Rang De was started to address the huge unmet need for affordable credit for livelihood to overcome poverty. The inspiration for Rang De came from Muhammad Yunus and his contributions at the Grameen Bank. In its earlier avatar, Rang De has successfully reached out to 65,000 entrepreneurs and helped them build sustainable livelihoods.

“Our unique model leverages technology to connect social investors to rural unbanked entrepreneurs.”

Since their inception in 2008, they’ve been persistent in providing credit at affordable interest rates to credit-starved communities–early-stage or new entrepreneurs from low-income households.

Razorpay has helped Rang De in serving thousands of rural entrepreneurs across India with affordable credit by helping them raise social capital online from social investors. They have just relaunched Rang De as an NBFC-P2P. They are now regulated by RBI and are excited to be working with Razorpay in their new avatar.

“Rang De’s rural entrepreneur network is growing at 50% month on month and Razorpay has played a critical role in enabling this.”

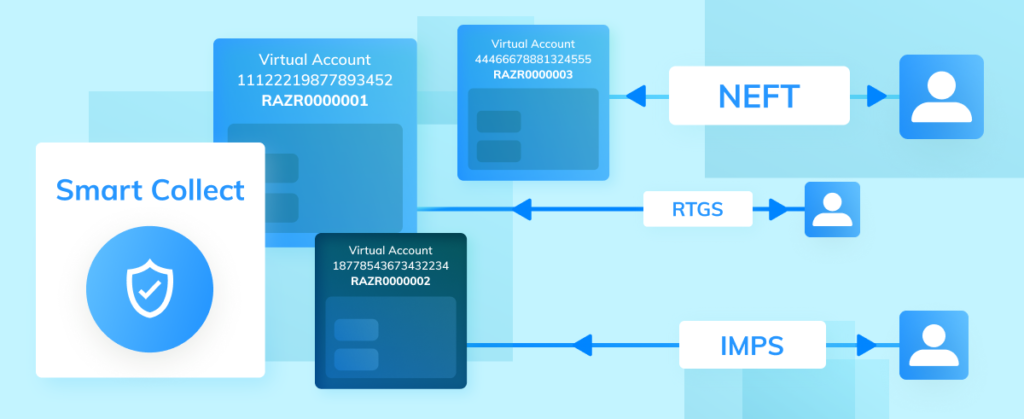

Rang De uses a key Razorpay feature called Smart Collect (Virtual Payment Account) to receive repayments from their borrowers across India. Smart Collect makes their operations super efficient and also cost-effective.

All of Rang De’s repayments from their borrowers are powered by Razorpay Smart Collect.

They plan to serve 1 million low unbanked entrepreneurs with affordable credit across the country in the next 5 years, Razorpay’s Smart Collect is going to save them 100s of man-hours every month in doing this.

“Integrating our core product was quite easy with Razorpay. Two weeks off the block, and we were able to migrate most of our social investor’s credit balances from Rang De’s older platform into our new NBFC-P2P platform.”

That’s a lot of saved manual effort since all of their repayments now come through Razorpay and are reconciled in real-time.

Rang De wanted a unified payment gateway for websites and mobile, which passed the high-security standards mandated by RBI. With Razorpay, they got more than they asked for.

The story of Rang De

We asked, Ramakrishna NK, Co-founder and CEO of Rang De, to tell us more about the birth of Rang De and the way forward for it.

1. What are your company’s vision and goal?

By reaching out to underserved communities and offering them credit at affordable interest rates, our vision is to make poverty history in India.

Started in 2008, Rang De is a pioneering peer-to-peer lending platform. Our mission is to reach out to early-stage, first-time entrepreneurs from low-income households and provide them access to venture debt at affordable interest rates.

Our unique model leverages technology to connect social investors (lenders) to rural entrepreneurs, Rang De has been able to reach out to 65000 entrepreneurs with credit at really affordable interest rates and helped them build sustainable livelihoods and create jobs.

Recently, we have transitioned into an NBFC P2P and are on a mission to provide credit to 10 million credit-starved entrepreneurs across India.

2. What was the idea behind the birth of Rang De?

The idea behind Rang De emerged in 2006, the same year when Muhammad Yunus won the Nobel Peace Prize for his work in the field of microcredit. We felt that credit could be a powerful tool to help people fight poverty.

However, the interest rates that borrowers were being charged were exorbitant. We felt something had to be done about it. That’s how Rang De was born – to connect individuals who needed access to credit with Individuals who could lend small sums of money.

3. What is the problem(s) your company is solving?

Our idea was to leverage the power of the internet to connect individuals who want to make a difference sustainably, by creating sustainable livelihoods to thousands of individuals who are either denied or not offered credit.

By tapping into the power of many, and decentralizing the source of funds, we have been able to significantly reduce interest rates on our loans to change the lives of potentially millions of credit-starved individuals across the country.

4. How do you see your company growing in the coming years?

We see credit as that financial opportunity that could help people overcome poverty. In the next five years, we would like to reach out to 10 million individuals across the country and provide them with access to need-based customized credit.