In times of strife as in times of calm, NGOs have always strived to make the world a better place. Today, amid crises and turmoil, NGOs are working day and night to ameliorate the lives of those hardest hit.

Online donations are at an all-time high for NGOs. In fact, there was a 180% surge in NGO donation transactions in the first 30 days of the lockdown.

[Read more: Special Report: The Impact of Lockdown on Digital Payments]

With donations pouring in from all parts of the world at such a rate, keeping up with receipts and invoices is no mean feat. Accepting donations, providing confirmations, and generating 80G receipts for tax exemptions should not bog NGOs down when working for the cause is paramount.

We, at Razorpay, have done our bit to make online transactions seamless for NGOs. Razorpay Payment Pages have been instrumental in running several successful donation drives and even routine donation acceptance.

We’re taking a step further in our quest for innovating and creating the finest payment solutions with Payment Page Receipts.

Table of Contents

What are Payment Page Receipts?

Razorpay Payment Pages, since its launch, has made waves in the not-for-profit sector, enabling several NGOs to collect donations and sell products for their causes.

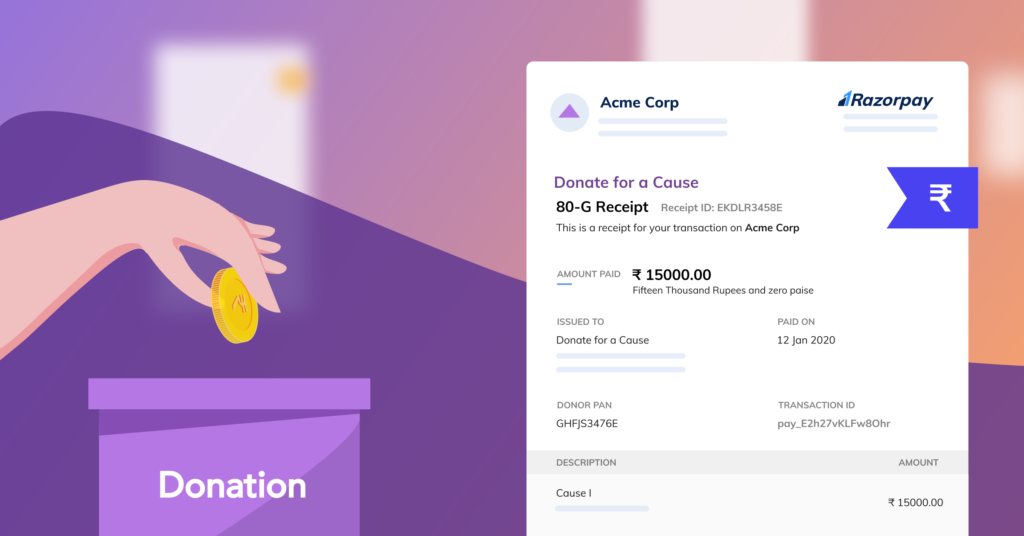

With Payment Pages Receipts, NGOs no longer have to generate 80G receipts manually. Confirmation receipts are generated instantly and are sent to donors via email as soon as their transaction is successful.

Understanding NGO Donation Receipt Format

A Donation Receipt Format for NGOs plays a significant role in the functioning of non-profit organizations. As non-profit entities working independently from governmental control, NGOs depend primarily on donations to support their charitable activities. This format is critical for officially recognizing and recording donations and formally acknowledging both the donor and the organization.

Such documentation is crucial in maintaining transparency and accountability, ensuring donors are informed about the appropriate use of their contributions in alignment with government regulations.

Receipts are essential for tax compliance, enabling recognized non-profits to issue tax-deductible donation receipts for donors to claim deductions, while smaller contributions receive informal receipts.

What Advantages Does a Non-profit Organization Gain from Registering as an NGO?

1. Tax Exemption for Donors

With registration, donors can benefit from up to 50% tax exemptions on their contributions, lowering their taxable income and overall tax liability. This tax-deductible status enhances the appeal of donations, increasing the chances of securing additional contributions.

2. Credibility Building

Obtaining Section 12A and 80G Registration positions your NGO as a trustworthy organization, receiving recognition from the Government of India. This credibility is vital for maintaining precise donation records and demonstrating the organization’s purpose and existence, which fosters transparency and trust.

3. Government Support

Registered NGOs qualify for government funding for welfare initiatives, making registration essential for accessing these resources. Moreover, it allows for accepting foreign donations, significantly broadening the NGO’s reach and fostering trust among domestic and international supporters.

What to Include in an NGO Donation Receipt Format?

-

List the name of the NGO receiving the donation, which aids in identifying the organization and ensures accurate record-keeping.

-

Include a statement that confirms the organization’s tax-exempt status as recognized by the Government of India.

-

Record the donor’s full name to personalize the receipt and ensure the donation is credited to the correct individual or entity.

-

Indicate the date when the donation was made, as this detail is essential for the NGO and the donor for record-keeping and tax purposes.

-

Clearly state the donated amount in numerical form and, if possible, write it out in words to avoid confusion.

-

If the donation includes non-cash items, provide a detailed description, noting that the donor is responsible for assigning a monetary value for tax.

-

Confirm if the NGO provided any goods or services in return for the donation, detailing the type and value of those items if applicable.

-

If goods or services were provided, include a statement representing their good faith value to help determine the net value of the donation for tax deduction purposes.

-

If no substantial goods or services were provided in return for the donation, include a declaration stating: “No goods or services were received in exchange for this gift.”

Importance of NGO Donation Receipts for Non-Profit Organisations

-

NGO donation receipts assist in lowering income tax liabilities for individuals, businesses, and multinational corporations that contribute. This tax incentive can significantly motivate increased donations to charitable organizations.

-

These receipts reassure donors that their contributions have been received and will be effectively utilized, thereby enhancing their satisfaction and trust.

-

Actively issuing donation receipts is crucial for cultivating long-term, trusting relationships with donors. It also provides an opportunity to show gratitude for their support, making donors feel valued and appreciated.

Importance of NGO Donation Receipts for Donors

-

Donors need donation receipts to claim charitable contributions when filing for tax refunds. This is a substantial incentive for many to lower their taxable income.

-

According to Section 80G of the Income Tax Act in India, contributions to qualifying NGOs are exempt from taxes. Donors can claim a tax exemption of 50% of the donated amount, capped at 10% of their adjusted gross annual income.

Why NGOs need Payment Page Receipts

Payment Page Receipts aim to help NGOs streamline their operations and ease a major chunk of their administrative burden.

Heavy involvement of manual labor

Generally, NGOs using Razorpay Payment Pages use their own invoicing mechanisms to generate invoices and receipts based on transaction reports. They download the donors’ names, email addresses, and other details, and send the receipts manually.

NGOs end up hiring individuals to manage their receipts and confirmations. Using multiple channels for confirmation adds to the workload, thereby consuming a lot of manhours. Hiring more employees just to keep up with receipts simply increases their operational costs, making the entire process quite expensive.

Data storage woes

Sometimes, donors do not remember the information they have entered in input fields. The situation gets worse if they have made multiple contributions. It can, thus, be extremely difficult for NGOs to keep track of receipts, sent and unsent.

To counter that, NGOs often store customer data and receipt particulars. However, maintaining sheets with such voluminous data is very cumbersome and time-consuming.

Roadblocks in Claiming Exemptions

This is a major issue for NGOs and donors alike when it comes to claiming tax exemptions. As per Section 80G of the Income Tax Act, taxpayers can claim tax exemption on the amount donated to certain funds or charitable organizations.

Donors often provide insufficient information while making donations, which results in the generation of non-80G compliant receipts being given to them. Later, the NGO staff have to dive into their records to confirm the donors’ particulars and regenerate appropriate receipts when they need to provide complete details for tax exemption.

With manual reconciliation and several means of communication involved, NGOs often take a very long time to send out these receipts. This is stressful for donors and NGOs alike, especially if there are last-minute requests for receipts by donors when they claim exemptions.

The antidote: Payment Pages Receipts

Here’s how Payment Pages Receipts can make your life easier and operations smoother.

1. Reduced operating costs:

You no longer need to hire someone just to send out and keep track of receipts. Payment Pages does it automatically for you

2. Immediate post-donation confirmation:

The donor receives a receipt instantly after making the payment. No more keeping track of unsent receipts and delayed manual confirmations

3. Fewer support queries:

With instant automated receipts, support queries can be avoided as the donor knows exactly what they have donated

4. Better for your brand:

Instant confirmation helps cement the brand image and trust of all the transacting parties. Let your donors remember the good cause, not the hiccups in the payment experience

5. Storage simplified:

The Razorpay Dashboard serves as a handy tool when it comes to storing your donors’ details and receipt particulars

6. Tax filing made easy:

NGOs no longer need to go fishing into their records for their donors in the tax filing season, when the donors wish to claim tax exemptions. The receipts generated for NGOs with all the claim-related information will be sent to them the moment they donate successfully

Related Read: Payment Gateway for NGO

It’s your turn

Excited to try out Payment Pages Receipts for your NGO? We bet you are. Sign up here.

Haven’t made your payment page yet? Check out our Payment Pages demo and unlock the secret to seamless, hassle-free payments!

Frequently Asked Questions (FAQs)

1. How to download 80G receipts online?

To access 80G receipts online, log in to your donation platform account using your registered email. Go to your donation history, choose the specific donation, and click ‘Download 80G receipt’ to obtain a PDF copy.

2. What are the fees for NGO 80G registration?

The cost for NGO 80G registration in India generally falls around ₹10,000 but can vary based on the service provider and the complexity of the process. This covers documentation, filing, and follow-ups with authorities. Check with your provider for exact pricing.

3. Is 80G mandatory for NGOs?

While 80G registration is not mandatory for NGOs, it is highly advantageous. It enables donors to claim tax deductions, making donations more appealing. Without it, NGOs may struggle to attract contributions due to the lack of tax benefits for donors.

4. What is the limit of 80G donation?

Donations under Section 80G can be deducted by 100% or 50%, depending on the institution. However, cash donations over ₹2,000 do not qualify for tax deductions. Additionally, contributions to specific funds are limited to 10% of the donor’s adjusted gross income.

5. How long does it take to get an 80G certificate?

If all necessary documents are in order, a non-profit organization can expect to receive the 80G tax exemption certificate within 3-4 months