- Solves for both direct lending models and co-lending models for lenders

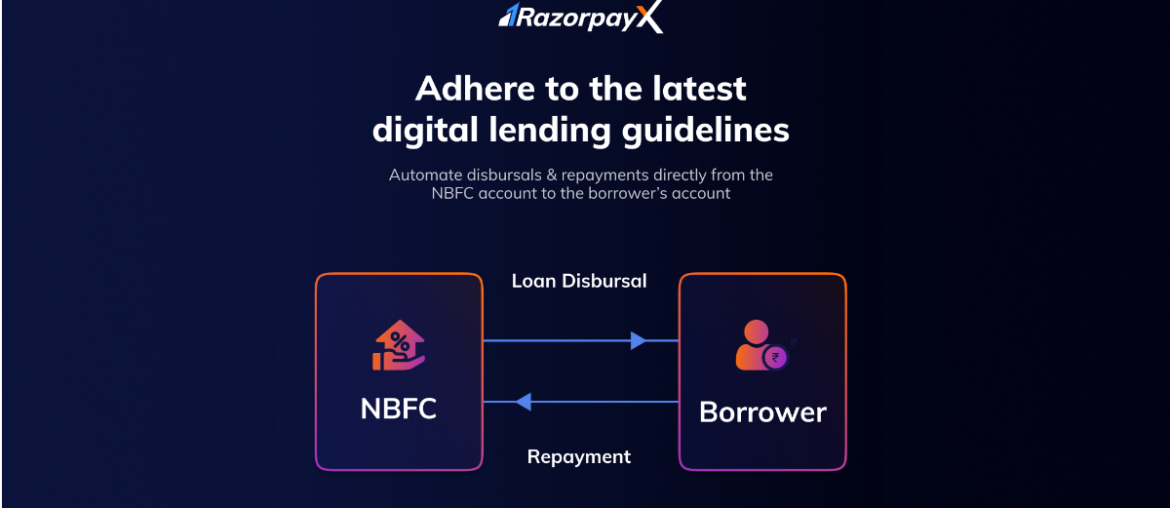

- Enables direct money transfers between the regulated entity (NBFCs or banks) and the borrower’s account for loan disbursals and repayments

- Allows NBFCs to manage multiple Fintech partners using a single current account

INDIA, Bengaluru – 9th November 2022: RazorpayX, the business banking platform of Razorpay, has launched RazorpayX Digital Lending 2.0, a complete digital lending solution for NBFCs and FinTechs to adhere to the new digital lending guidelines issued by RBI recently. The solution will help in automating direct disbursals & repayments between the borrower’s and the Regulated Entity’s account and make it easier for NBFCs and Fintechs to work together more efficiently than ever before.

Up until now, NBFCs transferred the money into third-party pool accounts or Fintech’s accounts, from where the funds were further disbursed by fintechs to their borrowers. However, after the latest guidelines, transferring money via pass-through account/pool account of any third-party/Fintechs is no longer compliant.

To help NBFCs and their associated Digital Lending Apps (DLAs) / Loan Service Providers (LSPs) and Fintech partners comply with these new guidelines, RazorpayX Digital Lending 2.0 provides a full-stack lending suite that enables these lenders to – Automate direct money transfers between the lender’s and borrower’s account; Manage multiple fintech partners using a single current account; Auto-reconcile millions of transactions with their transaction status. The product would not only enable direct digital lending models but also co-lending models involving multiple lending partners by automating the splitting processes of the repayment amounts and disbursals from a single account to borrowers.

Commenting on the launch, Rahul Kothari, Chief Business Officer, Razorpay said, “In the last two years, RBI has created regulations with consumer protection and transparency at its core, thereby making space for the financial services sector to reimagine the way lending and borrowing can be done. With RBI’s deadline making it mandatory for businesses to move to newer and compliant processes by 30th November 2022, it was essential for us to take into account the needs of our customers and come up with a solution that can help them transition into the future of digital lending with utmost ease and confidence. We are confident RazorpayX Digital Lending 2.0 will serve as a one-stop tech platform that doesn’t just address adhering to changes in the short-term but in fact makes it effortless to scale up seamlessly.”

Presha Paragash, CEO, Kisetsu Saison Finance India said, “RazorpayX is a reliable partner for payment solutions. Their fast and seamless integration is helping us in our growth and lets us stay ahead of the curve. RazopayX’s fully compliant digital money transfer solution has helped us solve complex integrations in a fraction of time.”

The digital lending market in India is currently valued at $270 billion and is expected to be valued at $1.3 trillion by 2030. The new digital lending guidelines announced by the RBI has made it mandatory that loan disbursals and repayments happen directly between the accounts of regulated lenders (NBFCs or banks) and borrowers. This has made many lending merchants rethink their payment infrastructure and figure out a new way to transfer money to their borrowers without any pass-through account/pool account of any third-party/Fintechs. This has resulted in an increased demand for compliant and scalable solutions for loan disbursals and repayments.

RazorpayX Digital Lending 2.0 has already onboarded some of the largest players in the ecosystem including Kisetsu Saison Finance India, MoneyTap (a Freo product) to name a few and aims to onboard many more lenders by November 30th.

RazorpayX currently serves over 30,000 businesses and in the last year alone has processed UPI transactions to over 20% of all UPI registered users in India. RazorpayX Payouts helps businesses to move money at scale across customers, vendors, suppliers, and partners via API-enabled banking. RazorpayX Payouts platform has seen over 200% growth in its business. The platform has disbursed payouts with an annualized money movement of over $30 billion. In addition to Payouts, RazorpayX has witnessed similar growth across its other products such as Neo-Banking, Vendor Payments, Payroll and Corporate Credit Cards.

***

About RazorpayX:

RazorpayX is the leading new-age business finance platform from Fintech giant Razorpay. Built on top of a current account (from India’s leading banks), RazorpayX is designed to automate and simplify repetitive and time-consuming financial tasks. From facilitating day-to-day payments, accounting & reconciliation, to helping businesses borrow collateral-free loans, automate the payroll process, and adhere to the latest tax compliance standards, RazorpayX provides businesses and entrepreneurs with a future-forward solution. RazorpayX current account is powered by RBL & ICICI Banks. RazorpayX have over 30,000 businesses on its platform.

Media Contacts:

Anu Saraswat || anu.saraswat@razorpay.com || +91 8884696968

Harshit Pai || harshit@themavericksindia.com || +91 7411082766