Artificial Intelligence (AI) in digital payment systems is reshaping the payments industry in an era of quick technological transformation. From better fraud detection to more efficient transactions, AI is changing the way of payment processing.

This article explores the transformative impact of AI on digital payments, highlighting key advancements and future possibilities.

Table of Contents

What is AI in Payments?

AI in payments refers to using artificial intelligence and machine learning algorithms to streamline and enhance various aspects of financial transactions and payment processes. Unlike traditional payment methods, which rely on predefined rules and manual checks, AI-driven payment systems continuously learn from transaction data to detect fraud, personalize customer experiences, and automate tasks. This active approach improves security, efficiency, and accuracy by adapting to new patterns and emerging threats in real-time.

Common AI Tools and Technologies Used in Online Payments Industries

1. Machine Learning

- Fraud Detection: These algorithms analyze transaction patterns to identify anomalies and flag suspicious activities in real-time.

- Customer Segmentation: They classify customers based on behavior and preferences, aiding in the development of targeted marketing strategies.

- Predictive Analytics: Leveraging historical data, these algorithms forecast future trends, such as spending habits and potential risks.

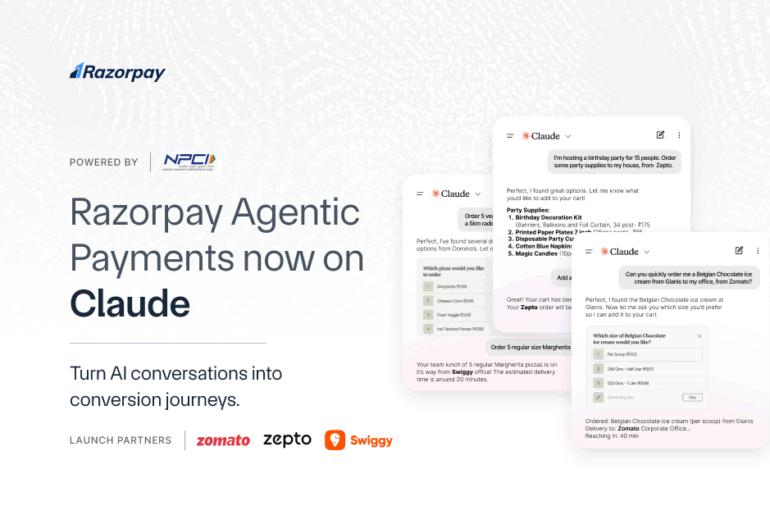

2. Natural Language Processing (NLP)

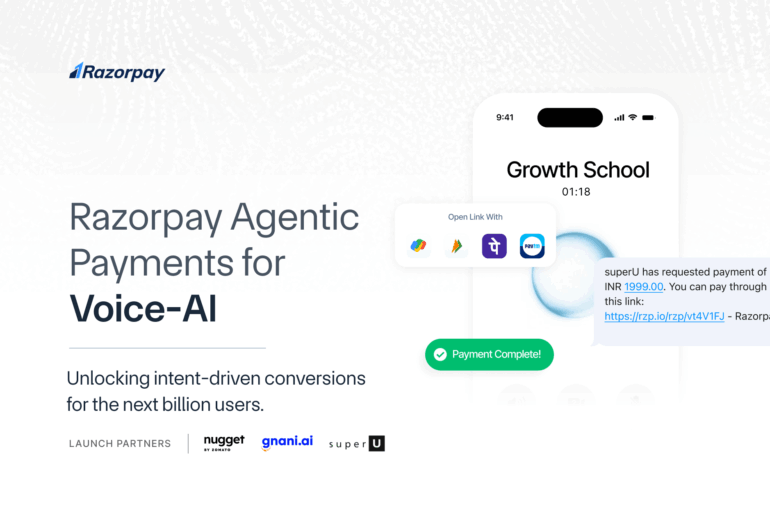

- Voice-Based Transactions: Users can complete transactions through voice commands, providing a hands-free and convenient experience.

- Chatbots: NLP-powered chatbots handle customer inquiries, process transactions, and offer 24/7 support, enhancing customer satisfaction.

- Sentiment Analysis: NLP helps analyze customer feedback and sentiment, enabling businesses to refine their services and address issues more effectively.

3. Biometric Authentication

- Facial Recognition: This technology authenticates users by analyzing facial features, making unauthorized access difficult.

- Fingerprint Scanning: A quick and reliable method for mobile payment authentication.

- Voice Recognition: Adds an additional security layer by verifying voice patterns to ensure only authorized individuals complete transactions.

4. Blockchain

- Secure Authentication: Utilizes a decentralized digital ledger where transactions are encrypted and linked in an unchangeable chain, enhancing security and reducing fraud.

- Smart Contracts: These self-executing contracts automatically perform and verify transactions when predefined conditions are met, minimizing the need for intermediaries.

5. Data Analytics

- Pattern Discovery: Examines transaction data to identify valuable patterns, aiding in strategic decision-making.

- Personalization: Provides insights into customer behavior, allowing for tailored services and offers.

- Process Improvement: Detects inefficiencies in payment procedures, enabling quicker and more reliable transactions.

6. Generative AI

- Content Creation: Uses Generative Adversarial Networks (GANs) and Variational Auto-encoders (VAEs) to produce realistic text, images, and other outputs.

- Personalization: Tailors payment experiences and marketing content to individual preferences.

- Enhanced Interaction: Improves customer interactions with responsive, context-aware replies, increasing engagement and satisfaction.

Key Areas Where AI is Transforming Digital Payments

1. Fraud Detection and Prevention

AI in payment systems can analyse data quickly to find and flag dubious transactions and stop fraud before it occurs.

For example, machine learning can spot irregular spending, such as large purchases or transactions from unexpected locations, and alert banks.

2. Personalisation and Customer Experience

By interpreting user behaviour and preferences, AI can suggest personalised payment options, discounts, and promotions.

For example, AI-driven tools can identify the ideal payment plan according to a customer’s spending habits. This ultimately boosts satisfaction and loyalty.

3. Automation of Payment Processes

AI simplifies tasks like invoice handling, payment scheduling, and payment reconciliation, allowing human resources to focus on more intricate responsibilities. This speeds up transactions and maintains accuracy and consistency in payment operations.

4. Risk Management and Credit Scoring

AI analyses various data points, including transaction history, spending patterns, and social behaviour, to generate accurate credit scores and perform risk assessments. This helps financial institutions decide whether they should approve funding to a particular applicant or not.

5. Automated KYC Processes

AI-assisted systems handle Know Your Customer (KYC) documentation by cross-referencing information with databases and detecting discrepancies. This automation speeds up the onboarding process and ensures compliance with regulations while decreasing the chances of fraud and identity theft.

6. Improving Accuracy in False Declines

AI-enabled machine learning tools refine the accuracy of transaction approvals by detecting authentic transaction patterns. It slashes false positives and negatives to ensure legitimate transactions aren’t wrongly declined.

7. AI in IVR Payments

IVR payment systems, often used in customer service and payment processing, have been significantly enhanced with the integration of Artificial Intelligence (AI).

They provide round-the-clock support, improving customer service and reducing the workload on human support teams.

If needed, they can pass complex cases to human agents for better service.

8. Cross-Border Payments

AI in payment systems can analyse exchange rates and transaction fees to find the most cost-effective routes for international payments. Integrated with an international payment gateway, this not only speeds up the transfer process but also ensures that customers receive the best possible rates to make cross-border payments more efficient and affordable.

Benefits of AI in Digital Payments

1. Enhanced Productivity and Efficiency

Automation helps employees to focus on more complex and strategic responsibilities. For example, it can handle tasks such as invoice processing, data entry, and transaction categorisation, which traditionally consume a lot of time and effort.

2. Accelerated Workflows

AI automates repetitive and time-consuming activities. Through advanced algorithms, it streamlines workflows, from data entry to complex decision-making, reducing manual intervention and error rates.

In sectors like finance and manufacturing, it optimises operations and resource allocation to improve productivity. This speed and precision expedite results and drive tangible profits by lowering operational costs and allowing faster responses to market changes.

3. Improved Customer Service

AI can predict customer needs by analysing past interactions, purchase history, and demographic data, offering relevant recommendations or solutions. This personalised approach results in a more engaging experience. Further, AI-powered chatbots and virtual assistants deliver 24/7 support to contribute to higher retention rates and brand loyalty.

4. Advanced Monitoring and Issue Detection

In equipment maintenance, AI in payments systems continuously analyse sensor data to identify wear and potential failures before they occur, facilitating preemptive repairs. It leverages machine learning to detect anomalies and threats for cybersecurity by scrutinising network traffic and user behaviour patterns. This proactive approach allows for rapid response to potential breaches, minimising damage and improving overall system security.

5. Reduction of Human Error

AI reduces human errors by automating routine tasks and applying precise algorithms. It can manage complex processes without fatigue or oversight. Additionally, AI can evolve by learning from historical data, progressively enhancing its accuracy and performance.

Challenges in AI for Digital Payments

1. Data Privacy and Security Concerns

AI in the payment industry often needs access to large data volumes to perform effectively. This suggests severe concerns about data privacy and security, including the risks of unauthorised access, potential breaches, and data misuse.

2. Algorithmic Bias

Historical data biases can be inadvertently integrated into AI models, causing inequitable or inefficient payment routing. Such bias in AI signifies systematic and unfair discrimination in the algorithms’ outcomes, originating from the biases present in the training data.

3. Regulatory Compliance

AI helps achieve regulatory compliance through automated monitoring and reporting. Despite this, incorporating AI in payments systems introduces significant regulatory issues. Financial institutions must establish an AI strategy that defines acceptable practices, incorporates pre-launch evaluations, and maintains ongoing compliance checks.

4. Integration Challenges

Integrating AI into payment systems involves technical complexities, such as data privacy issues and regulatory compliance. Businesses face additional challenges like biases in data and algorithms, decision-making clarity, data security, cybersecurity risks, employment implications, knowledge deficits, regulatory concerns, and potential issues with current regulatory frameworks.

5. Cost of Implementation

The expense of deploying AI in payments can differ significantly based on the sophistication and features of the solution.

Future Trends in AI for Digital Payments

1. Real-time Payments and Instant Transfers

Real-time payments (RTPs) are revolutionising financial transactions by allowing funds to be transferred instantly at any time of the day. This quickens transfers, helps manage cash flow better, simplifies admin tasks, and improves the customer experience.

2. Biometric Authentication

Biometric authentication is a security method that checks a person’s unique traits against stored data to allow access. It is becoming a highly reliable way for businesses to verify the identity of customers and employees.

3. Increased Use of AI-Powered Chatbots

AI chatbots increasingly handle quick and easy interactions, managing 65% of business-to-consumer chats. Their popularity is expected to increase, as 86% of consumers have had good experiences with them.

4. Blockchain Integration

Blockchain is gaining momentum due to its decentralised design. It helps businesses by providing more transparency, better security, and easier tracking. When combined with back-end legacy systems, it can improve overall outcomes.

5. Artificial Intelligence of Things (AIoT)

The Artificial Intelligence of Things (AIoT) merges AI technologies with IoT infrastructure. This combination results in more efficient IoT operations, better interactions between humans and machines, and improved data management and analysis.

6. Quantum Computing and Payments

With its ability to run complex simulations at remarkable speeds, quantum computing enhances investment and business decisions. Its instantaneous data processing will prove vital for risk analysis and credit underwriting.

Which Businesses is Getting Benefits of AI Payments?

1. E-commerce

In e-commerce, AI analyses customer behaviour, preferences, and purchase history. Based on that, it provides personalised product recommendations. AI also streamlines the checkout process by integrating various payment methods and automating the payment process. E-commerce platforms can also use chatbots to assist customers during the checkout.

Related Read: How AI Is Transforming Ecommerce?

2. B2B (Business-to-Business)

In the B2B sector, AI can automatically fetch information from invoices to reduce manual intervention and eliminate the risk of human error. Payment automation not only speeds up transactions but also improves cash flow. Further, AI can reconcile payments with invoices to confirm the records do not have any discrepancies.

3. SaaS (Software-as-a-Service):

AI enhances personalised marketing in SaaS by analysing large volumes of customer data to create tailored marketing strategies. This helps improve customer engagement and ultimately drives sales.

Also, automating recurring tasks, such as billing, data entry, and answering common customer queries, allows staff to focus on more critical responsibilities.

Further, its predictive analytics functionalities can foretell customer behaviour and help SaaS companies to strategise effectively. AI can also detect real-time cybersecurity threats to prevent potential data breaches.

4. Subscription

AI helps companies manage subscription-related churn by analysing customer behaviour and usage patterns to predict when customers may leave, allowing them to take proactive steps to retain them.

Additionally, AI automates regular payments, ensuring timely subscription renewals and improving cash flow. It also enhances customer communication by sending timely, personalised messages.

Frequently Asked Questions

1. How does artificial intelligence improve payment security?

AI algorithms analyse transaction data to identify anomalies, such as unusual spending behaviour or device usage. Continuous learning from new threats helps its system adapt, improve transaction fraud detection capabilities, and ensure more reliable payment processes.

2. What are some examples of AI applications in payment processing?

AI in payments processing features real-time fraud detection, tailored customer interactions through behaviour analysis, automated support with AI chatbots, risk evaluation via credit scoring, and task automation for activities like invoice handling. These innovations boost both efficiency and security in payment systems.

3. How does AI enhance fraud detection and prevention in payments?

AI enhances fraud detection and payment prevention by analysing real-time transaction patterns to identify unusual activities. Machine learning algorithms detect anomalies and potential fraud by learning from historical data, enabling quicker responses and reducing false positives.

4. Can AI help personalise payment experiences for customers?

AI improves payment experiences by analysing customer data to offer personalised payment solutions, reminders, and promotions. It increases user satisfaction by customising interactions, predicting preferences, and tailoring services to individual needs.

5. What role does AI play in streamlining payment reconciliation processes?

AI improves payment reconciliation by automating matching invoices with payments, detecting discrepancies, and quickly flagging errors. Over time, machine learning algorithms refine accuracy by learning from data patterns.

6. How does AI contribute to reducing payment processing errors?

AI reduces payment processing mistakes by automating routine procedures, cutting manual involvement, and lessening the risk of human errors.