Be it traveling abroad for education, medical treatment, business, or pleasure, things have become a lot smoother than before. Flights…

In the intricate dance of global commerce, import payments are like the conductor of an orchestra, ensuring there is harmony…

The payment ecosystem is complex and consists of multiple players. There are Acquirers, Issuers, Banks, Networks, Gateways, Aggregators, and so…

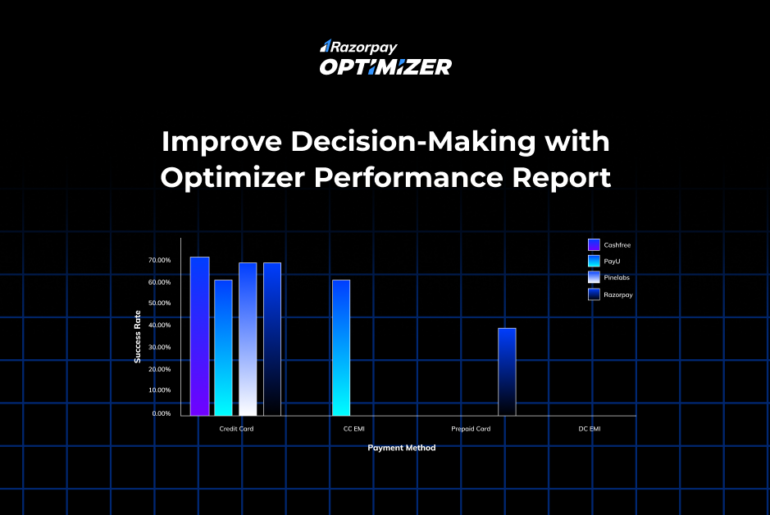

At Razorpay, one of our core values is ‘transparency’. When we heard from some of our Optimizer merchants that they…

In the dynamic landscape of online payments, optimizing payment processing is paramount for businesses seeking efficiency and cost-effectiveness. Dynamic Routing…

When Razorpay Optimizer made its foray into the payments routing world as an AI powerhouse, it redefined the payments ecosystem…

Empowering Businesses Globally In today’s interconnected world, businesses face the challenge of simplifying payments to drive growth and innovation. At…

With over a third of all financial transactions in India occurring online, and digital transactions being all set to surpass…

As Indian consumers get increasingly comfortable shopping online, Indian businesses have become more reliant than ever on payment gateways to…

Discover the future of payments with Razorpay Payment Gateway 3.0. Elevate your business with streamlined transactions and enhanced conversions. Explore now!