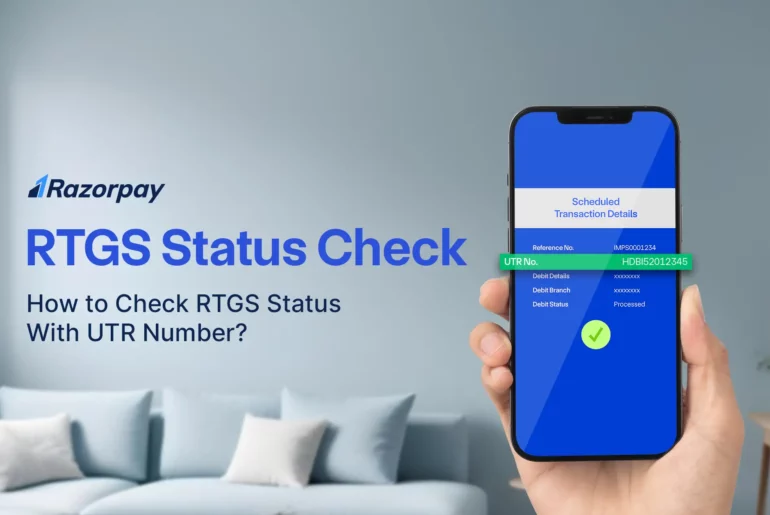

One of the features of RTGS that make it particularly relevant for modern consumers is that the transactions can be initiated through net-banking.

Real-time Gross Settlement (RTGS) is an electronic fund transfer system…

Introduction to RTGS Transactions Real Time Gross Settlement (RTGS) is…

Consumers can use RTGS to transfer funds through two ways – online internet banking and offline by visiting a bank branch.

Currently, there are over 150,000 IFSC Codes operating in India, with more than 1,400 banks all over the country.

RTGS is a convenient transaction mode that is ideal for high-value transactions. Individuals can use this form of payment for large investments & payments.