Payment security is a critical concern for businesses in 2025, as the digital landscape continues to evolve. It encompasses protective measures and protocols to safeguard sensitive payment information during online transactions.

In FY2022-23, banks reported a total number of 6,659 cases of digital payment fraud. According to the IBM Security report of 2023, the average cost of a data breach in India reached INR 17.9 crores. This represents a 28% increase since 2020! Thus, businesses must prioritise payment security to protect their funds and ensure customer loyalty.

You must be wondering what a secure payment gateway is. In this article, we’ll delve into the concept of payment security, explore various types of payment security, and discuss payment security protocols. Read ahead for insights and strategies to protect your business and customers.

Table of Contents

What is Payment Security?

Payment security refers to the processes, techniques and protocols used to safeguard online and offline financial transactions of businesses and protect sensitive payment and personal information of clients from threats like payment fraud, unauthorised access, and breach of privacy.

There are multiple layers of protection and businesses can choose to apply these layers depending on their requirements. Some of the most commonly used payment security layers are:

-

Encryption

-

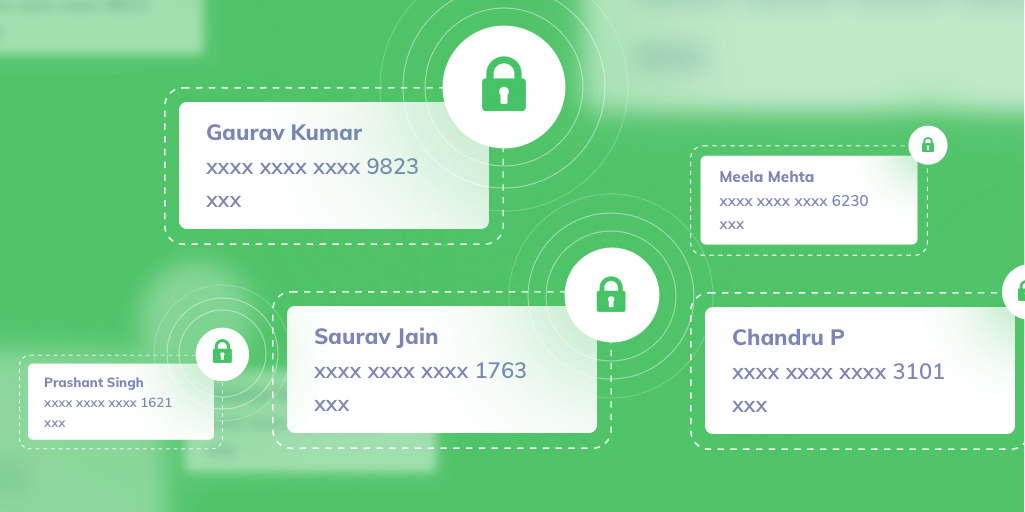

Tokenization

-

Authentication

Types of Payment Security

Payment security encompasses various measures to protect sensitive financial information during transactions. Key methods include:

1. Tokenization

Tokenization replaces sensitive data, such as credit card numbers, with unique tokens. This token is meaningless to unauthorised users, thus preventing the risk of data breach.

Payment data is collected, tokenized, securely stored, and then used for transactions. Most payment gateways employ tokenization for enhanced security.

Related Read: What is Card Tokenization?

2. Encryption

Encryption converts data into a coded format, decipherable only via the correct key. The two types of encryption are symmetric (the same key for encryption and decryption) and asymmetric (a pair of public and private keys).

Widely used encryption protocols like SSL (Secure Socket Layer) and TLS (Transport Layer Security) help establish secure connections during online transactions. Businesses should prioritise using the latest encryption protocols and update them regularly. They should also store and manage encryption keys securely to prevent them from falling into the wrong hands.

3. Authentication

Authentication is used to verify user identity. You can activate different authentication modes for users to log on to your platform. These include –

Single-factor authentication

Requires one verification method (e.g., a password)

Two-factor authentication

Involves two different verification methods to enhance security (e.g., a password followed by a security question)

Multi-factor authentication

Incorporates additional verification factors, like biometrics or one-time passwords (OTPs).

Types of authentication methods

One-time passwords (OTPs)

These are temporary, single-use codes. Businesses usually send OTPs via phone number or email ID to verify user identity.

Biometrics

It involves the use of unique physical or behavioural characteristics of an individual to verify their identity. This can include a fingerprint scan or facial recognition.

CVV (Card Verification Value)

Card Verification Value is a 3-4 digit code present on debit and credit cards. It verifies that the user physically possesses the card since the code is not embedded into the magnetic chip or stripe. This reduces the risk of fraud during online or card-not-present transactions.

Address Verification Service (AVS)

AVS matches the provided delivery address with the cardholder’s billing address.

The benefits of this method include –

-

Fraud prevention: It prevents fraudulent transactions by confirming the address.

-

Cost savings: It reduces costs related to chargebacks, shipping errors and customer service.

-

Compliance: It helps your business meet legal requirements for identity verification.

-

Efficient shipping: AVS ensures on-time deliveries and reduces the chances of returns.

However, there are some shortcomings to this authentication mode as well

- Limited accuracy: AVS relies on exact matches between the provided address and the billing address. This can lead to false rejections for minor discrepancies, such as abbreviations or typos.

- Address privacy concerns: It raises privacy concerns as it involves sharing personal address information. Some users may be uncomfortable with this.

- Doesn’t prevent the use of stolen cards: AVS is not designed to prevent transactions using stolen cards if the thief has access to the billing address information.

Related Read: What Is Address Verification Service (AVS) and How Does It Work?

3D Secure

3D Secure is an online payment security protocol for credit and debit card transactions. It requires cardholders to provide a unique authentication code, such as an OTP, for online purchases. This helps verify user identity and mitigate fraud.

It involves three domains of payer authentication:

-

Acquiring domain (merchant): The online retailer or merchant where the purchase is being made.

-

Issuing domain (bank): The bank that issued the credit / debit card.

-

Interoperability domain (3D Secure protocol): The intermediary that facilitates secure communication and authentication between the two aforementioned domains.

The latest version, 3D Secure 2 (3DS2), is an enhanced version of the 3D Secure protocol. It provides a more secure and seamless experience during online transactions. 3DS2 supports a wider range of authentication methods, making it more adaptable to the evolving landscape of online payments. In addition to OTPs and biometric verification, 3DS2 also makes use of the following methods –

- Device fingerprinting: It analyses the unique characteristics of the cardholder’s device (the device’s IP address, location and browser type) to verify their identity.

- Risk-based authentication (RBA): This method assesses the risk level of a transaction based on factors such as location and transaction amount. If the transaction is considered low risk, it may not require additional verification.

- Password authentication: Cardholders need to enter a password to authenticate their identity. It may be the same password that they use for online banking.

- Out-of-band authentication: This verifies a transaction via a different channel, such as a phone call to the cardholder.

Secure Payment Gateway Protocols and Standards

Payment gateway security elements include encryption, tokenization and fraud prevention to safeguard transactions and sensitive data. Let us understand some of these in detail.

1. PCI DSS (Payment Card Industry Data Security Standard)

PCI DSS is a set of rules for securing cardholder data. It benefits businesses by reducing fraud risks, data breaches and potential fines.

You can follow the below-given steps to ensure that your business is PCI DSS compliant:

Assess data

Regularly evaluate sensitive customer payment data to identify where it’s stored, processed or transmitted within your organisation.

Limit storage

Minimise the retention of cardholder data to the bare minimum necessary for business purposes. Reducing data storage limits the potential for data breaches and ensures you’re not storing sensitive information longer than required.

Secure networks

Implement strong network security measures, like firewalls and encryption, to protect payment data during transmission. This prevents unauthorized access or interception of sensitive information while it’s in transit.

Control access

Restrict access to cardholder data to authorised personnel only. Implement strict user authentication and access controls to ensure that sensitive information is only available to those who need it.

Monitor data

Continuously monitor data and track potential breaches to detect and respond to threats in real-time.

Maintain policies

Develop and enforce comprehensive security policies and procedures that align with PCI DSS requirements. This ensures that your organisation follows the best practices for safeguarding payment data and maintaining compliance.

The 12 key requirements of PCI DSS

1. Install and maintain a firewall configuration

Build and maintain a secure network by using firewalls to protect cardholder data.

2. Do Not Use Vendor-Supplied Defaults for System Passwords

Change default passwords and settings to prevent unauthorised access.

3. Protect Stored Cardholder Data

Encrypt stored cardholder data and implement access controls.

4. Encrypt Transmission of Cardholder Data

Use secure encryption protocols when transmitting cardholder data across open, public networks.

5. Use and Update Antivirus Software

Employ antivirus software and keep it up-to-date to protect your systems against malware.

6. Develop and Maintain Secure Systems and Applications

Regularly update and patch systems and applications to address vulnerabilities.

7. Restrict Access to Cardholder Data

Limit access to cardholder data to authorised personnel only, based on a need-to-know basis.

8. Assign Unique User IDs

Assign unique user IDs for system access and authentication to enable monitoring and tracking of individual users.

9. Restrict Physical Access

Implement physical security measures to prevent unauthorised physical access to cardholder data.

10. Track and Monitor All Access to Network Resources and Cardholder Data

Implement logging and monitoring systems to detect and respond to security events.

11. Regularly Test Security Systems and Processes

Conduct regular security testing and vulnerability assessments to identify and address weaknesses.

12. Maintain a Security Policy

Establish and maintain a security policy and ensure all personnel are aware of and follow these practices.

PCI DSS compliance levels are determined by the volume of card transactions a business processes annually. There are four compliance levels:

-

Level 1: Over 6 million annual transactions

-

Level 2: 1 million to 6 million annual transactions

-

Level 3: 20,000 to 1 million annual transactions

-

Level 4: Less than 20,000 annual transactions

Secure Electronic Transaction (SET)

SET (Secure Electronic Transaction) is a collaborative system and protocol developed by VISA and Mastercard. It encrypts credit card payment data, safeguarding personal information on the card, thwarting fraud, and preventing unauthorised access. SET also prevents merchants from accessing customers’ data. This boosts transaction security and privacy for consumers, thus mitigating the chances of fraud and data breaches.

Encryption Protocols

SSL (Secure Sockets Layer) and TLS (Transport Layer Security) are encryption protocols that are used by payment gateways. These encryption protocols secure data during online transactions. Here’s the process that is followed via these protocols:

1. Handshake: Establish a secure connection.

2. Encryption: Encrypt data in transit.

3. Authentication: Verify server identity.

4. Data transfer: Securely exchange payment information.

5. Closure: Safely end the connection.

These protocols help ensure confidential and secure payment transactions.

Tokenization

Tokenization is a security method used in payment systems. It replaces sensitive card data with a token – a unique set of characters. This renders the original information useless to hackers. This enhances security by protecting cardholder information from being exposed during transactions.

Authentication and Fraud Prevention:

Payment authentication protocols verify the identity of users and protect against fraud. Common methods include:

-

3D Secure: A system that adds an extra layer of security by requiring a password or one-time code during online transactions.

-

Biometrics: It uses unique physical traits (like fingerprints or facial recognition) to confirm the user’s identity.

-

Two-Factor Authentication (2FA): It combines two verification methods, like a password and an OTP, for added security.

-

Risk-Based Authentication (RBA): It analyses transaction risk factors to determine the level of authentication required.

These methods help ensure secure and trustworthy payment processes, thus reducing the chances of fraud.

For Which Businesses is Payment Security Important?

Payment security is crucial for all kinds of businesses due to the nature of their operations, large volumes of data handling, and the acceptance of mobile payments.

1. E-commerce

E-commerce businesses handle vast amounts of sensitive customer data online, making robust payment security vital to protect against data breaches and fraud.

2. Brick-and-mortar stores

Even traditional stores accepting card payments must prioritise payment security to safeguard customer information and maintain trust.

3. Hospitality

The hospitality industry manages numerous transactions and guest data, necessitating secure payment systems to prevent cyber threats.

4. Education

Educational institutions handling tuition payments and student information must ensure payment security to protect sensitive data.

5. Recurring payments

Businesses with subscription models rely on secure payments to manage recurring transactions and safeguard subscriber details.

6. Non-profits

Non-profit organisations handling donations require payment security to protect donor information and maintain credibility.

7. B2B businesses

B2B companies dealing with large transactions should prioritise secure payment gateways to protect the financial data of their clients.

8. Start-ups

Start-ups, often targeted by cybercriminals, need strong payment security from the outset to establish trust in a new market and protect customer information.

Payment Security Strategy and Best Practices

Building a robust payment security strategy involves several key steps:

Conduct a risk assessment

Identify vulnerabilities and areas for improvement in your infrastructure, processes and systems. Determine the types of sensitive data, as well as where it’s stored, processed and transmitted.

Document payment compliance requirements

Understand industry regulations like PCI DSS and outline specific compliance needs. Employ security controls and practices mandated by these standards.

Develop and implement security policies

Create clear policies addressing payment security, data handling, access controls, incident response, and staff training. Ensure that these policies align with industry regulations.

Establish security measures

Implement security measures like encryption, tokenization, strong authentication and robust firewall configurations. Choose secure payment gateways that adhere to PCI DSS.

Monitor systems and keep iterating

Continuously monitor payment systems, networks, and applications for threats and vulnerabilities. Conduct vulnerability scans, penetration tests, and audits to assess effectiveness and adapt to evolving threats. Keep evaluating the effectiveness of your security strategies to the changing needs of your business and industry regulations.

Develop an emergency response plan

Craft a well-defined incident response plan, delineating roles, communication protocols and procedures for containing and mitigating security breaches. Adapt and protect your customers’ data.

Conduct regular employee training

Continuously educate your staff on payment security practices to reduce human errors that could compromise security.

Encrypt data

Implement robust encryption for data at rest and in transit to safeguard sensitive information from unauthorised access.

Importance of Payment Gateway Security

Payment gateway encryption and security are of paramount importance in today’s digital landscape, serving as the guardian of both customer trust and company reputation. Here’s why it matters:

-

Protecting customer data: Payment gateways ensure that customers’ sensitive financial information, such as credit card numbers and personal details, remains confidential. Any breach in this security could expose customers to identity theft and financial loss.

-

Safeguarding business reputation: Security breaches can inflict substantial damage to a company’s reputation. News of a data breach spreads quickly, eroding customer trust and confidence. Businesses may struggle to recover the lost trust, often facing long-term consequences.

-

Avoiding legal and financial consequences: Security breaches can lead to severe penalties and fines. For instance, GDPR violations can result in hefty penalties, and non-compliance with PCI DSS may lead to fines or even the loss of the ability to process card payments.

-

Enhancing customer experience: In the realm of e-commerce, a secure payment gateway is pivotal. Customers need assurance that their transactions are safe. Providing a secure shopping environment not only keeps customers loyal but also encourages repeat business.

Beware of Common Payment Frauds

While a payment gateway does its best to ensure that data cannot be breached, fraudsters work equally hard to try and exploit sensitive customer information. It is always good to stay aware of the common methods of fraud to prevent the chances of falling victim to them.

| Type of fraud | How it works | Potential solutions |

| Phishing or spoofing | Process of accessing personal information through fraudulent emails or websites that claim to be legitimate | Think twice before clicking on links that appear fraudulent and don’t give out personal information unless the recipient is trustworthy |

| Data theft | Card details and other data stolen from businesses by dishonest employees | Avoid dealing with companies unheard of that don’t maintain stringent data security norms |

| Fake schemes and offers | Offers that provide heavy discounts on illegitimate products | Don’t fall for offers that seem too good to be true – verify the company and product before making a purchase |

One should always use two-factor authentication to make online payments. It adds an extra layer of security to digital transactions.

For example, even if your data gets compromised and someone gets access to your card details, they won’t be able to complete a transaction without the OTP that comes to your phone number if you have two-factor authentication enabled.

Conclusion

Payment gateway security is not a mere operational detail but a foundational pillar of trust in today’s digital economy. Protecting customer data, maintaining a positive reputation, and avoiding legal repercussions are compelling reasons for businesses to prioritise a secure online payment gateway.

While addressing fraud efficiently is crucial, choosing the right payment methods and partners is equally essential to ensure the safety of online transactions.

By making security a top priority, businesses can not only thrive but also build enduring relationships with their customers, fostering a climate of trust and confidence in an increasingly interconnected world.

Frequently Asked Questions

How do payment gateways encrypt payment information?

Payment gateways encrypt payment information using secure protocols like SSL and TLS, converting data into unreadable code during transmission.

What is tokenization in payment gateway security?

Tokenization replaces sensitive data with unique tokens, rendering the data unreadable even if intercepted by unauthorised individuals.

What is two-factor authentication and how does it enhance payment gateway security?

Two-factor authentication requires users to provide two forms of verification, typically something they know (e.g., password) and something they receive (e.g., a one-time code), thus enhancing security.

What are some common fraud detection techniques used by payment gateways?

Payment gateways employ common fraud detection techniques such as IP geolocation, velocity checks, and machine learning algorithms to identify suspicious transactions.

How can businesses ensure that their payment gateway is secure?

Businesses can ensure payment gateway security by selecting reputable providers with robust security measures, regularly updating software, and complying with industry standards like PCI DSS.