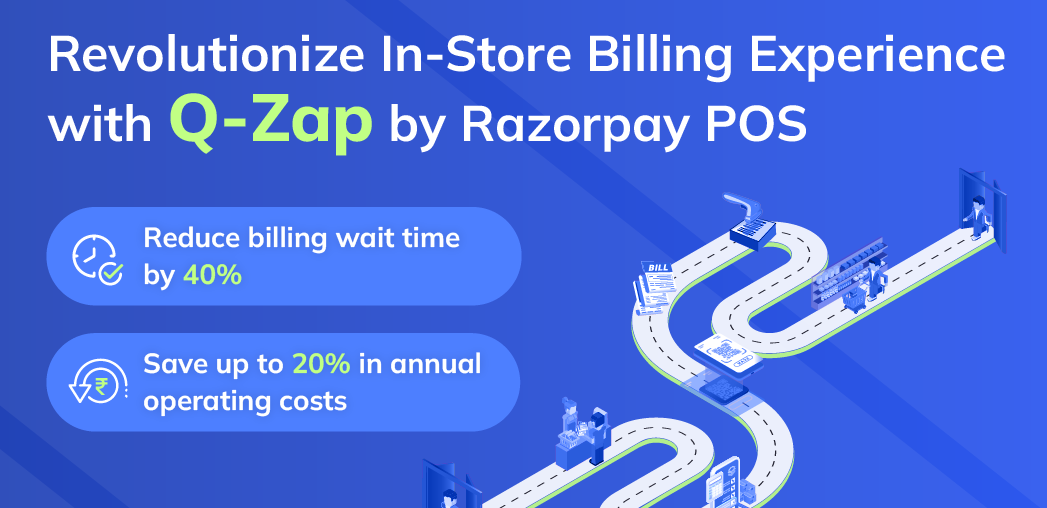

- The solution will help businesses save up to 20% in annual operating costs

- The plug-and-play integration with 120+ billing partners speeds up solution setup significantly, from 4 weeks to 4 days

INDIA, Bengaluru, 29 May 2024: Staying true to its commitment to helping offline businesses unlock new levels of growth, Razorpay POS, the offline payments arm of the fintech giant, today announced the launch of ‘Q-Zap’, an intelligent payment solution for retailers, designed to facilitate faster checkouts and zero queues. With the help of Q-Zap, Razorpay POS aims to redefine the in-store customer experience by reducing billing time by 40% and helping retailers save up to 20% in annual operating costs.

How does Q-Zap help businesses?

When customers make purchases in a store, they often have to proceed to the billing counter and wait in line to complete their payment, even for the smallest purchases. These long checkout lines can be frustrating for customers and merchants, negatively impacting customer satisfaction and sales for businesses. Enter Q-Zap, an intelligent suite of queue-busting solutions that allows businesses to collect payments beyond the traditional billing counter. Using self-checkout kiosks or hand-held POS devices integrated with the Q-Zap solution, customers can complete their payments from anywhere within the store, eliminating the need to wait in long lines. Q-Zap also offers seamless Ready Plug-and-Play integrations with over 120 billing partners, accelerating solution implementation within 4 days as compared to the industry standard of 4 weeks. This integration with billing software streamlines tasks such as billing, payment collection, and the reconciliation of goods sold against payments received, making the process highly efficient. This user-friendly, and all-in-one solution enhances the customer experience significantly. Q-Zap seamlessly integrates Razorpay POS hardware and software, supporting all payment methods, including UPI, credit cards, and debit cards, across all major networks such as Visa and Mastercard for faster checkout.

The traditional Point of Sale (POS) is rapidly evolving into a ‘Point of Service’, as customers increasingly expect enhanced experiences at every interaction. Eliminating the checkout line is just the first step in this transformation. Once staff members are relieved from stationary cash registers, they must be elevated to cater to additional responsibilities. To effectively manage these new duties, they must be equipped with the appropriate tools. This is where non-traditional checkout options, like self-service, can help businesses significantly.

Commenting on the launch, Rahul Kothari, Chief Operating Officer, Razorpay, said, “At Razorpay, we are committed to empowering businesses with tools that ensure seamless payment experiences. Q-Zap, our queue-busting solution, aims to not only eliminate tedious checkout lines for customers but also to free up in-store staff’s time so they can be available to customers and provide them assistance, which could include answering questions or facilitating customer checkout. As India’s consumer market evolves dynamically, so do the needs of businesses. With the market poised for exponential growth, achieving the ambitious $2 trillion target by 2033 requires robust infrastructure. Razorpay prides itself on innovation, constantly developing agile solutions to address key pain points in the entire money movement journey of not just online businesses, but offline too.”

Razorpay began extending its payment offerings for the offline world with the acquisition of Ezetap (now Razorpay POS) in August 2022 and evolved into an omnichannel payment platform for online and offline businesses. Recently, the company introduced innovative products and features, such as Instant refund within 2 mins for failed UPI transactions on Razorpay POS devices and the Dynamic QR Soundbox (DQR) – India’s first enterprise-ready QR device with card support at its flagship event FTX. With these new offerings, Razorpay POS is enhancing the in-store payment experience by providing various touchpoints and continually reinventing the wheel of payment solutions.