At Razorpay, one of our core values is ‘transparency’. When we heard from some of our Optimizer merchants that they were “in general happy” with Optimizer but did not “really have a detailed understanding of the impact created” , we realized that there was a gap. We had access to internal data that gave us a clear picture of the impact created – on success rate, refunds performance, settlement coverage and much more. However, the customer did not have easy access to any of this information. In essence, we were not living up to our own core value of ‘transparency’.

To bridge this gap in transparency, we have started rolling out the ‘Optimizer performance report’.

This report sheds light on:

- Performance summary for the merchant

- Performance of routing rules

- Payment method level success rate

- Dynamic routing overview

- Refund performance

- Identified opportunities for growth

- Update on upcoming product and feature releases

Optimizer Performance Report

Coming to Optimizer’s Performance Report, let’s unfold a comprehensive analysis of payment processing activities.

Optimizer Rule-Engine Performance Report

Here’s a snippet from a sample report to give you a glimpse of the metrics you can expect in yours. We’ve added some more sample reports throughout the blog for your convenience.

The report opens with a drumroll, promising to shed light on the volume of payments processed through each rule and identify underperforming rules affecting the average success rate. A detailed breakdown is provided, showcasing the success rates for various payment methods across different gateways. Notably, the report highlights the performance of rules associated with gateways like Paytm and Razorpay.

The report opens with a drumroll, promising to shed light on the volume of payments processed through each rule and identify underperforming rules affecting the average success rate. A detailed breakdown is provided, showcasing the success rates for various payment methods across different gateways. Notably, the report highlights the performance of rules associated with gateways like Paytm and Razorpay.The presented data outlines the success rates for specific payment methods, such as Credit Card, UPI, Net Banking, and more. Razorpay’s Credit Card transactions boast an impressive 91.12% success rate, demonstrating its efficiency. In contrast, the report unveils areas of improvement, such as the 0.00% success rate for certain Prepaid Card transactions.

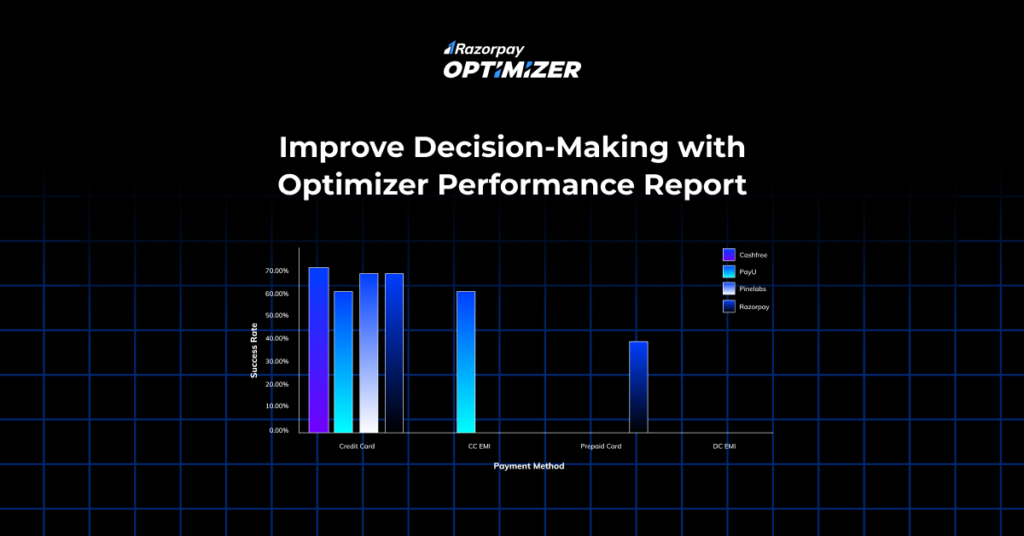

Overview of Method Level Success Rate Across Gateways

A closer look at the analytics dashboard is recommended for detailed insights; to obtain actionable information for refining payment strategies.

A closer look at the analytics dashboard is recommended for detailed insights; to obtain actionable information for refining payment strategies.Success Rate Overview

An evaluation of gateway performance across different payment methods is presented, showcasing the interplay between rules and gateway efficiency.

Dynamic Routing Overview

Refund Success Rate

The blog includes an overview of refund success rates, indicating that 90% of overall refunds created in September were successful in the terminal state. This statistic adds a layer of insight into post-transaction processes and customer satisfaction.

The blog includes an overview of refund success rates, indicating that 90% of overall refunds created in September were successful in the terminal state. This statistic adds a layer of insight into post-transaction processes and customer satisfaction.Identifying Opportunities for Growth

A detailed analysis of downtime for the previous month emphasizes the significant reduction witnessed in the reported month. We recommend considering provider priority for each rule to leverage dynamic routing benefits, highlighting the impact of a dynamic routing strategy on Success Rate improvement.

The report identifies a dip in Gross Merchandise Volume (GMV) by 15 crores over the course of a month. Through Gross Merchandise Value attribution analysis, a 1% dip in Success Rate and a 1.35% dip in Average Order Value are linked to the overall decrease in GMV.

Industry-Wide Trends and Preferences

A comparison of success rates for different payment gateways, including Razorpay, Cybersource, Cashfree, Pinelabs, and PayU, provides industry benchmarks. We encourage businesses to prioritize payment methods with higher success rates to boost overall performance.

Tips for Improving Success Rate

The report concludes with actionable tips for enhancing Success Rate. Specific recommendations include redirecting traffic from PayU to PineLabs or Razorpay for Credit Card transactions, routing Debit Card payments through Razorpay for improved success, and prioritizing gateways like Razorpay, Pinelabs, and PayU.

What’s New and Exciting

Paytm Instant Onboarding on Optimizer

Razorpay Optimizer introduces a seamless onboarding experience for Paytm on the Optimizer platform, simplifying the process for businesses starting with a new payment

Process TPV Transactions via Optimizer

In a move to serve the needs of BFSI (Banking, Financial Services, and Insurance) customers, Optimizer now supports Third Party Validation (TPV) on UPI payments. This self-serve functionality from the Optimizer dashboard allows customers to add bank gateways and configure TPV payments, enhancing flexibility and convenience.

Cashfree Settlements on Optimizer Single View Recon

Efficient payment management is crucial for businesses using multiple payment aggregators. The addition of Cashfree to the Single View Recon feature consolidates transaction and settlement data in one place for Cashfree, PayU, Paytm, and Billdesk, simplifying the reconciliation process.

Conclusion

The combined insights from the Optimizer Rule-Engine Performance Report and the Optimizer Performance Report offer you a roadmap for optimizing payment strategies. By leveraging the detailed analyses and actionable recommendations, businesses can navigate the dynamic landscape of e-commerce with confidence, unlocking the full potential of their payment processing capabilities.