Earlier this year, the Finance Ministry of India introduced the dual tax regime, a whole new tax regime to the existing one, bringing in prevalent changes to the way taxes are calculated for employees from the financial year 2020-2021.

Since the financial year has just begun, businesses need to quickly upgrade to a payroll software that is compliant with the dual tax regime and automate their payroll process.

Let’s talk a little bit about the tax regime.

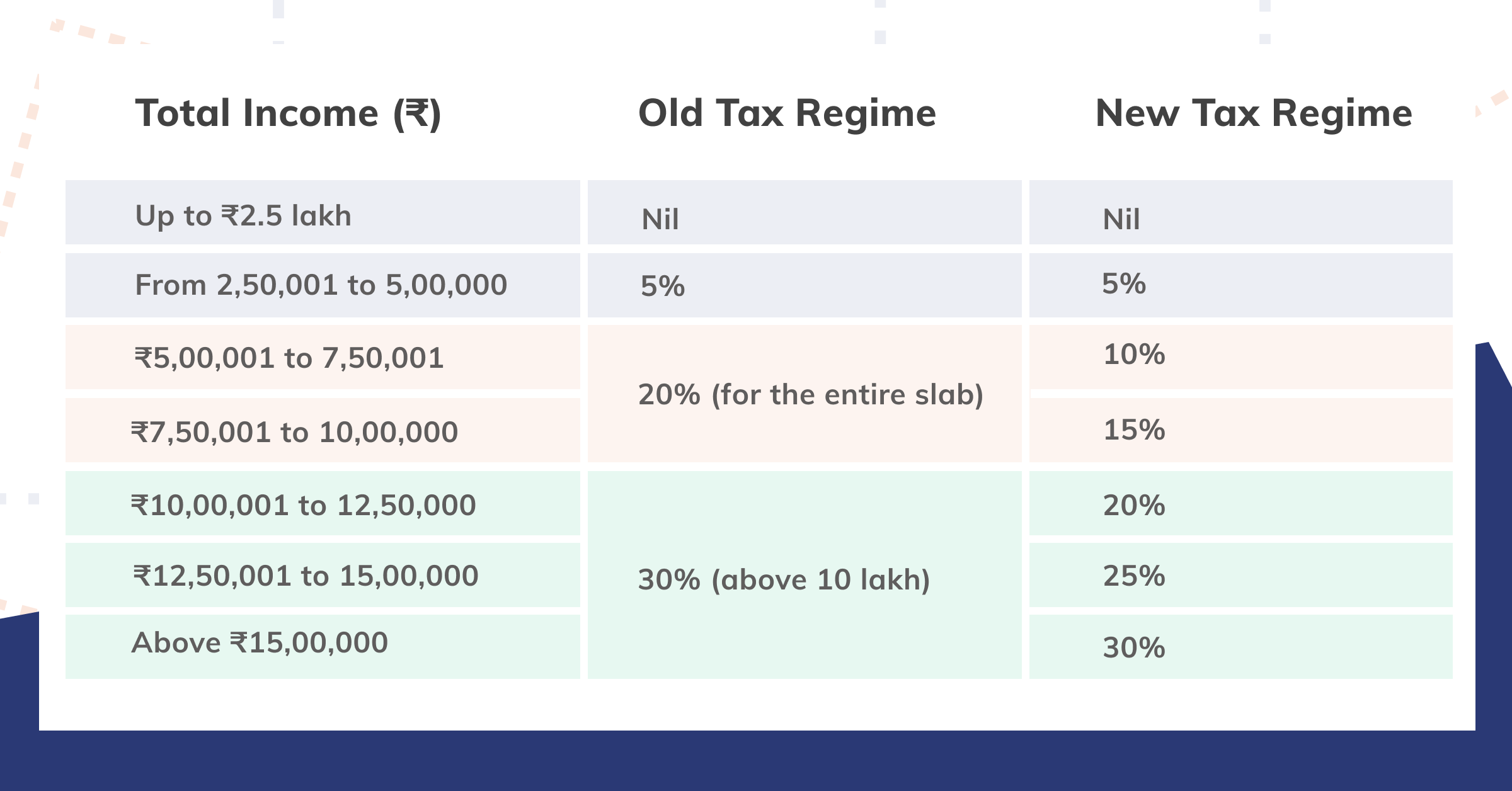

As opposed to the higher tax slabs with benefits and exemptions, the new tax regime is all about lower tax slabs, but without the benefits and exemptions. The Union Budget 2020 allows employees to choose from the two options.

- The new income tax for employees whose income lies between ₹5 lakh and ₹7.5 lakh is 10% whereas according to the old regime, the income tax is 20%

- The next slab is for the range between ₹7.5 lakh and ₹10 lakh, where the tax is 15% while the tax is 20% in the old regime

- Employees with income between ₹ 10 lakh and ₹ 12.5 lakh would pay 20% tax, which is reduced from 30% in the old regime

- Finally, for income over ₹ 15 lakh, the tax is 30%

The perks of the new income tax regime

Lower taxes

Your employee can take home more money than before under the new tax regime since the taxes are reduced. Meaning, your employee need not exclusively invest in tax saving schemes.

Fewer compliances

The new tax regime is very straightforward compared to the old regime. Except for NPS, savings interest from the post office, and PPF, benefits, and exemptions are cut off, making the tax filing process much simpler.

Flexible investments

With the new tax regime, your employee can personalise their investments that provide better fluidity to withdraw their money.

Like we mentioned before, the benefits and exemptions are nearly cut off. HRA (House Rent Allowance), housing loan interest, investments like life insurance, provident fund, etc. (Section 80C investments), medical insurance, education loan interest, savings bank interest, and leave travel allowance are removed.

What exemptions are still available in the new regime

- Leave encashment on retirement

- Scholarship received for education

- Funds received on VRS up to ₹5 lakh

- Maturity amount and short term withdrawals from NPS

- Pension commutations

- EPF

- Death, retirement benefits

How to choose between the two income tax regimes

Your employee should consider both the advantages and disadvantages of the new tax regime in comparison with the old one. They should calculate their deductions, income after taxes, and the total tax for their annual income, based on both the regimes.

This will help them understand what works for them the best.

How the new income tax regime will impact your payroll

Payroll compliance is absolutely important, especially when there is a change in regulations. Having out-of-date payroll software will definitely not help you with change management and will limit your productivity since payroll can be largely time-consuming if done manually.

Also, let’s not disregard the fact that your HR team will have to spend hours and hours every month to keep step with compliance, whereas they could be contributing to the business.

If you’re wondering what can help your business minimise impact, let’s introduce RazorpayX Payroll, a payroll software that will put an end to all your payroll processing troubles.

RazorpayX Payroll is compliant with the dual tax regime. The payroll software allows your employee to choose their preferred regime during the time of their investment declaration for the financial year.

They can also see their projected taxes for the year based on their income and regime so that they can make an informed decision keeping their tax liabilities and savings in mind.

Your employee can then file their declarations and edit them based on their regime. RazorpayX Payroll also recommends a breakup predicated on their salary, so that they’re aware of the benefits of both regimes.

This helps you completely automate your payroll process without having to worry about the dual tax regime compliance, without any manual intervention.

[ Suggested read: Automate Your Employee Salaries with RazorpayX Payroll ]

RazorpayX Payroll for all your payroll needs

Relying on outdated payroll software will create a big setback for your business.

RazorpayX Payroll will help you carry out your business operations without any interruptions since the software scales itself and helps you stay up-to-the-minute with changing regulations and compliance.