I remember, a couple of years ago, I was window shopping online and came across a limited edition Sega Gamer Boxset. It had everything–a funky console, stickers for laptops, rare collectable items and a limited edition badge to prove my rank amongst my fellow gamers.

My euphoria, though, was short-lived, till I discovered the price tag. It asked for an arm and a leg.

The only EMI option available on the product at that time was on credit cards. Unfortunately, I didn’t have a credit card and there were no other options for me to make the console mine.

It wasn’t possible at that time, but today, a business can provide its customers like me with the option to make EMI purchases even if they don’t own a credit or debit card. This is what we call Cardless EMI.

What is Cardless EMI?

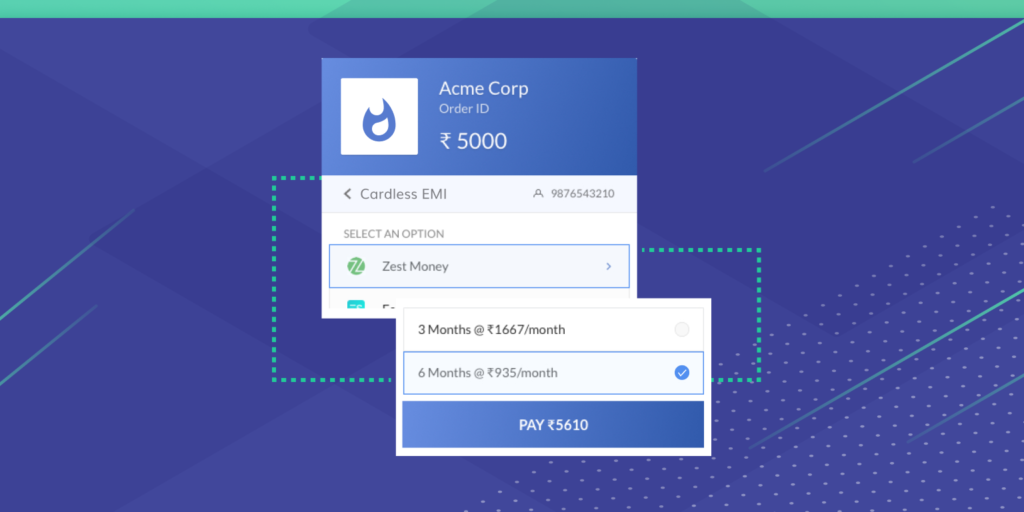

Cardless EMI is a checkout payment method that allows customers to convert their payment amount to EMIs. The user doesn’t require a debit or credit card. The payments are made via credits approved by the supported Cardless EMI payment partner.

To improve online payment flexibility, the Cardless EMI option is available on Razorpay Checkout with custom UI integration methods for web, mobile web and mobile (Android and iOS) platforms.

Cardless EMI is a new form of payment method for consumers of Razorpay merchants where users can complete the payment via approved credits from various EMI payment partners like ZestMoney, EarlySalary and InstaCred.

Read More About: What is Deferred Payment and How Does it Work?

Customer journey using Cardless EMI

Since this is an alternate payment method to credit/debit card, netbanking, wallets and UPI, the end consumer will be given an option to choose Cardless EMI as a payment option during checkout.

However, it is vital that a customer is registered with one of the preferred Cardless EMI payment partners, and must have an approved credit limit from the partner.

Here’s how the payment flow works on Razorpay checkout:

Step 1: Enter the required details on the checkout form and select EMI

Step 2: Select your cardless EMI service provider

Step 3: Authorise account via the OTP sent to your registered phone number

Step 4: Select an EMI plan to complete the transaction

After the payment is completed, the user is redirected to the merchant screen, and Razorpay settles the amount to the merchant in bulk.

Finally, the EMI is deducted on a monthly basis as per the plan selected by the end customer, and the details are shared via email and SMS.

Cardless EMI – Integration

If you are using Razorpay Checkout, there is no need for any separate integration or change to the existing integration.

But if you are integrating using the Custom UI SDK, after the customer selects the EMI payment method (step 2 – shown above), they are redirected to a Razorpay hosted page where they enter the OTP they received on their registered phone number and proceed to select the desired EMI plan.

Here’s the flow on Razorpay Custom UI/S2S Integration:

Benefits of using Cardless EMI

| Businesses | End Customers |

| Increases buying capacity for end customers | Flexible EMIs to suit specific consumers |

| Reach 5 million+ consumers across India | No credit/debit card or credit score required |

| A success rate of 93% for approved customers | Quick loan approval for online shopping |

| Frictionless payment | Credit limit increases as per transaction history |

| No restriction on product categories | Instant approval and easy account opening |

| Increase in average order value | No upfront prepayment penalties |

Well, here it is, the dream payment method, which defies every new solution that has emerged to maximise your customer’s shopping experience. And improve your business metrics to boot.

Also read: 7 Reasons Why Razorpay is Right for You