Do you know what’s common amongst all Indian startup founders and business owners?

They struggle managing tax and compliance payments. And, if you’ve just started your business, chances are you’d be struggling with them too.

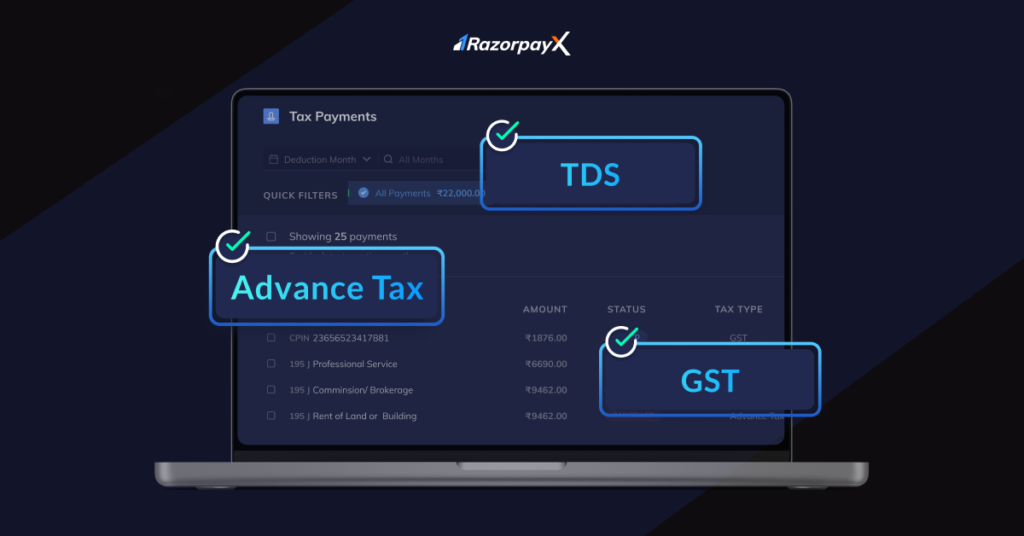

Indian startups lose countless hours managing taxes including GST, advance tax and TDS payments manually.

Automate Tax Payments for your Business

Not anymore.

Read on to know you can automate end-to-end tax payments for your business.

Automated Tax Payments tailored for startups

Following are the benefits of startups after automated tax payments.

1. No more manual tax calculations

Automate TDS deductions and payments, whether you are paying suppliers, contractors, or your employees

[Also Read: GST Accounting and Reconciliation – What Businesses Need to Know]

2. Easy one-click tax payments

Manage TDS, Advance Tax, and GST payments all on one faster, more secure, and easy-to-use dashboard instead of multiple tax portals dashboards

3. On-time payments, every time

Schedule and get timely reminders or enable auto-pay TDS, Advance Tax, and GST payments for your business

4. All challans in a single place

Access all your tax challans and send them to your finance team and CA directly from the dashboard

Do what you love and leave your tax payments worries to us

Join 10,000+ businesses on RazorpayX today and focus on growing your businesses and never worry about tax and compliance payments, ever again.