As businesses today adopt digital methods to securely store sensitive business data, it’s clear that a good digital signature is a valuable new frontier for both individuals and institutions. A digital signature serves as a digital fingerprint for two parties involved in an online transaction. As online transactions climbed exponentially, digital signatures began to serve as reliable conduits of trust. In simpler terms, digital signatures help businesses verify that the receiver got a message from a sender and that the sender indeed sent it, reducing mistrust between parties. Not surprisingly, Allied Market Research reports that the global electronic signature market will grow from 51.7 crores in 2015 to 344 crores by next year.

In India, businesses like D. Sign Softech have pioneered digital signatures for businesses, greatly reducing the time they spend on transactions. When Akash Garg was looking to start a new business in 2007, he knew that any Indian business that needed to scale up its online revenue will need a trustworthy partner to secure its online transactions. A digital signature could help the business harness the powers of asymmetric cryptography to secure data.

Garg then founded D. Sign Softech, whose origin coincides with the time when the Government of India introduced the Information Technology (Amendment) Act, 2008 and introduced the concept of Digital Signature** in India.

The IT Act appointed the Controller of Certifying Authorities (CCA) to license and regulate Certifying Authorities like eMudhra. eMudhra issues digital signature certificates for electronic authentication in India. According to Garg, D. Sign Softech was one of India’s first Licensed Registering Authority for eMudhra. As a Licensed Registering Authority, D. Sign Softech empowers any business that uses Digital Certificates for income tax, MCA (ROC), tenders, foreign trade, or banking purposes by issuing all types of Digital Signature Certificates (DSC).

Taking the Leap: From Digital Signatures to e-Commerce Integrations

Seven years later, when the Unique Identification Authority of India (UIDAI) approved Aadhaar-based fingerprint scanners for use, the company also acquired the distributorship of a Make in India product called Mantra MFS100, a USB Fingerprint Scanner. “At that time, e-commerce was still very new to India,” Garg recalls.

As a new-age solution distributor for Mantra MFS100, Garg needed to supply large quantities of fingerprint scanners to clients all over India and even abroad. “Since outsourcing options were scarce, we planned to launch our own e-commerce website. After a lot of research, we zeroed in on Ecwid, an e-commerce SaaS platform that proved to be the right fit for an SME’s needs.”

The main obstacle on D. Sign Softech’s journey to integrate Ecwid with its internal systems was the absence of a payment gateway integration. “Initially, Ecwid provided integration with only one payment gateway solution. But, we got stuck with the provider due to a lot of operational issues. That’s why we decided to develop an Ecwid integration for payment gateways, but this time we developed it completely in-house. However, a few of our other customers began to request to use the integration for their business needs,” says Garg.

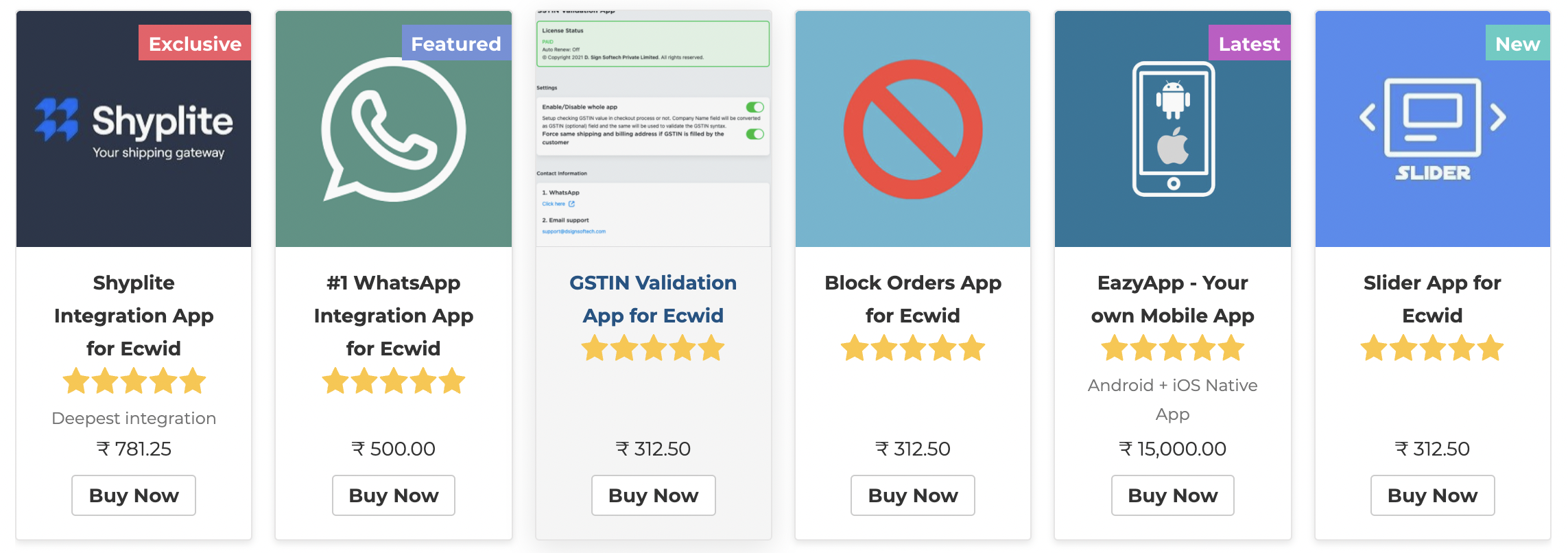

It wasn’t long before D. Sign Softech began developing integrations for more use cases that arise out of businesses that build an e-commerce website with Ecwid. “In the following 9 months, we launched three more payment integration apps for the platform. Today, we have launched more than 12 integrations for Ecwid including WhatsApp integration, Shipping Automation, GSTIN integration and more,” says Garg.

Growing as a Razorpay Partner

“Until March 2020, we didn’t know about the potential of joining a payment solution partner program. When we did, we approached all the available gateways and found Razorpay to be the most promising solution among them as it provided us with satisfactory referral fees,” says Garg.

Soon after, D. Sign Softech signed up to become a Razorpay partner with 15 clients in December 2018. “Our revenue at that time was lesser than INR 10,000 from app sales. Today we have 1400+ clients under Razorpay’s Partner Program and app revenues have increased by almost 4900%. We then enrolled as an Aggregator Partner in Dec 2020 and since then, we have already achieved a 130% increase in our revenue,” says Garg.

As D. Sign Softech plans to launch an integrated platform that will house payments, shipping, accounting and notifications to help businesses scale up quickly.

Become a Razorpay partner today!

*Section 18 of The Information Technology Act, (IT Act) 2000 said digital signatures were at par with handwritten signatures and digitally signed electronic documents were at par with paper documents.

**A digital signature is a digital version of your traditional pen and paper signature. It helps you sign documents online and share them with any relevant parties or partners. The signature can be created using your mouse, fingers, or a platform that renders your typed name into different fonts.