At Razorpay, we believe in inclusive growth. For us, our growth lies in the growth of our customers.

We understand that it is natural for every growing business to encounter challenges and difficulties with their money management. This is where Razorpay steps in, to solve such business problems with our numerous, tailored products.

One of the biggest fears for most businesses is facing a lack of funds at inopportune moments. This cash crunch may happen due to economic conditions, market instability or other individual factors.

As a company, our objective is to help our customers overcome this fear by way of customised products. This was the driving force behind our decision to launch Razorpay Capital, so that our customers don’t have to face a shortfall of funds.

With Razorpay Capital, we are trying to solve all financing roadblocks for our partners. You get access to three types of solutions under our Capital product.

- Sign up to get your transactions settled as per their requirements

- Claim Cash Advance which is a line-of-credit product with a flexible interest rate, depending on the credit amount and borrowing duration

- Avail a collateral-free business loan through our Working Capital Loans product for financing salaries, infrastructure overheads and procurement of raw material

Suggested read: How Namaste Farm Scaled Operations with Razorpay Capital

But while trying to help our customers face their challenges, we too are faced with multiple obstacles. One among these is finding the right customers for our products. There is always a risk involved in operating in the fintech space. Thus we, as an entity, need to make sure that we are empowering businesses in a viable manner.

For our Capital products specifically, we can split this problem into two parts:

- Identifying customers who might need our Capital products

- Identifying the risk involved in catering to those customers

One way of identifying potential customers for a particular product is by targeting existing customers using some of our other products. Pitching other relevant products to existing users, based on their behaviour, is known as cross-selling.

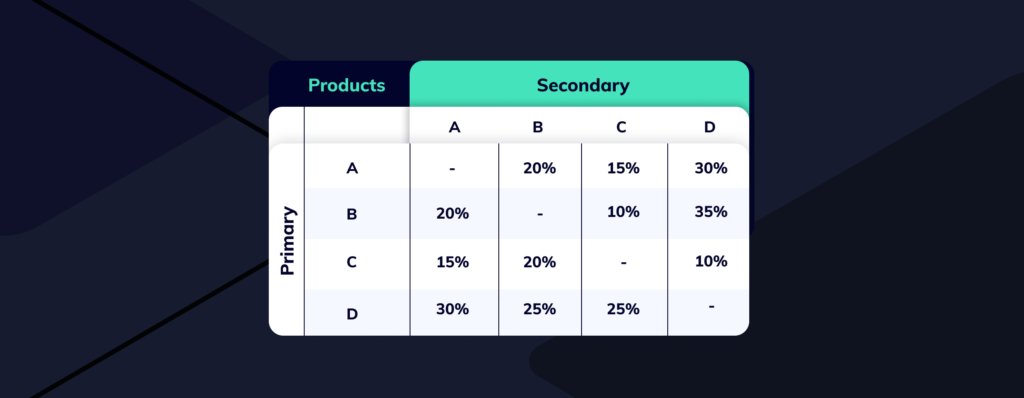

Suppose you are selling products A, B, C and D. You’ve provided these products to customers from various sectors such as healthcare, education, fintech, FMCG and so on. You can find a pattern by looking at the distribution of your products across the different sectors. For example, 35% of your customers from the healthcare sector who primarily use Product B are also using Product D.

This indicates that there could be a use case in the healthcare industry that is making those who use B also opt for D. Such insights can be leveraged to get better conversions while selling another product to your existing customers.

This indicates that there could be a use case in the healthcare industry that is making those who use B also opt for D. Such insights can be leveraged to get better conversions while selling another product to your existing customers.

At Razorpay, we offer our Capital products to businesses who have been associated with us for an adequate period of time. We make an intuitive decision with respect to the eligibility criteria that we expect them to meet. While offering capital to any business, we ask ourselves a few questions first. Let’s explore them one at a time.

Do we know the business?

Unsecured loans (which do not involve any collateral) pose a higher risk to the lender. In such cases, the terms of the loan are based on the lender’s judgement towards the borrower. Thus, it is fundamental that you know the business that you are lending to.

To get a fair picture of the business, we consider the time for which they have been active i.e. their business vintage. We check whether the business has furnished their GSTIN or not. Our team also looks at the business category and spends some time to understand their business model. This qualifies as our initial check for shortlisting businesses that we can offer capital to.

How has their behaviour been on our platform?

Since our Capital products are directed towards customers who already use our services, we have the advantage of categorising them based on their history with us. Customers who use our payment gateway frequently and without any frauds being reported against them are given priority. Along with the monthly average number and amount of transactions, we check if they are growing their business on our platform over each month.

Are the customers trustworthy?

We trust customers who have a history of fair dealings with their clients. This can be verified by inspecting the customers’ history for any chargebacks, disputes or fraud claims. Customers with a high rate of refund are also flagged out.

How do we price our customers?

Pricing on any lending instrument relies on the risk borne by the lender. We categorise customers into multiple risk thresholds and use these to base our pricing. A set of parameters related to a merchant can be used to determine their risk category. Razorpay uses a k-Means Clustering Algorithm to solve this problem.

What is k-Means Clustering?

We use three parameters for this calculation. Based on these, the businesses can be clustered into subgroups that define the risk associated with them. The parameters include:

- Average active days of a merchant

- The ratio of chargebacks raised on transactions

- The ratio of refunds made on the transactions

With these parameters in place, the next step is to decide the number of clusters that can be made from the dataset. For this, we use the Elbow Method Algorithm. This method helps in finding the optimal number of clusters by running the data for multiple k-values and fetching the value that ranks the highest according to the algorithm.

After deciding the value of k, the three parameters are used to determine means that will act as the centroids of the clusters. Initially, k data points are arbitrarily chosen from the dataset to form the first k number of clusters. As the model runs iteratively on each value, the k means are recomputed.

After computing the k means, each data point is grouped into the clusters that are formed around these means.

The clusters thus formed will correspond to different pricing on the Capital products. The parameters that determine the pricing can vary every month. Because of this, businesses who take care of their customers can expect a better pricing on our products.

Data is at the core of most decisions made at Razorpay. Using data-backed approaches helps us take an informed call while offering our products to our customers. Our mission has always been to help businesses solve their financial problems and empower them to take on their next big challenge.