The new RBI guidelines made many lending merchants rethink their payment infrastructure and the way they were transferring money to their borrowers.

Up until now, NBFCs transferred the money into third-party/pool accounts – primarily owned by their Fintech partners, from where it was further disbursed by Fintechs to their borrowers. This money flow helped NBFCs limit their fund exposure with Fintech partners and work together seamlessly.

Even at the time of repayment, the money was received in the payment gateway and transferred into a third-party / pool account before it was transferred to the NBFC’s current account.

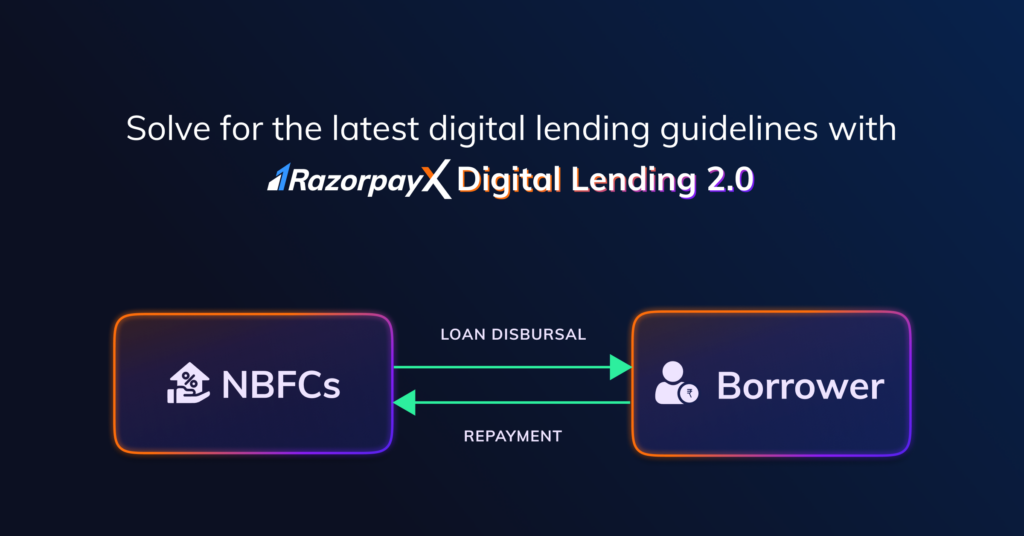

However, the digital lending guidelines announced by RBI on 2nd Sep 2022 clearly stated that loan disbursals & repayments must happen directly between the Regulated Entity (NBFC)’s account and the borrower’s account – as represented by the “New flow” in the image below. Transferring money via third-party / Fintech-owned pool accounts is no longer compliant.

This means that if you are an NBFC or a Fintech impacted by these guidelines, you now need to figure out:

1) A scalable & regulated way to make these direct money transfers

2) How to work with your Fintech / NBFC partners

3) How to manage day-to-day operations like reconciliations & reporting at scale – as the responsibility for these financial operations will now shift from Fintechs to the NBFCs

Introducing RazorpayX’s Digital Lending 2.0

RazorpayX’s Digital Lending 2.0 is a full-stack lending suite that solves all of these problems. It not only helps you solve for your today, but also makes it easy for you to scale effortlessly tomorrow.

RazorpayX Digital Lending 2.0 is built on three core pillars

1) Secure Money Transfers

Automates direct money transfer between the Regulated Entity (NBFC)’s account and the borrower’s account, so you can adhere to the digital lending guidelines.

2) Fintech Management System

A system that helps NBFCs and Fintechs collaborate efficiently and scale effortlessly – be it a 100:0 model or a co-lending model.

Key benefits:

- NBFCs do not have to open a new current account each time they onboard a new Fintech. They can manage multiple Fintechs partners, each with a separate sub-merchant account, under a single current account.

- Fintechs can manage & initiate disbursal requests independently from their sub-merchant accounts to the NBFC’s bank account. Money is released to their borrowers via APIs, only when the disbursal request is approved by the NBFC – this can be set on auto-approval or conditional manual approval.

- We can get your Fintech partners up & running on the RazorpayX platform in 24-48 hours

- Financial controls help NBFCs monitor & manage disbursals at scale, reduce money leakages and choose to be as involved in disbursals as they want to be, across multiple Fintech partners.

3) Auto-reconciliations & custom reports

We auto-reconcile millions of transactions with their transaction status, so you don’t have to. NBFCs can see a single view of all disbursals. RazorpayX maintains separate ledgers at both Fintech-level and NBFC-level to help you manage books easily.

A complete lending ecosystem in ONE place

RazorpayX integrates with your preferred banking partners and brings together your Payment Gateway, banks, and Fintech / NBFC partner all on the same platform.

Why RazorpayX is the best digital lending solution in India right now

Built on the solid foundation of our Payouts technology, which is currently being used by brands like WhatsApp, ZestMoney, Dunzo, Rupeek, etc., Digital Lending 2.0 assures you:

- Remarkable success rates

- Accurate transaction status

- Auto-retries for failed disbursals

- Dedicated customer support that you can actually rely on

…. And a lot more!

Interested in RazorpayX’s Digital Lending 2.0?

Write to us at lending-support@razorpay.com. We took three NBFCs live on our platform just in the past week itself and would love to talk to you!