Banking as a Service (BaaS) is yet another fintech innovation that is enabling bank and fintech collaborations. The tickler is, many of these innovations are confused for the other.

We’re here today to clarify what Banking as a Service is and what it isn’t.

The banking sector has gone through somewhat of a metamorphosis in the last few years. With fintech players entering the market, this transformation has become unstoppable. Financial services are changing in a way that they’re creating new products, channels, partnerships, and opportunities. Banking as a Service plays a significant role here, at the core of it all.

What is Banking as a Service?

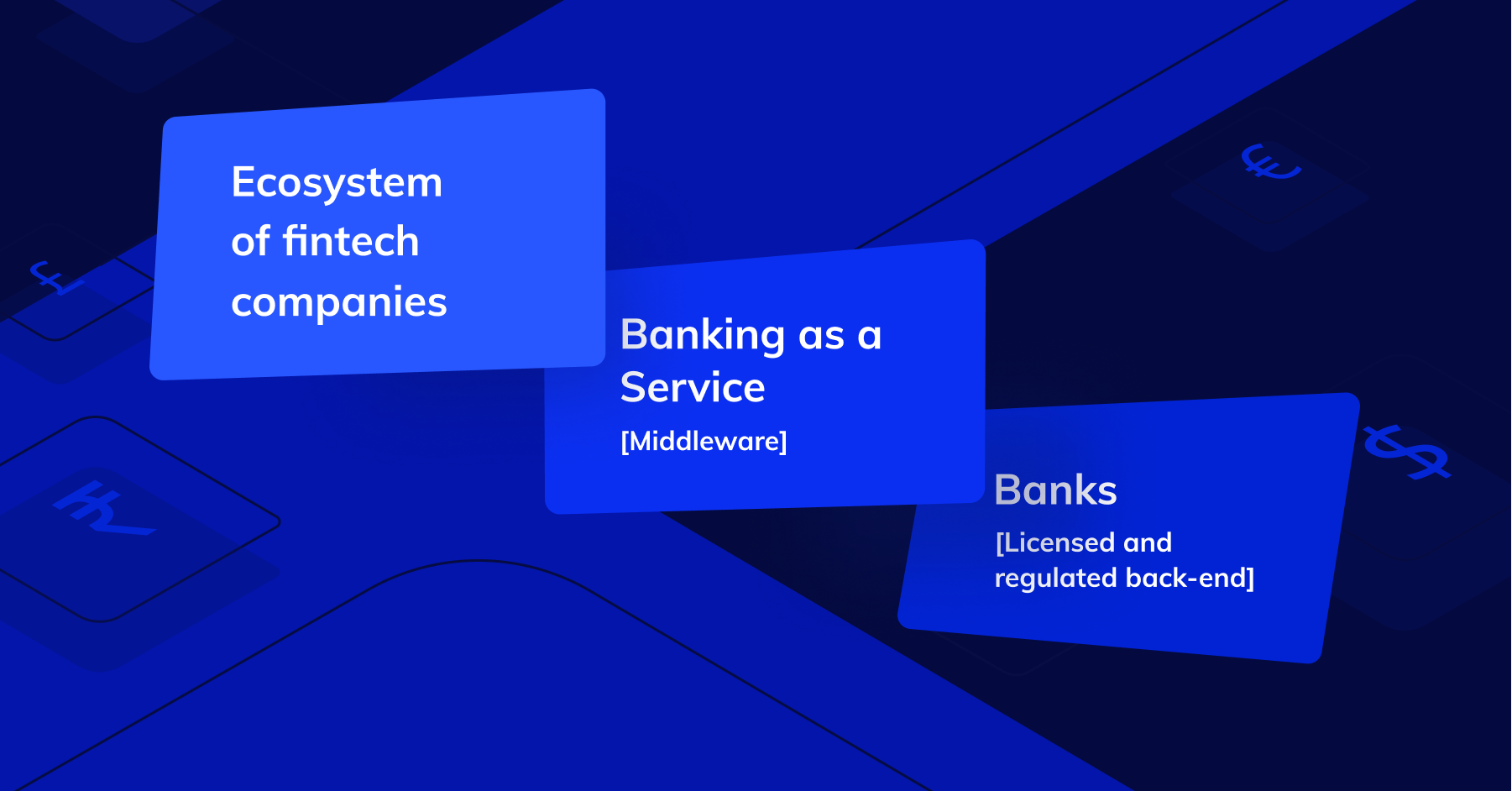

BaaS is an end-to-end approach that facilitates fintech companies and other third party organisations to connect with a bank’s system employing APIs. This helps organisations build innovative financial services upon the provider bank’s regulated infrastructure while enabling open banking services.

How is Banking as a Service different from traditional banking?

To understand this, let’s break down the functions of a bank – holding money, remittance, and payment processing. For banks to support these functionalities, they need to put in a ton of investment and constitute the necessary infrastructure.

The processes, along with the complex infrastructure, end up creating gridlocks. And these gridlocks are what have created an immense thought and application for fintech companies and non-bank organisations towards building financial services — partnering with banks instead of building these financial services from the ground up.

How does Banking as a Service work?

Banking as a Service allows third party organisations to draw off of the existing banking services through APIs that communicate between banks and third parties. These APIs allow the use of these banking services by fintech companies, programmers and developers, and other non-financial companies.

This allows them to build their own features as a layer on top of the existing banking services. In simple words,

- Fintech company/individual pays to use BaaS

- Bank/financial institution which is a BaaS platform opens its APIs

- Fintech company/individual builds innovative financial services using these APIs

[ Also read: The New Age Ways of Business Banking ]

What are the factors influencing BaaS?

While fintech is growing and revolutionising the way financial services work today, there are a few key aspects that have led to the emergence of BaaS.

- Banks are trying to catch up to the speed of fintech companies. Or, banks are partnering with fintech companies to innovate financial services

- Startups and SMEs are starting to leverage easier and effective business banking

- The digital transformation and mobile-first approach that has soared over the recent years has played a phenomenal role in influencing BaaS

- Business architecture of banking is evolving to a much more modern system that is inclusive of newer tech and methodologies

- Banking regulations have seen an evolution that has further promoted a healthy growth of industrialisation

How do businesses benefit from BaaS?

- BaaS helps creates new sources of revenue for businesses by enabling cross-selling capabilities because of API driven facilities

- With BaaS, businesses can compartmentalize business logic and data, and reduce time to build and ship apps

- Businesses innovate much more by means of capitalizing on APIs of their own, along with third parties

- Building products and services using API ecosystems can drastically increase Customer base

Banking as a Service vs open banking

The BaaS model is often confused with open banking since both models involve the use of APIs to communicate among banks and fintech companies. But in reality, both models serve completely different objectives.

Banking as a Service: Businesses integrate complete banking services into their products

Open Banking: Businesses use only data for their products

Industry impact of Banking as a Service

BaaS has created quite a trend in the fintech industry. Platforms like RazorpayX have enabled businesses like Cure.fit, MPL, Dunzo, and more, to make payouts at scale while keeping the costs low.

RazorpayX takes business banking further by including all standard banking services like debit cards, accounting statements, cheque books, and more.

Many BaaS and challenger banks looking for an alternate source of revenue have also opened their doors for other non-financial companies to use their APIs.

More than just creating a source of revenue, BaaS has also enabled legacy banks to grow a relationship with emergent as well as fintech giants. This further helps legacy banks to catch up to what some of the fintech companies are doing.