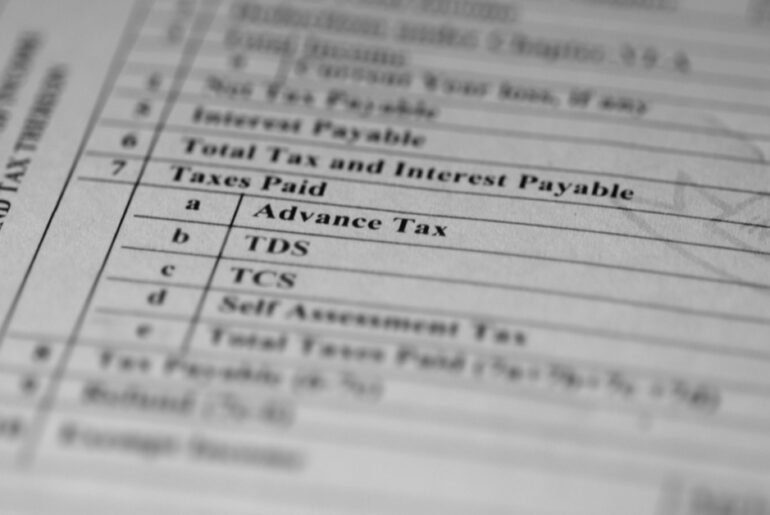

TDS and TCS are two of the most significant sources of income for the government. Read as we take a deep dive into the difference between TDS and TCS and their importance for businesses.

Paying advance tax is simple. If you’re trying to figure out how to pay advance tax online for your business, then check out this handy guide.

Tax collected at source is the tax collected by the seller, at the time of sale. Read on to know everything about TCS and its impact on your business.

Bookkeeping means keeping a record of day-to-day financial transactions. It provides key financial insights that helps in strategising businesses growth.

Read on to understand what is cash on delivery (CoD), how does it work and why is it important to offer CoD for online businesses.

Corporate tax applies to every company in India. Here’s the only guide you’ll ever need to understand corporate tax in India and how to pay it online.

We are sailing into a technology-driven economy and this shift…

Startups require a current account for streamlined withdrawals, deposits and other business transactions. This blog post covers startup current account and the best way to bank for Indian startups.