Investment proof submission is an important part of payroll processing in any organisation.

It’s that time of the year when employees have to submit investment proofs for tax-saving investments declared at the beginning of the financial year. If you already know about the process and want to directly read the instructions for investment proof submission please find the free PDF below.

As a general notion in India, employers seek investment declaration from their employees twice every year – one at the beginning of the financial year, and another during December-January.

The first one is just a declaration of tax-saving plans for your employees, and the second is the submission of proof that the tax-saving investments were made as planned. Before diving into the process of submitting investment proofs, let’s talk about tax-saving investment options.

Table of Contents

List of tax-saving investment options

There are various ways for individuals to save tax on their annual income. The Income Tax Act provides several exemptions from the salary while computing taxable income.

In addition to the exemptions, the income tax also has various sections under which individuals can invest their money and save tax by getting tax deductions. Given below is a list of tax-saving investment options-

Tax Saving Fixed Deposit in a bank (up to 5 years): You can invest in a tax-saving fixed deposit for 5 years. It provides deductions up to Rs 1.5 lakh per annum under section 80 C of the Income Tax Act, 1961. You can earn up to 6-7% returns yearly on these deposits.

Public Provident Fund: Public provident fund is a long-term investment that can be withdrawn fully after 15 years and partially after completing 6 years. You can make an investment in PPF under section 80 C.

National Savings Certificate (NSC): NSC is a government saving bond aiming to induce small investors to invest in it and save tax under section 80 C.

National Pension Scheme (NPS): Investment in NPS for up to 10% of salary for salaried individuals and 20% for self-employed individuals is exempt under section 80 CCD (1).

ELSS funds: ELSS is a tax-saving investment scheme that has a lock-in period of 3 years. By investing in ELSS, you can claim a deduction of up to Rs 150000 a year.

Unit Linked Insurance Plan (ULIP): ULIP is an integrated scheme offering investment and life insurance. Investment up to Rs 150000 can be claimed as a deduction under section 80C.

Senior Citizen Saving Scheme (SCSS): This investment scheme helps senior citizens (above 60 years) save money for retirement. The amount remains locked in for 5 years. The amount invested in this scheme can be claimed as a deduction up to a maximum of Rs 150000 a year.

Tax-saving investment sections

Various sections within the Income Tax Act 1961 allow individuals to save taxes by making investments during a year.

Section 80 C: Section 80 C is a section of the Income Tax Act, 1961 that allows the individuals and HUFs to claim deductions for up to Rs 1.5 lakh for certain investments and expenses made during a year. Here are some of the investments allowed under this section-

- Tax saving Fixed Deposit (5 years)

- Equity Linked Savings Scheme (ELSS)

- Public Provident Fund (PPF)

- National Savings Certificate (NSC)

- National Pension Scheme (NPS)

- Unit Linked Insurance Plan (ULIP)

- Sukanya Samriddhi Yojana (SSY)

- Senior Citizen Savings Scheme (SCSS)

Section 80 CCD: A deduction of Rs 50,000 can be claimed on any investment made in NPS. This deduction can be claimed in addition to the deduction of NPS claimed in section 80 C.

Section 80 EEA: Any interest payment made for purchasing a new house under the affordable housing scheme is eligible for deduction of up to Rs 1,50,000 under Section 80EEA.

Investment Proof Submission Process

Investment proofs are documents proving that an investment has been made and contains the details. The finance and payroll team need to collect and verify the investment proofs of the employees to calculate the income tax, deduct TDS and then remit the remaining amount as salary.

There are various steps involved in the collection and verification of investment proofs. Let us look at the 7-step process to collect and verify investment proofs. You can also download this PDF which lists the instructions for submitting the investment proofs in detail and even pass it on to your employees.

Download PDF instructions for investment proof submission

Planning

It involves mapping out the entire process and deciding the window during which the employees can submit their POIs (Proof Of Investments) and the deadline for submitting the same.

Collection of Proofs

It is the process of collecting the proofs from your employees either in hard or soft copy. An employee portal can make the process easier as they can upload the proofs and the supporting documents on the portal, and the payroll team can access them easily.

Resolve Queries

Ensure the employees have all the relevant knowledge about the proof submission process. Resolve their queries and be approachable over email, calls, and texts.

Verifying the submitted Proof of Investment

This step involves verifying the investment proof submissions with the investment declared by the employee. Based on the verification process results, you can accept or reject the POI.

Re-collecting POI

If the POI submitted is invalid or does not have the correct information, it can be rejected, and the employees can be asked to re-submit it.

Re-verifying POI

This step involves re-verifying the POI submitted by the employees.

Computing Payroll

The last step involves computing the payroll using the investment proofs, deducting TDS, and remitting the remaining amount to the employees.

Investment Proof Submission on Behalf of Employees

Once the employers receive the proof of investment from the employees, they are required to submit the same on their behalf. One of the best ways to make the investment proof submission process easy is to invest in a good employee self-service portal.

These self-service portals allow the employees to submit their proofs and supporting documents at any time, anywhere. It is also a great way to automate the process of keeping the employees informed about the deadlines of proof submission and whether the proof was accepted or rejected. If your employees fail to submit proofs, a huge chunk from their salary might be deducted as TDS.

One such software or self-service portal is RazorpayX Payroll.

RazorpayX Payroll simplifies the tedious process of investment declaration and proof submissions for your employees. The software allows employees to calculate their tax liability under the old & new tax regime, helping them plan their taxes, and declare investments. Also, it automatically triggers reminders for investment proof submission around the cut-off date.

Let’s have a look at the process.

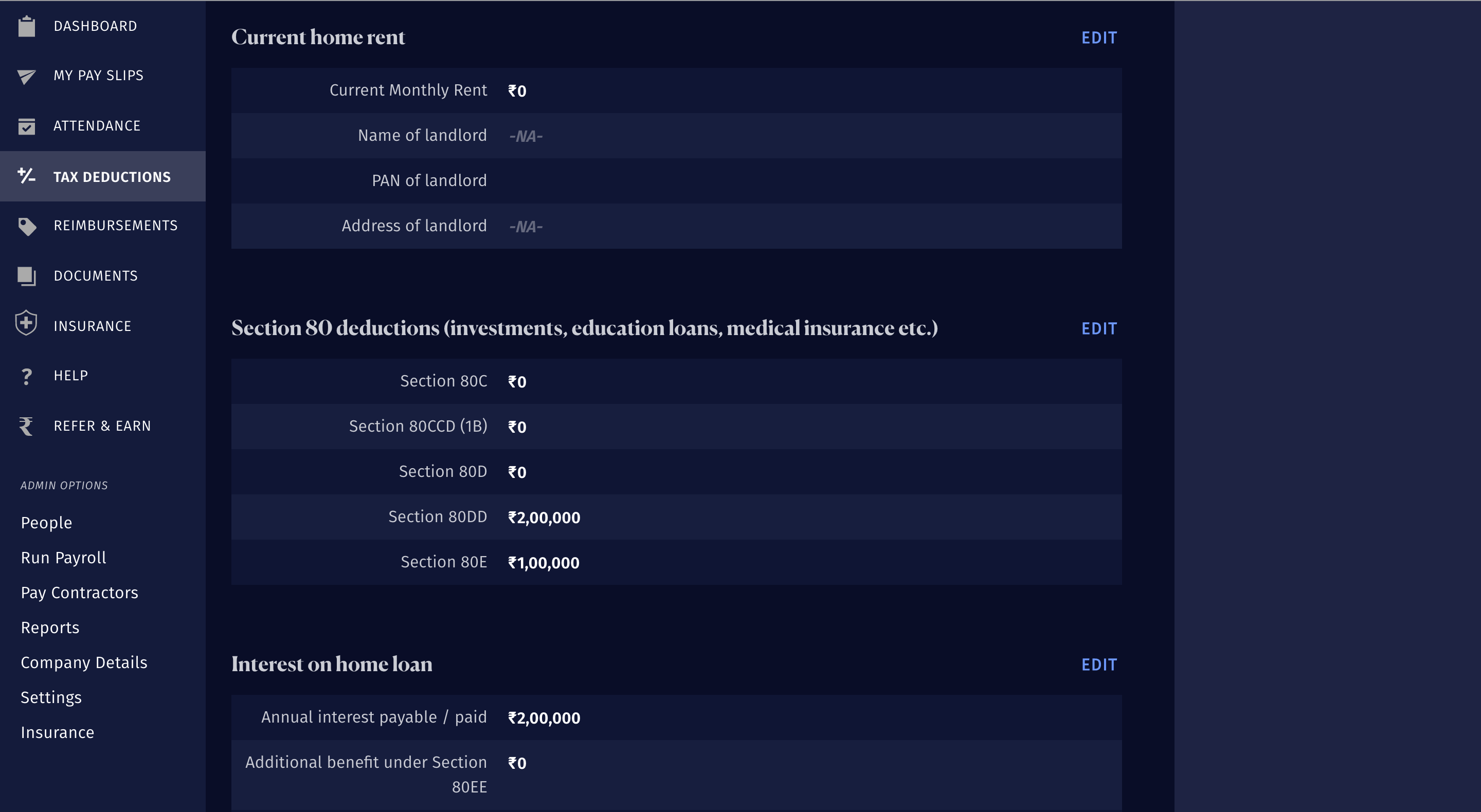

Your employees can log in to their personal or individual account and upload their investment proofs under ‘Tax Deductions’. Or, they can just click on https://payroll.razorpay.com/taxDeductions, and upload related documents.

We understand that there can be some tax-saving investments where the payments are due in the later months of FY 2022-23.

In such cases, your employees can upload partial or previous year’s investment proofs (if any). The software will validate it accordingly and provide an accurate claim. Your employees can update the proofs once the actual payments are made. But, these changes will require your approval.

Once your employees are done with the submission, RazorpayX payroll will validate all the tax-saving investment claims. If the software detects any missing information, the tax deduction will be removed automatically. Such adjustments will affect your employees’ TDS for the remaining months of this financial year and reduce their take-home salary.

Please ensure to communicate with your employees that any false claim or incorrect information can create trouble in the future.

What’s in it for employers?

RazorpayX Payroll provides you 100% visibility of the entire payroll process, including employee tax declarations.

You can login and view the ‘Tax Deduction Report’ under ‘Reports’ column at any time and from anywhere. This report will help you understand whether your employees have declared and submitted their tax-saving investments proofs.

If you haven’t tried RazorpayX Payroll for your business, sign up now and let it manage all things payroll for you.