Every business or enterprise expects its customer’s transaction to reflect in their account directly. But even today, in the era of digital-first platforms, these settlements are not instant. To give you more clarity on the payment gateway settlement process, let us show you what happens behind the scenes.

Settlement process: A business’s perspective

Settlements is a process through which a business receives a certain amount paid by their end-users via online transactions for a particular product or service.

In this case, an individual pays via a payment gateway on the business’s website or app, and that amount is transferred to the business’s account by the payment gateway.

Here’s what a typical settlement process looks like:

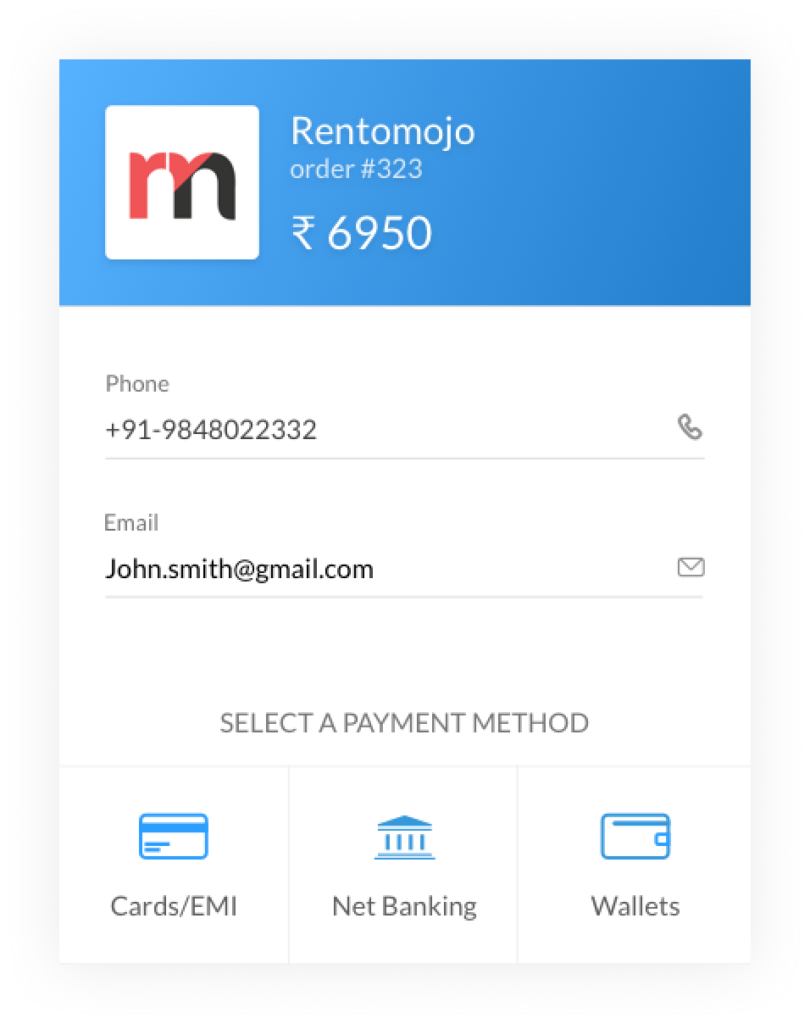

Step 1: The cardholder inputs their bank account or card details on the Razorpay checkout form to pay for a product or service

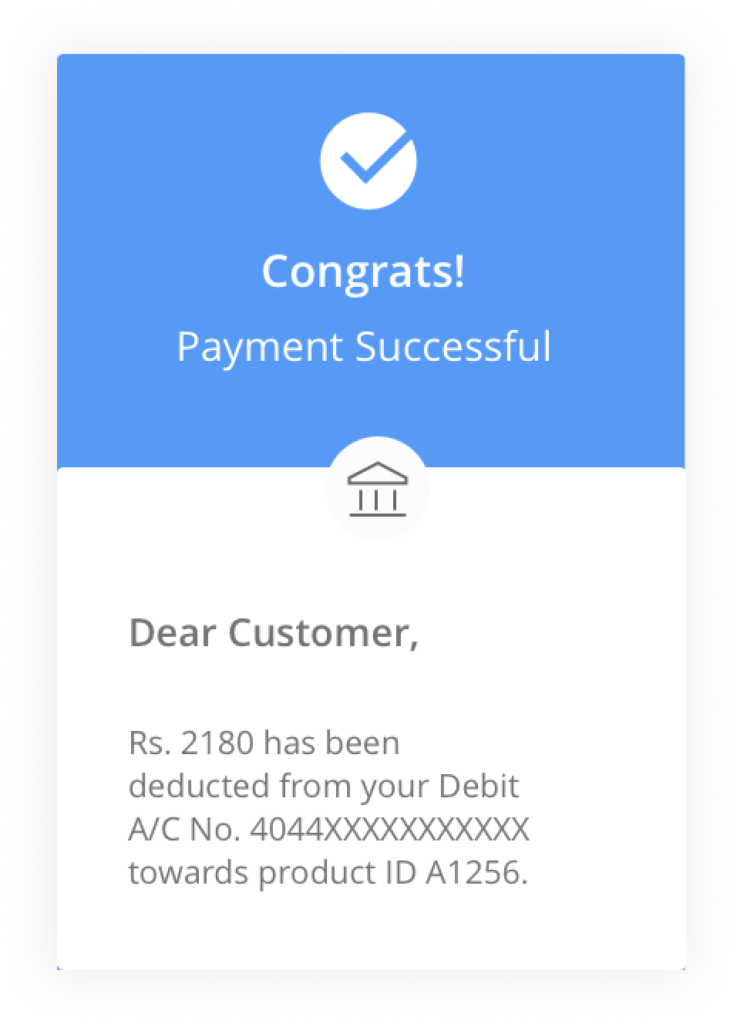

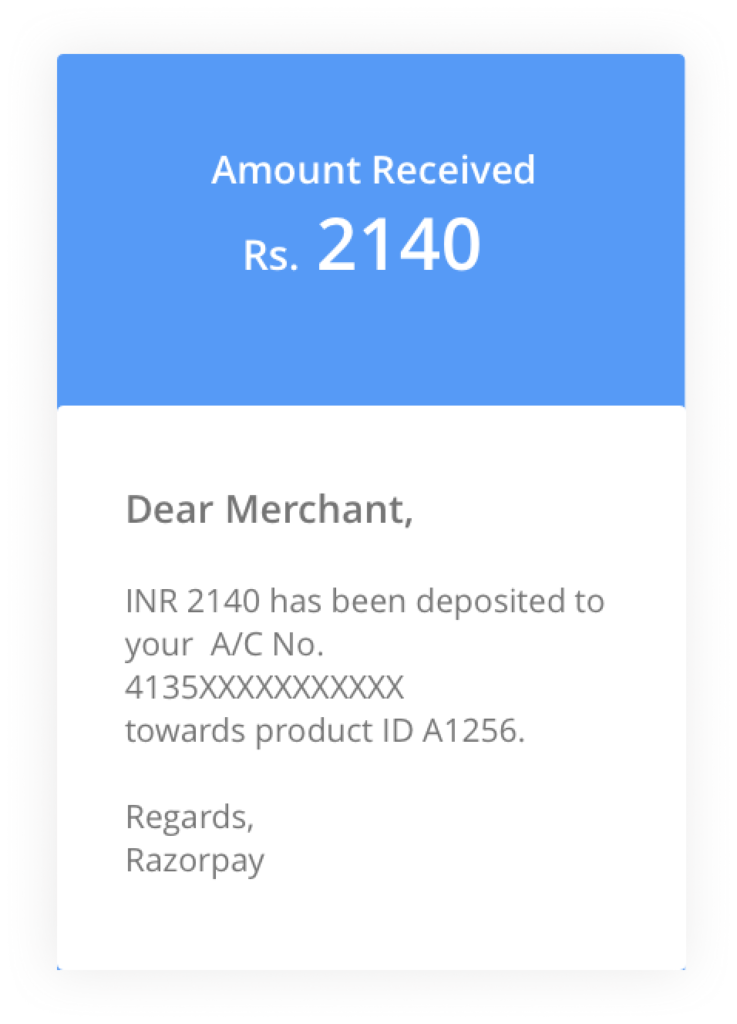

Step 2: After successful authentication via OTP or 3D secure, the money is debited from the cardholder’s account, and the individual receives a confirmation notification for the same

Step 3: The transaction amount is routed via the card networks to Razorpay’s acquiring banking partners

Step 4: Once Razorpay receives the amount, it is settled to the seller’s bank account after the deduction of a specific fee

Why don’t settlements happen instantly?

Payment settlements may look like a very straight-forward process, but they are not. The primary reason why settlements are not instant is that money movement at every step of the process is not immediate.

Also, the underlying complexities of reconciliation is an additional challenge that stands in the way of instant settlements.

Well, reconciling transactions can be a nightmare for accountants, and here’s why:

- Every bank has or offers a different settlement cycle. Hence, the time-frame for the acquirers can vary. For example, Bank A may usually settle within a day, whereas Bank B may take two days to pay. Keeping track of these timelines and consolidating it all in a single sheet does take time

- Bringing along a whole new level of complexity are refunds and chargebacks. In case of refunds, a customer expects them immediately. But refunding the money without reconciliation puts the business at risk

- The business owner can end up paying back an amount that was never received. Also, it would be a disaster when the bank statements and reconciliation documents would fail to show a clear picture

When does Razorpay settle a business?

For every business on the Razorpay Payment Gateway, we define a settlement schedule–the time from the date of payment capture to when the business should receive the due amount.

As per the schedule established for the business, the settlement is created only for captured payments and refunds requested for the captured payments.

Earlier, the complete process used to consume T+3 business days for domestic transactions (T being the date of payment capture).

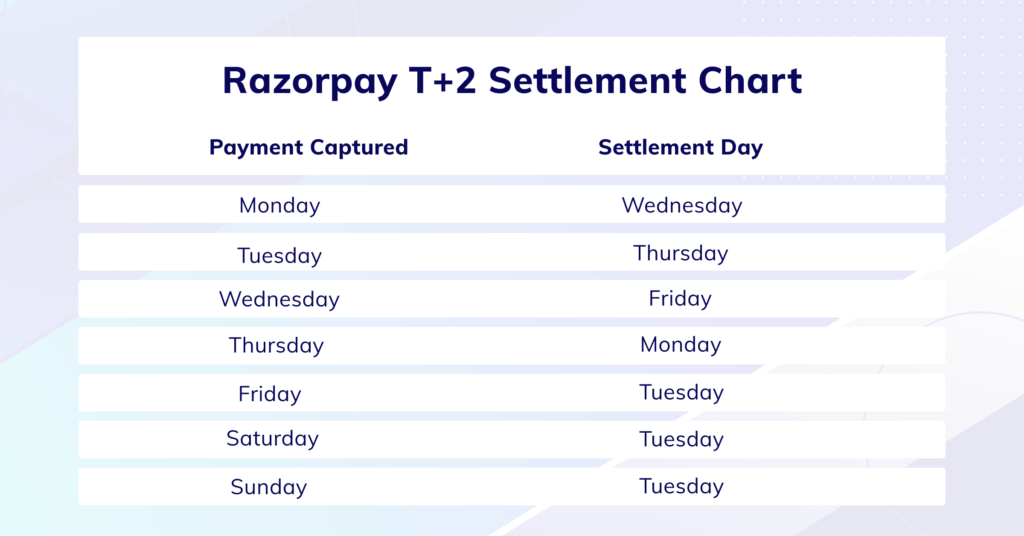

Today we are glad to announce that customers can unlock faster settlements at no additional costs. Yes, the settlement cycle has been upgraded from T+3 to T+2 by default.

Note: Razorpay doesn’t schedule settlements on weekends.

Here’s the Razorpay T+2 settlement chart:

Note: Maximum settlement time – four days

To settle this

Settlements usually depend on the multiple intermediary hops. In the case of cards, the acquiring bank, card network, and issuing bank are involved.

In the case of a payment method like UPI, along with the acquiring and issuing bank, NPCI also plays a role. This is why the amount of time taken to process the settlements also depends on the mode of payment used to make the transaction.

The entire money movement process in online payments happens via nodal accounts. This means that payment gateways cannot earn interest from the money they hold or move on behalf of their customers.

At Razorpay, we are genuinely devoted to providing the best payment experience, not just for the businesses that work with us, but also for their end customers.

We truly believe that if online payments have to replace cash, then it has to provide the same ease of use, which is what we strive to achieve.

To make settlements even smoother, and to help businesses manage their working capital requirements efficiently, we also provide 24x7x365 On-Demand Instant Settlements. Read about that here.