their financial data. Banks must ensure that they have robust security measures in place to protect customer data and protect customers from fraud.