A commercial invoice is a crucial legal and customs document used in international trade to record a sale and declare shipment details like goods description, quantity, value, payment terms, and Incoterms. It is used by customs authorities to calculate import duties and taxes and acts as evidence of a contract between seller and buyer. Accurate commercial invoices help prevent delays, disputes, and compliance issues during customs clearance.

Table of Contents

What Is a Commercial Invoice?

A commercial invoice is a legal document that acts as a contract and proof of sale between a buyer and seller in international transactions. It is crucial for export and import clearance, helping customs assess duties, taxes, and shipping details, as well as for financial processes. Key details in a commercial invoice include item description, quantity, value, payment terms, and shipping information such as the Bill of Lading number, HS code, etc.

Commercial invoices also offer legal protection for both parties and are essential for accounting, helping businesses maintain accurate financial records for tax compliance. For large-scale manufacturers engaged in international business, commercial invoices are indispensable, playing a vital role in customs clearance and serving as proof of transaction.

Key takeaways

- A commercial invoice is a legal document used in international trade that details a sale transaction between a seller (exporter) and a buyer (importer), including the description, quantity, and value of goods shipped.

- It serves as a customs declaration for cross-border shipments, helping customs officials assess applicable duties, taxes, and import regulations to clear goods through international borders.

- A commercial invoice acts as proof of sale and contract evidence between trading parties, and it can be used for accounting, legal verification, and financial record-keeping.

- Accuracy and completeness are crucial, as missing or incorrect details can lead to customs delays, penalties, or shipment rejections.

- Unlike regular domestic invoices, a commercial invoice is tailored specifically for export/import purposes and is typically required for all international shipments involving goods.

Related Read: 15 Types of Invoices: Meaning, Examples and Key Elements

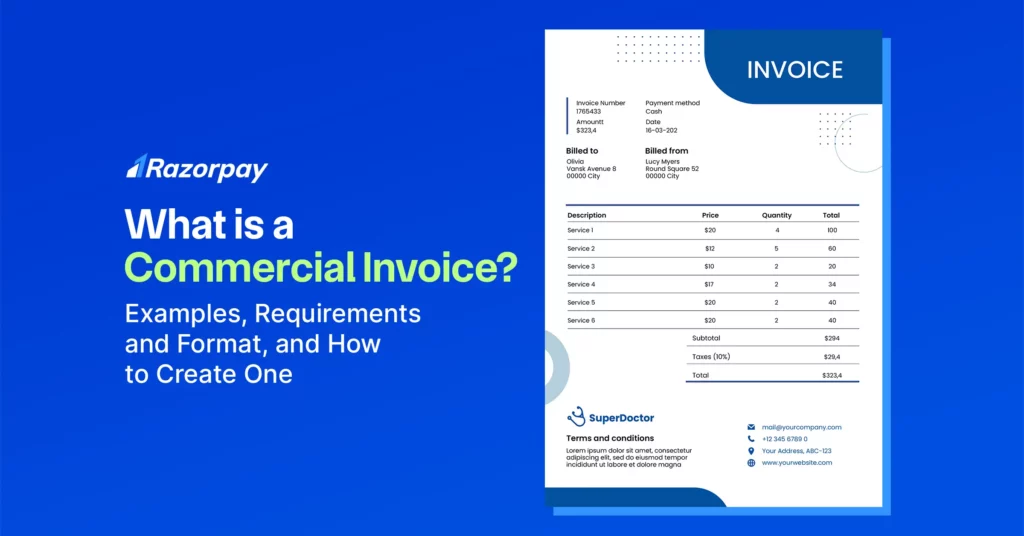

Commercial Invoice Example

Let’s say you run a business in India that manufactures handcrafted furniture, and you’ve just received an order from a retailer in the UK. Here’s a commercial invoice sample for this transaction:

1. Seller Details

Company Name: Artisan Furniture Co.

Address: 789 Craft Street, Jaipur, India

Contact: +91 98765 43210

Email: sales@artisanfurniture.in

2. Buyer Details

Company Name: British Home Interiors

Address: 101 London Road, London, UK

Contact: +44 20 1234 5678

Email: purchasing@britishhome.co.uk

3. Invoice Details

Invoice Number: AF-2025-1001

Invoice Date: 22nd July 2025

Payment Terms: 50% Advance, 50% on Delivery

Currency: GBP

4. Description of Goods

Item |

Quantity |

Unit Price (GBP) |

Total Price (GBP) |

|

Handcrafted Wooden Chairs |

50 |

150 |

7,500 |

|

Dining Tables |

20 |

400 |

8,000 |

|

Bookshelves |

10 |

600 |

6,000 |

Subtotal: £21,500

Shipping Cost: £1,200

Total Amount: £22,700

5. Signature of Seller

Amit Sharma

Managing Director, Artisan Furniture Co.

In this example, Artisan Furniture Co. is exporting handcrafted furniture to British Home Interiors. The commercial invoice details the items sold, quantities, unit prices, and total cost, along with essential information like invoice number, date, payment terms and shipping costs.

Related Read: What is an Invoice? Purpose, Types, and Format

Format of a Commercial Invoice

A commercial invoice contains several key components essential for international trade.

Here’s a breakdown of the main elements you’ll need to include:

1. Details of goods being shipped

- Description of items

- Quantity

- Weight

- Value per unit and total value

2. Buyer and seller information

- Full names

- Complete addresses

3. Payment and delivery terms

- Payment method

- International commercial terms (Incoterms)

- Delivery timeframe

- Country of origin of the goods

4. Mode of transport

- Air, sea, road, or rail

- Destination country

5. Identification numbers

- Tax identification number

- Exporter’s registration number

6. Additional information

- Invoice number and date

- Purchase order reference

- Harmonised System (HS) codes

- Any special instructions or certifications required

Related Read: What Is a Shipping Invoice?

Details Required to Create Commercial Invoices

For Indian companies engaged in international trade, creating a commercial invoice involves adhering to specific requirements set forth by the Customs Act of 1962 and India’s Foreign Trade Policy. These regulations ensure compliance and facilitate smooth international trade operations. The following details are essential for creating a comprehensive and compliant commercial invoice.

1. Information required for shipping

When shipping goods internationally, your commercial invoice should contain:

- Detailed description of the goods

- Quantity and weight of the goods

- Unit and total price

- Buyer and seller information

- Country of origin and destination

- Payment terms

- Regulatory compliance statements

2. Information required for a transaction

For any international transaction, ensure your commercial invoice includes:

- Transaction terms (Incoterms), including price, payment method and terms of delivery

- Applicable taxes and duties

- Buyer and seller contact details

- Necessary documentation, such as packing lists, certificates of origin, bill of lading, and other shipping documents

3. Information required for exporters and importers

a) Exporters

Exporters need to provide comprehensive details on the commercial invoice, including:

- Detailed description of goods sold, including quantity, value, etc.

- Exporter’s name and address

- Consignee’s details

- Invoice number and date

- Shipping method and terms

- Company’s Tax identification number and Export licence number

- Harmonised System (HS) code for the goods

- Other documents for legal and regulatory compliance

b) Importers

Importers must carefully review the commercial invoice to ensure:

- All details are complete and accurate

- Goods are described correctly

- Payment terms are clearly stated

- Any discrepancies are addressed before customs clearance

How to Create a Commercial Invoice?

Creating a commercial invoice is a crucial step in international trade, ensuring transparency and compliance with legal and regulatory requirements.

Steps to create a commercial invoice:

STEP 1: Gather the necessary information

- Start by collecting all relevant information about the goods and the parties involved.

- Include the correct Harmonized System (HS) Code.

- Declare the Correct Value of Goods.

- Ensure Compliance with Incoterms.

STEP 2: Use simple but detailed language

Employ clear and concise language to describe the goods and transaction details.

STEP 3: Choose a suitable template

Select a commercial invoice template that fits your business needs. You can find various templates online or create one that includes all the necessary fields.

STEP 4: Fill in the details accurately

Accurately complete the chosen template with the gathered information. Ensure that all fields are filled correctly.

STEP 5: Include the required supporting documents

Attach any necessary supporting documents, such as bills of lading, certificates of origin, or packing lists. These help verify the shipment and facilitate customs clearance.

STEP 6: Review for Accuracy and Completeness

Double-check all details for errors or omissions to ensure complete and accurate information.

STEP 7: Send the completed invoice

Once the invoice is complete, send it to all relevant parties.

When Do You Need a Commercial Invoice?

A commercial invoice is important for smooth international trade operations and is required in various scenarios such as:

1. Scenarios requiring commercial invoices

When exporting goods to another country, a commercial invoice is mandatory. This document is also necessary when importing goods, as the supplier must prepare it. Customs officials use these invoices to clear goods through their system efficiently.

2. Accurate and complete information

Providing accurate and complete information on your commercial invoice helps to avoid delays or rejections during customs clearance. This ensures your goods reach their destination without unnecessary complications.

3. Legal and financial record-keeping

Commercial invoices are important for legal and financial record-keeping as they serve as proof of the transaction between the buyer and the seller, making them crucial for auditing and compliance purposes.

Importance of Commercial Invoice

1. Customs Clearance

Customs authorities rely on the accuracy and completeness of the commercial invoice to assess duties, taxes, and comply with import regulations. Inaccurate or missing information can lead to delays, penalties, or even seizure of goods.

2. Proof of Transaction

The commercial invoice serves as a legal record of the sale, specifying the goods, quantities, prices, and payment terms. This documentation is essential for resolving disputes, claims, and verifying the transaction.

3. Financial Record keeping

For businesses, the commercial invoice is a primary source of data for accounting and tax purposes. It helps track sales, manage cash flow, and comply with tax regulations in both the exporting and importing countries.

Create your Invoices with Razorpay Invoicing Software

Commercial Invoice vs Packing List

Aspect |

Commercial Invoice |

Packing List |

|

Purpose |

Facilitates international trade and customs clearance |

Details of the contents of the shipment |

|

Content |

Includes buyer and seller information, description, quantity, price, and payment terms |

Lists the items, their quantities, and packaging details |

|

Regulatory Use |

Required for customs and legal compliance |

Used for shipment handling and verification |

|

Financial Details |

Contains the financial details of the transaction |

Does not include financial information |

|

Document Type |

Legal document |

Logistical document |

Commercial Invoice vs Proforma Invoice

Aspect |

Commercial Invoice |

Proforma Invoice |

|

Purpose |

Final billing document used for customs and payment |

Preliminary invoice issued for informational purposes before sale is completed |

|

Binding Nature |

Legally binding |

Not legally binding, more like a quote |

|

Content |

Includes final prices, terms, and shipment details |

Provides estimated prices and terms |

|

Use Case |

Used for actual sale and customs clearance. |

Used for buyer’s approval and import permits |

|

Timing |

Issued after goods are ready to ship |

Issued before goods are shipped |

Commercial Invoice vs Tax Invoice

Aspect |

Commercial Invoice |

Tax Invoice |

|

Purpose |

Used for international trade and customs clearance |

Used for domestic transactions and tax compliance |

|

Tax Details |

May include international taxes and duties, if applicable |

Includes local taxes such as GST |

|

Content |

Detailed description of goods, prices, and terms for international shipment |

Detailed description of goods/services and applicable taxes |

|

Regulatory Use |

Required for customs and export/import regulations |

Required for tax filing and compliance |

|

Scope |

Used in international trade |

Used in domestic trade |

Commercial Invoice vs Export Invoice

Aspect |

Commercial Invoice |

Export Invoice |

|

Purpose |

Used for international trade and customs clearance |

Specifically used for exporting goods |

|

Content |

Includes detailed descriptions, quantities, prices, and terms |

Similar to a commercial invoice but may include additional export-specific details |

|

Use Case |

Broad use in international transactions |

Specifically for export transactions |

|

Additional Information |

May include HSN codes, country of origin, and other trade details |

Includes all commercial invoice details plus any export-specific requirements |

Related Read: What is the Difference Between Invoice and Bill?

Conclusion

A commercial invoice is a critical international trade document detailing shipment specifics from seller to buyer. It includes essential information such as goods description, value, buyer and seller details, and terms of sale. Both parties must accurately complete commercial invoices to prevent delays or issues in shipment.

Related Read: Invoice Vs Proforma Invoice: Differences, Benefits and Examples

Frequently Asked Questions

1. Who provides a commercial invoice?

The seller or exporter is responsible for providing the commercial invoice. This document accompanies the shipment and ensures that all transaction details are transparent and accessible for both the buyer and customs authorities.

2. Is a commercial invoice required for all international shipments?

Yes, a commercial invoice is required for all international shipments. It serves as a key document for international shipments.

3. Are there different types of commercial invoices?

Yes, there are different types of commercial invoices, including proforma, standard and final invoices that reflect the final amount due. Each type serves a specific role in the transaction process, from initial estimates to final payments.

4. Can I use electronic commercial invoices?

Yes, electronic commercial invoices (e-invoices) are widely accepted and can streamline the shipping process. E-invoices facilitate quicker processing and can be easily shared between parties and customs authorities, enhancing efficiency and accuracy.

5. What happens if there are errors on a commercial invoice?

Errors on a commercial invoice can lead to significant delays in customs clearance and potential penalties. It is crucial to ensure that all information is accurate and complete to avoid shipment hold-ups and compliance issues.