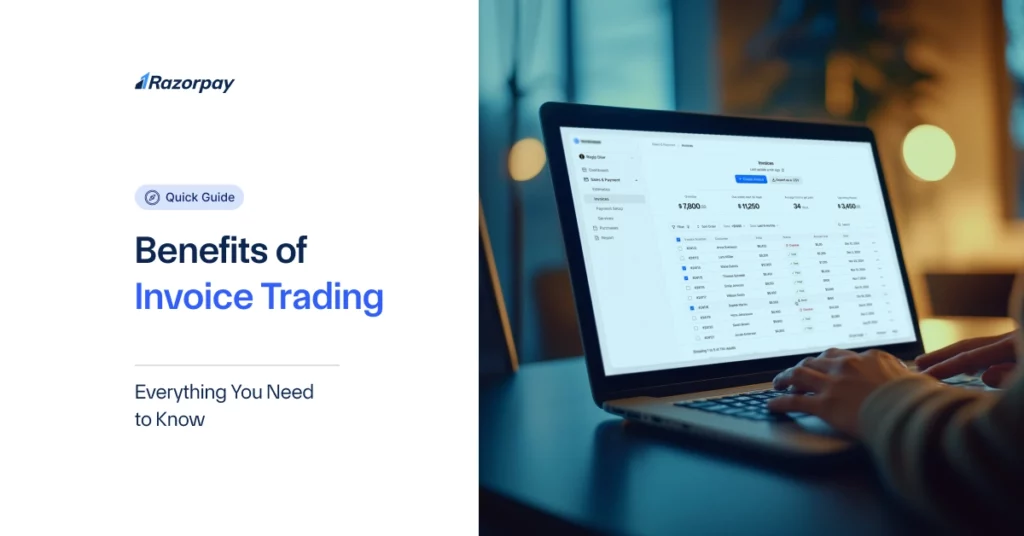

Many businesses face cash flow problems when customers take too long to pay. Invoice trading helps solve this issue by letting companies get money faster. It uses online platforms to turn unpaid bills into quick cash, giving businesses the funds they need to keep growing and running smoothly. In this article, we will understand what invoice trading is, how it works, and its pros and cons.

Table of Contents

What Is Invoice Trading?

Small and medium enterprises (SMEs) in India often face cash flow challenges due to extended payment cycles. Sectors like manufacturing, IT services, and logistics frequently experience payment delays of 60-90 days. Invoice trading helps these businesses bridge financial gaps. This ensures they can pay salaries, purchase raw materials, and continue operations without interruption.

Consider a Mumbai-based IT startup that completes a software project for a large corporation but must wait 90 days for payment. Instead of waiting, they can sell the invoice to investors and receive 70-90% of the funds immediately.

How Does Invoice Trading Work?

Invoice trading operates through specialised online platforms that connect businesses with investors. Businesses start by registering on these platforms and submitting their unpaid GST invoices for review. The platform carefully verifies the invoices and assesses the creditworthiness of both the business and its customers.

After verification, investors can purchase the invoices. Businesses typically receive 70-90% of the invoice value upfront. The trading platform then takes responsibility for collecting the full payment from the customer when the invoice becomes due.

This service comes with a fee, which varies based on factors like invoice amount, customer reliability, and payment duration. The primary benefit is improved cash flow, allowing businesses to access funds quickly instead of waiting for extended payment cycles. By using invoice trading, companies can maintain financial flexibility and continue their operations without cash flow interruptions.

Who Can Get Into the Invoice Trading Facility?

Invoice trading works best for small and medium-sized businesses across various industries. Companies with a stable client base and regular invoices can typically access this financial solution. Manufacturing, IT services, logistics, retail, and professional service sectors find invoice trading particularly beneficial.

Financial institutions evaluate several key factors when considering a business for invoice trading. They look for companies with high-quality invoices from reliable customers, typically those less than 90 days old. The creditworthiness of both the business and its customers plays a crucial role in determining eligibility.

Businesses with a consistent stream of receivables have the highest chances of qualifying. This means companies that regularly issue invoices and have a track record of working with established clients can easily access invoice trading. The goal is to provide a flexible financing option that helps businesses manage cash flow more effectively.

Pros & Cons of Invoice Trading

Pros of Invoice Trading

Invoice trading benefits businesses with quick access to cash when they need it most. Companies can convert unpaid invoices into immediate working capital. This solves short-term financial challenges. This approach eliminates the need for traditional collateral.

The method significantly reduces financial stress by bridging cash flow gaps. Businesses no longer need to wait months for customer payments. Instead, they can access funds quickly. This allows them to pay suppliers, invest in growth, or manage unexpected expenses without disrupting operations.

Cons of Invoice Trading

While invoice trading offers numerous benefits, it comes with some drawbacks. Financial platforms charge fees for their services, which can reduce the overall value of the invoice. Businesses typically receive 70-90% of the invoice value, meaning they sacrifice a portion of their potential earnings.

Frequent use of invoice trading can create a dependency cycle. Businesses might become reliant on this method instead of addressing underlying cash flow management issues. The convenience can mask deeper financial planning challenges that need more comprehensive solutions.

The cost of using invoice trading can accumulate over time. Repeated use of these invoice trading services means continuously paying fees, which can eat into a company’s profit margins.

Conclusion

Invoice trading offers businesses a smart way to manage cash flow by converting unpaid invoices into quick funds. While it provides financial flexibility, companies must carefully assess the costs and benefits. This innovative financing method can help businesses bridge payment gaps, but it should be used strategically as part of a comprehensive financial approach.

Frequently Asked Questions (FAQs)

1. How quickly can a business access funds through invoice trading?

Invoice trading typically provides businesses with funds within 24-72 hours after invoice verification.

2. What fees are typically associated with invoice trading?

Fees range from 1-3% of the invoice value, depending on the platform, invoice amount, and customer creditworthiness.

3. Can any business participate in invoice trading, or are there specific requirements?

Not all businesses qualify. Small and medium enterprises with stable client bases and invoices less than 90 days old are prime candidates. Manufacturing, IT, logistics, and service sectors often find invoice trading most beneficial.

4. How does invoice trading differ from factoring?

Unlike traditional factoring, invoice trading allows businesses to maintain customer relationships and doesn’t require selling entire invoice portfolios. Platforms verify individual invoices and provide more flexible funding options.

5. Are there any risks involved with invoice trading?

Risks include potential fee accumulation, receiving only 70-90% of the invoice value, and creating financial dependency. Businesses should carefully assess their cash flow needs and compare invoice trading with alternative financing methods.

6. How do I know if my business is eligible for invoice trading?

Key eligibility criteria include having reliable customers, consistent invoice streams, and good financial health.

7. Is there a minimum invoice value required for trading?

Most platforms don’t specify a strict minimum invoice value but typically prefer invoices from ₹50,000 to ₹5 lakhs.

8. Can I trade an invoice that is overdue?

Overdue invoices are generally not accepted, as platforms prioritise low-risk, recent invoices from creditworthy customers.