Neobanks have gotten a stronghold in the US and European banking ecosystem, and India is fast catching up to this fintech revolution.

The expected 46.5% CAGR between 2019 and 2026 of the global neobanking market is a testament to the potential neobanks have to transform the banking sector. Still, they are considered a fad by many.

To help us demystify how neobanks came into existence, what they hold in the future and everything in between we turned the mic to an esteemed panel of fintech experts.

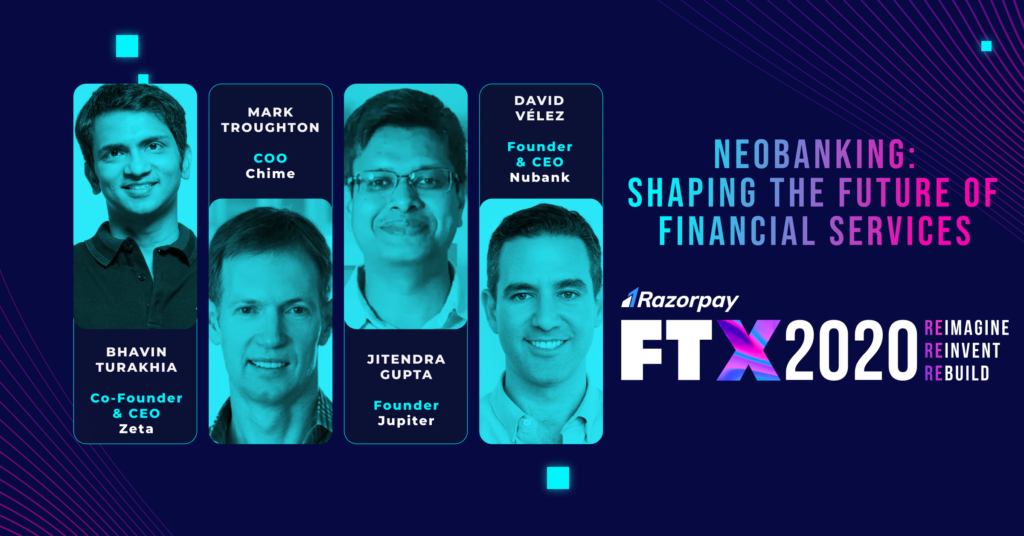

The Neobanking Panel at FTX 2020 hosted Bhavin Turakhia, co-founder & CEO Zeta Suite, Mark Troughton, COO Chime, Jitendra Gupta, founder Jupiter and David Velez, founder & CEO Nubank along with Shashank Mehta, GM at RazorpayX.

Here’s a breakdown of everything that went down.

Birth of neobanks across the globe

When it comes to neobanking, the question that’s mostly asked is about its inception. David recites one of his personal experiences that led to the launch of Nubank, one of the leading neobanks in Brazil.

“Late 2012, I entered a big branch in São Paulo, and that experience was nothing short of entering into a prison or security lines at the airport. After going through multiple security checks & waiting a long time, I interacted with a very uninterested bank manager who had no intention of helping me out. It took me about three months of going to the branch about six to seven times again and maybe 25 hours of investment to eventually open a bank account.”

“Such a terrible consumer experience by one of the most profitable banking industries in the world didn’t add up. This made me realise that there is a big opportunity to make the banking experience better. And what enabled a startup like us to launch a neobank was a confluence of internet and smartphone penetration. It gave us a shot at developing fully digital financial service with a customer-first approach.”

Jitendra & Mark share a similar story behind the inception of Jupiter & Chime.

The archaic banking workflows, broken customer service, and hidden fees were some of the reasons that pushed them to build better banking services for their customers.

This is exactly what we aspire to solve at RazorpayX every day, too.

Understanding what led to the birth of neobanks led us to the next big question.

Why are traditional banks lagging in innovation

Traditional banks are not oblivious to the above-mentioned customer challenges. To understand what’s holding them back to build innovative solutions themselves, we turned to Bhavin.

“The entire banking industry comprises the consolidation of different legacy stacks that were built 25 years ago. The core and processing units were built in silo and were never meant to interact with one another. Such legacy stacks make it impossible for banks to provide an outstanding digital experience to their customers. That’s where a neobank would win the race. Its innovative technology leads to fast-paced feature launches with enhanced customer experience.”

The partnership model of traditional banks and neobanks

Another key insight shared by the panel was why banks prefer to ally with a neobank.

- New Distribution channel – Banks might not be able to build niche financial products. With neobanks, they can harness newer technologies to reach new target audiences and offer smart functionalities to their users.

- Digital native thinking – Banks can leverage the digital-first approach of neobanks to tap onto better product management and growth hacks. This helps banks to acquire more customers and increase NPS.

“Regulators in most geographies are extremely progressive in wanting consumers to get the best banking experience, securely. As a result, neobanks can build tech stacks from the ground up and work in a meaningful partnership with banks”, says Bhavin

Fintech enthusiasts worldwide are now eagerly waiting to see what the next big wave in fintech holds. And we caught the expert opinion on the thing that’s now on everyone’s mind.

Is embeddable finance the future of finance

Embeddable Finance is the integration of a financial product or technology with a non-financial service or product. Embeddable Finance’s core lies in enhancing the customer experience by embedding the financial products & services, i.e. banking where transactions or commerce is taking place, says Bhavin.

In India, Zeta’s Fusion is seeing tremendous growth by providing embeddable banking. They build APIs and SDKs for fintech and enable them to embed their loan, credit and debit products.

According to David, the US Market is also seeing a similar growth trend in embeddable finance.

As more of the world uses fintech in their day-to-day lives, the opportunities for embedded finance will only increase.

The success of neobanks in India

The future of finance is indeed exciting. As we stand at the dawn of a new era of rapid fintech development, we wanted first-hand insight into what will mark the success of neobanks in India.

“Rather than terms of valuation, the success of neobanks will be rightly measured when customers trust them as their primary source of managing finances. Another metric that will determine neobank success will be an increase in NPS”, says Jatin.

Neobanks have revolutionised banking in a way that it is no more a tedious and complicated task. But they still have a long way to go in carving out a niche that best fits their audience demands.

Watch the entire Neobanking Panel below or head over to our Youtube Channel to catch many more exciting sessions at the largest Indian Fintech conference.