Table of Contents

What is payment orchestration?

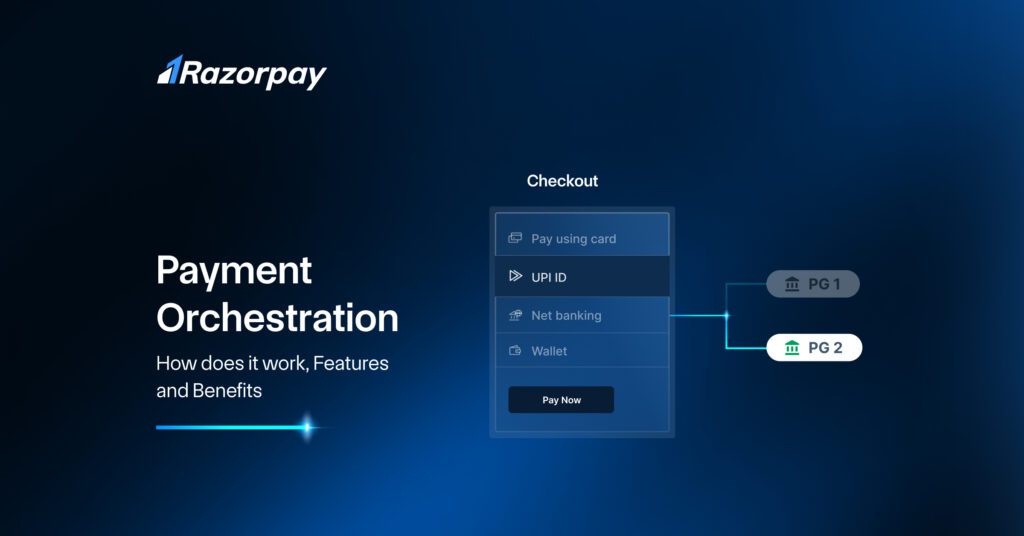

Payment orchestration is the process of managing the chaos of various payment methods, payment gateways, payment providers, banks, and issuers and streamlining them from one unified platform. Payment orchestration optimizes the flow of payments, minimizing disruptions and maximizing success rates.

By centralizing the payment process, businesses can avoid the complexity of managing multiple payment partners and rely on a single, easy-to-integrate solution. This enhances reliability, facilitates smooth transactions and allows businesses to focus on their core activities while experts handle payment orchestration.

How does payment orchestration work?

Payment orchestration follows the following steps:

- The customer adds the product to the cart and proceeds to checkout.

- The customer chooses the payment method and enters the payment details.

- The payment gateway encrypts and sends data to the acquiring bank via the payment processor.

- The acquiring bank verifies the payment with the issuing bank for authorization.

- The payment orchestration platform intelligently evaluates available methods and gateways based on factors such as cost, speed, location, and reliability.

- It routes the payment through the most suitable payment gateway.

- If the primary payment gateway is experiencing downtime, the platform reroutes the transaction to another gateway for minimal disruption, ensuring that the payment is successful.

- If a payment fails, the payments orchestrator/router automatically reroutes the payment to an alternative method/gateway to ensure that the payment goes through successfully.

- Multiple Payment Gateway Integration: It enables businesses to integrate with multiple payment gateways and methods, providing flexibility. It enables various payment methods such as credit cards, debit cards, e-wallets, bank transfers, etc., catering to diverse customer preferences.

- Smart Routing: Payment orchestration utilizes intelligent routing or smart routing to route payments to the most optimal gateway or acquiring bank based on factors such as cost, speed, reliability, and other transaction attributes.

- Fraud Detection: It implements robust fraud detection systems leveraging AI and machine learning to identify and prevent fraudulent transactions, ensuring transaction security.

- Security Compliance: Payment orchestration platforms adhere to industry-standard security protocols and regulatory requirements as per the RBI guidelines. This safeguards sensitive payment data and maintains trust with customers.

- Real-time Monitoring: Payment orchestration systems continuously monitor transactional data as it flows through various payment channels and gateways. This includes capturing information such as transaction amounts, payment methods used, timestamps, and transaction statuses. Using robust analytics tools, it provides data and insights in real-time.

What are the benefits of payment orchestration?

The adoption of payment orchestration yields a world of benefits for merchants looking to optimize their payment workflows and enhance customer satisfaction.

- Increased Conversions: It reduces payment failures by optimizing the payment process, covering everything from payment authorization and payment method selection to reconciliation and refunds. This ensures that all authorized transactions are completed successfully, reducing drop-offs and increasing conversions.

- Global Coverage: By partnering with multiple PSPs(Payment Service Providers) and banks, it enables seamless cross-border transactions, managing exchange rates and regulatory requirements effortlessly.

- Enhanced Customer Experience: Offering a smooth checkout process provides your customers with an ideal payment journey. Not only does payment orchestration streamline the payment process but it also reduces payment failures. This lets your customers know that their payments are secure and will be completed with ease, contributing to higher customer satisfaction and retention rates.

- Revenue Optimization: It provides businesses the option to set custom rules and parameters based on which transactions are routed. Merchants can use the payment method that charges the lowest transaction processing fee without compromising on payment success rates. This enables merchants to optimize pricing according to business needs.

- Actionable Analytics: Comprehensive analytics reports generated by payment orchestration platforms offer actionable insights into payment trends, transaction success rates, refunds, settlements, and other key metrics, empowering merchants to make data-driven decisions.

- Easy Integration: Most payment orchestration platforms are fairly easy to integrate into your payment workflow. Post integration, you can choose to add payment providers and set custom rules to determine your payment workflows. For example, Razorpay Optimizer comes with a simple one-click integration process.

How to get started with payment orchestration?

Here’s a complete guide for businesses looking to start their payment orchestration journey:

- Assess Your Payment Needs: Evaluate the payment methods and channels that you want to support based on your customer preferences. Consider the regions and currencies where you plan to operate, and identify any unique payment flows specific to your business.

- Choose a Flexible Payment Orchestration Platform: Select a platform that integrates with a wide range of payment gateways, processors, and acquirers. Ensure it allows for the addition of new payment methods as your business grows. Also make sure that the platform supports complex payment processes to provide the necessary scalability.

- Select Reliable Payment Partners: Evaluate potential payment gateways, processors, and acquiring banks based on factors like cost, security, and reliability. Ensure they support the necessary payment methods and currencies, and comply with necessary regulations such as RBI guidelines. Understand local regulations for all regions where you operate and ensure the platform meets these requirements, incorporating features like tokenization and encryption for data protection.

- Configure Payment Workflows: Before going live on a payment orchestration platform, try out a variety of payment workflows in-house. This will help you understand which flows lead to the quickest and smoothest checkout with the least hiccups and lock in on them accordingly.

- Monitor and Optimize Payment Processes: Conduct regular monitoring of analytics reports to understand payment trends such as success rates, downtimes, extent of use of each method, etc. to address any issues promptly.

Razorpay Optimizer– India’s First AI Powered Payments Router is a modern, new-age payment orchestration platform. Coupled with assisted integration and smooth SaaS technology, all these steps become easy and seamless with Razorpay Optimizer. Razorpay Optimizer is an API-driven payment orchestration platform powered by AI and machine learning. By leveraging Optimizer’s capabilities, businesses can unlock new revenue opportunities, enhance operational efficiency, and deliver exceptional customer experiences, positioning themselves for success amidst fierce competition.

Frequently Asked Questions

1. What is payment orchestration?

Payment orchestration is the process of managing and optimizing payment flows across multiple payment methods, gateways, and providers. It involves automating payment routing, handling diverse payment methods, and ensuring a seamless and efficient payment experience for customers and merchants.

2. How does payment orchestration differ from traditional payment processing?

Traditional payment processing typically involves using a single payment gateway or provider to process transactions. In contrast, payment orchestration involves using multiple gateways, providers, and methods concurrently. It leverages technology, automation, and data analytics to optimize payment routing, reduce transaction failures, and improve conversion rates.

3. How does payment orchestration help businesses optimize their payment processes?

Payment orchestration optimizes payment processes by intelligently routing transactions to reduce failures, offering diverse payment methods to improve acceptance rates, and leveraging automation and data insights for operational efficiency and streamlined financial management.

4: Can payment orchestration handle cross-border transactions?

Yes, payment orchestration platforms like Razorpay Optimizer are designed to manage cross-border transactions seamlessly by partnering with global PSPs and banks.

5. Can payment orchestration integrate with existing e-commerce platforms?

Yes, payment orchestration is designed to integrate seamlessly with existing e-commerce platforms, allowing businesses to leverage their current infrastructure while optimizing payment processes. Integration capabilities may vary, so businesses should ensure compatibility and functionality alignment before implementation.