Here we are with our 4th edition of ‘The Era of Rising Fintech’!

2019 was particularly a good year for fintech. Many innovations contributed to India becoming one of the most advanced countries in terms of digital payments. With the new year kicking in, we wanted to bring you a few insights on how India carries out digital transactions.

As Razorpay oversees enormous volumes of digital transactions from all over the country, we were able to derive these insights based on how Indian businesses accept payments from their customers. Further, we also analysed how Indian consumers transact.

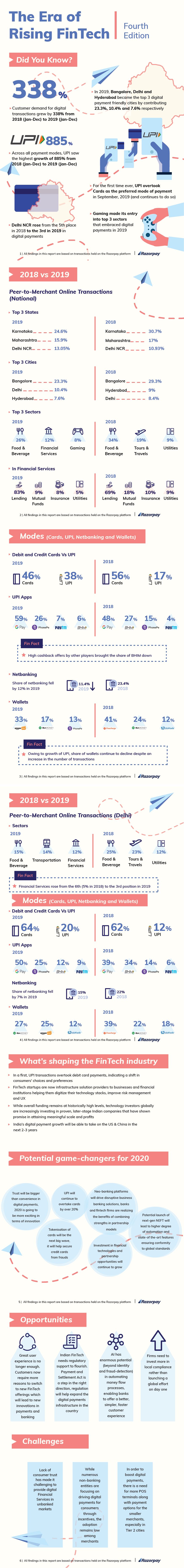

All findings in this report are based on digital transactions made on the Razorpay platform from January 2018 to December 2019.

Here are a few nuggets:

- Demand for digital payments have been at a consistent rise – 338% from 2018 to 2019

- Bangalore was the most digitised city in 2019 with a contribution of 23.3% of the total digital transactions carried out in the year, followed by Delhi and Hyderabad at 10.4% and 7.4% respectively

- UPI overhauled netbanking, cards, and other digital payments in September 2019, becoming the most preferred payment mode in India for the very first time

- UPI also saw the highest growth at 885% in 2019 from 2018

Growth of digital payments in India

We enable payments of over 800,000 merchants from all over India. We studied all the P2M (Person to Merchant) transactions made in 2018 and 2019 throughout the country. Here are a few points that are mention-worthy.

- Karnataka pitched in the majority of digital payments in both 2018 and 2019, at 30.7% and 24.6% respectively

- After Bangalore (23.3%), Delhi (10.4%) and Hyderabad (7.6%) were the most digital payments friendly cities in 2019

- In 2019, UPI exceeded its previous contribution at 38%, eating into cards’ share while credit and debit cards collectively contributed 46%

- Google Pay’s reign continued through 2019 at 59%, becoming the most preferred UPI app of all time

- Top sectors in 2019 were food and beverage (26%), financial services (12%), and gaming (8%) industries

- Lending, mutual funds, and insurance were the top three verticals in the financial services industry, contributing 83%, 9%, and 8%

The Era of Rising Fintech – Delhi edition

In our last report, we focused on Hyderabad and its growth towards becoming one of the advocates for digital payments. Our star for the 4th edition is Delhi.

We pooled in the transactions carried out in Delhi during 2018 and 2019 and inferred these insights.

- Digital payments in Delhi saw a huge spike at 234.97% from 2018 to 2019

- In 2019, cards were mostly preferred for digital payments at 64% over netbanking and UPI

- UPI contributed 12% of the total digital transactions made in 2018, but saw a rise in adoption and usage in 2019 at 20%

- Google Pay was the #1 UPI app in Delhi throughout 2018 at 39%, as well as 2019 at 50%

- Amongst wallets, Ola Money (27%) was mostly used, followed by Amazon Pay (25%)

What we can expect in 2020

We, at Razorpay, love numbers. Over the years, we have spent long hours analysing numbers to draw insights, patterns, and trends. And, based on data and research, here’s what we can look forward to this year.

Trust is something fintech did not immediately win over from Indian consumers. But, with innovations that have made payments easier and much more secure, we believe more and more consumers will trust fintech, resulting in more innovations in 2020.

We predict that this trend will continue in 2020, where UPI will thrive as the most preferred payment mode.

We also believe tokenisation of cards will cause the next big wave this year, helping credit card frauds go down. Also, consumers and businesses will become more aware of what neobanking is and how it can simplify financial operations.

We can also expect the potential launch of next-gen NEFT that can lead to a higher degree of automation and features that conform to the global standards.

End of the line

India is becoming one of the leaders in fintech and digital pa

yments. While tier 1 cities contributed to this growth, we are very excited to see tier 2 and 3 cities jumping on the bandwagon.

Let’s meet again in our next edition of The Era of Rising Fintech, with insights about a whole new city!