In 2019, the graduation rate in India was 5.9% and the employment rate was 10%. So with an unemployment rate of 18.5% as per the Centre for Monitoring Indian Economy (CMIE), 1 in every 4 graduates was looking for jobs.

So, the problem was twofold: the skill gap and the mismatch between the requirements of the companies and the skills of the graduates.

Siddharth Maheshwari and Nishant Chandra, two young techies from IIT Roorkee, decided to change this.

And, that’s why Newton School was born in 2019.

Table of Contents

Newton School: Outcome-Oriented Education for all

Newton School is a Bangalore-based ed-tech startup on a mission to bridge the gap between millions of college graduates struggling to find great employment opportunities and thousands of companies struggling to find the right talent.

Their gameplan🚀:

Through one-on-one mentorship from industry experts, live projects, soft-skills training and placements, Newton School enables aspiring IT professionals to land their dream jobs and is redirecting education towards a skill-oriented paradigm.

“ We at Newton School are building an outcome-oriented Neo university where we are getting folks jobs in software and data science sectors.- Nishant Chandra, Co-Founder of Newton School”

What challenges did Newton School face?

Currently operating with around 500 mentors and nearly 2,000 students, Newton School is on the road to expansion.

But like any growing company, with scale came its own set of challenges.

For Newton School, this meant every new mentor added more paperwork & logistical challenges to their operations – particularly financial.

“As very young founders we started to realise how much time is banking taking for us-making sure there’s reliability in payroll, things that are going on time with our vendors, that started taking a lot of time from our plate which could be utilized in making great products for our users- Nishant Chandra, Co-Founder of Newton School”

Newton School knew they needed a new-age solution for their financial operations – one built for the unique needs of startups like them. They no longer wanted to waste time working with traditional banking solutions that didn’t serve them.

That’s when they turned to RazorpayX.

Deep-dive into challenges faced by Newton School👀

With a growing number of mentors, vendors, and employees, the three-member finance team of Newton School faced three key challenges on the financial operations front.

Problem 1: Making monthly payments to mentors🧐

Making a monthly payment to multiple vendors was taking up the majority of their time since they had to do it manually.

| Challenges | Solution( RazorpayX) |

| The finance team would have to add each new mentor as a beneficiary on the bank portal and wait out the cooling period. | RazorpayX introduced the option of uploading beneficiary details in bulk and they no longer had to wait around for the cooling period to elapse.

|

| And then, they would manually have to make payments to each of the mentors, one by one. | Instant beneficiary activation which further enabled lightning-fast payouts for Newton School. |

| Manual operations became harder when the number of mentors grew from a handful to hundreds. | The satisfaction of the mentors, who were now being paid accurately and on time, also translated into a boost in Newton School’s Net Promoter Score (NPS) |

Problem 2: Payroll and Compliance 💡

Just like any other startup, Newton School ran into payroll troubles as its workforce expanded.

| Challenges | Solution(RazorpayX) |

| Payroll processing was painfully time-consuming, taking an entire day for execution at the end of each month. | End-to-end RazorpayX payroll automation, the finance team was able to cut down the payroll processing time from one day to 10 minutes. |

| Even with just 40 employees, the complex calculations, massive amounts of data, and compliance woes made payroll one tedious, error-prone affair. | Newton School could compute and make compliance payments like PF, PT, TDS, and ESI, and clear employee dues seamlessly, without voluminous excel sheets or error-prone manual calculations. |

Problem 3: Vendor and Tax payments💸

As the platform grew, so did the number of vendors Newton School had to pay – right from rent to SaaS products.

| Challenges | Solution(RazorpayX) |

| How much and when to pay each vendor had to be determined by keeping track of invoices. | The RazorpayX Vendor Payments app enabled them to scan invoices and fetch details accurately in a matter of seconds. |

| Next, the amount of TDS for each vendor had to be computed. | TDS calculations, too, were automated end-to-end |

| Finally, the vendors had to be paid their dues, and tax payments had to be made. | The finance team no longer had to manually enter invoice details and process vendor payments. |

| The possibility of errors while entering invoice details and the complexity of TDS calculations made the process even more arduous as the company scaled. | While calculations were taken care of, all that remained was making the final vendor and tax payments. And that took no more than a few clicks. |

Problem 4: Tracking Transactions🔎:

Tracking transactions was turning out to be more difficult and manual.

| Challenges | Solution(RazorpayX) |

| Tracking transactions was no mean feat either. If a payment made to a mentor failed, then the mentor would have to reach out to Newton School to look into the matter. | With easy tracking of payment status, they no longer had to wait for mentors to reach out to them in case of failed payments. |

| The team would then have to download bank statements and analyse them on excel sheets. As a result, making timely and accurate payments to mentors became a challenge. | Reconciliation became simpler and faster, with failed transactions tracked down and rectifications made easily and efficiently.

|

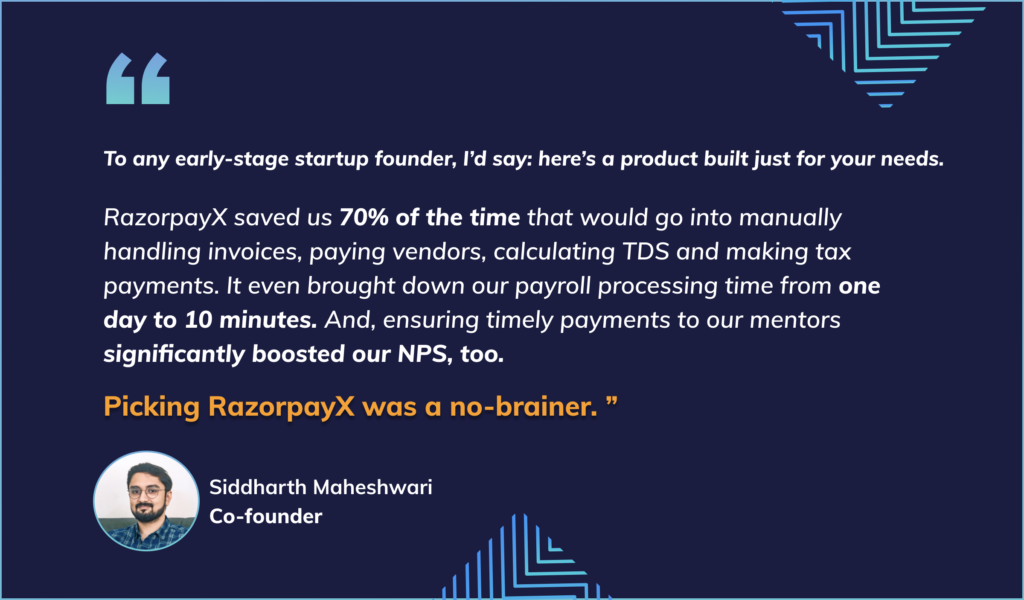

Right from the start, we knew RazorpayX was designed to enable the user – something that has been missing in the banking industry for the longest time- Siddharth Maheshwari, Co-founder of Newton School

Newton School signed up for a RazorpayX-powered Current Account, which eliminated the need for multiple products from different companies – making it a singular solution.

Additionally, the mobile banking of RazorpayX helped us make payments, make decisions, be on top of things on the go as well- Nishant Chandra, Co-founder of Newton School.”

Now, they are all set to scale, backed by a seamless solution for all their business banking needs. We at RazorpayX are proud to be enablers of disruptors like Newton School.

😮Let’s hear it from Nishant Chandra, Co-Founder of Newton School😮