If you’ve ever worked in a startup, you’ve probably dealt with some kind of vendor providing their services. Once the services are complete, an invoice is issued after which the vendor payment is made.

Not just startups, businesses of all sizes at some point use vendors for getting specialised services or goods. It could be the food vendor that provides meals in your office cafeteria or a social media agency helping you with creative stuff. This blog post covers invoices in detail along with a free, completely editable template that you can use.

Table of Contents

What is an invoice?

An invoice is a legally binding document/contract between a buyer and a seller, raised after the seller has provided a product or a service to the buyer. Among other details, this statement contains the amount payable and other terms associated with this transaction.

The next section covers all the details of invoicing such as information contained in an invoice, the importance of invoicing and different types of invoices.

Different parts of an invoice

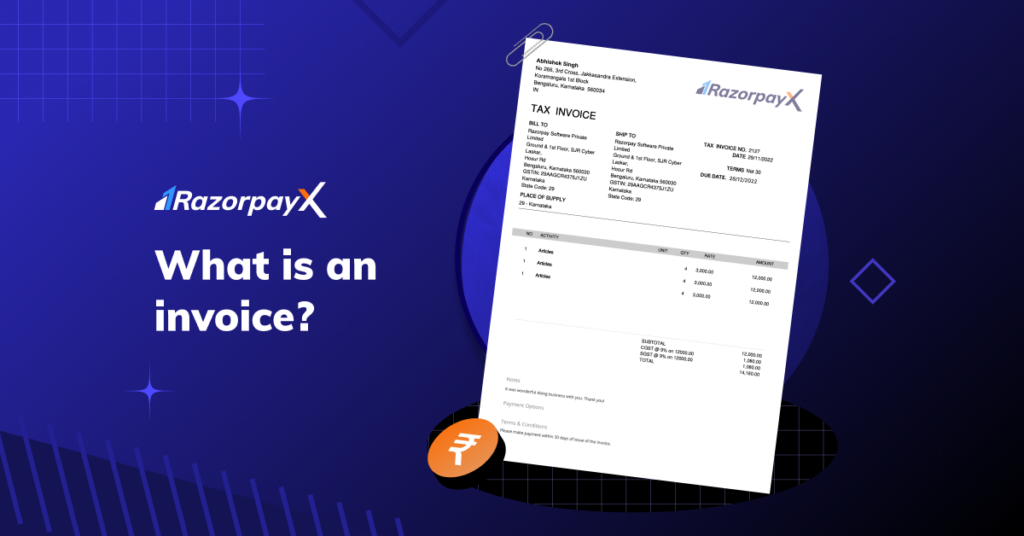

Please find below a sample invoice with its various parts listed on the left-hand side:

Download invoice template in Excel for free

Vendor payment methods for invoices can range from cash to electronic bank transfers or payoff via mobile apps. Usually, the payments are done online these days.

Why is an invoice important?

The primary function of an invoice is to ensure that both seller and buyer remain contractually obligated to uphold the terms of a deal. However, keeping such detailed documentation is also crucial because:

- It keeps a thorough record of which services or products had been provided by which entity to whom

- This record can safeguard both parties involved from facing any duplicitous litigation down the line

- When filing taxes, these invoices benefit businesses by substantiating revenue earned

- A business can analyse the behavioural pattern of its customers from the data recorded in an invoice. This way, they can determine which service or product a certain demographic has opted for the most. Consequently, targeted, personalised advertisements can become a possibility.

- MSMEs can leverage accounts receivables to avail alternative financing via invoice factoring or discounting

[Suggested Read: Invoice Processing 101: What is Invoice Processing And More]

Different types of invoices

Sales Invoices

Some of the most commonly used invoice types include:

Pro Forma Invoices

These bills are preliminary bills generated to establish that a seller will deliver products or services as per prearranged terms against a mutually decided price. This can be generated before the actual delivery of products or services.

Commercial Invoice

This type of invoice is generated when a seller exports its goods to a buyer overseas. Therefore, commercial invoices function as export documents for customs declaration about cross-border transactions.

Credit Invoice

A credit invoice is raised when there is any dispute about the terms of a transaction between a buyer and a seller. For instance, if there had been any error in the invoice from the buyer’s end or if the buyer returns a product and demands a refund, this documentation becomes necessary.

Timesheet Invoice

In a timesheet invoice, a customer is charged hourly depending on the working hours of the service provider’s employees.

Retainer Invoice

This type of invoice is raised when a business receives an advanced payment from its customer regarding a product or service. So, this bill keeps a record of the money paid off beforehand. Subsequently, when the buyer is charged with the total invoice amount, the seller will deduct the amount received previously.

Recurring Invoices

A business issues recurring invoices to a specific client against the same products or services availed for the same amount. Subscriptions, service contracts, or proceedings related to a lease come under this.

Interim Invoice

If a hefty amount is paid, a business may break that sum into multiple small remittances. In such a scenario, interim invoices are raised. These are generally used when charging a client for a comparatively bigger project, where each interim invoice is paid off throughout the partial completion of the job.

Past Due Invoice

Such an invoice is generated when a buyer fails to meet the payment deadlines of the original invoice.

Purchase Invoice

A purchase invoice is also given by the seller to the buyer but at the end of the transaction once the goods and services have been purchased. While all the above sales invoices deal with containing the quantities, items, unit rate, etc. for the services, the purchase invoice deals with the confirmation that the transaction is complete.

Related Read: What is the Difference Between Invoice and Bill?

Important things to note while generating an invoice

As it raises an invoice, a company should follow some basic guidelines such as:

- The terms of payment should always be in writing

- Automation can be the ideal way forward for invoice-related activities

- If sellers are making advance payments, they should be incentivised. This way, an organisation can build a more amicable relationship with its customers.

- The invoice payment procedure should be free of any inconvenience for the end user. An improved customer experience can increase the seller’s ability to client retention.

If you deal with generating invoices and doing vendor payments regularly, you should check out RazorpayX Vendor Payments software.

Explore RazorpayX Vendor Payments

Automate everything related to invoice payments with RazorpayX Vendor Payments

Some of the features of RazorpayX Vendor Payments include:

- One-click pay for an invoice generated

- Invoice details are auto-captured with intelligent OCR, saving you manual data entry

- The platform also conducts TDS-related transactions for an invoice

- Easy invoice management through various methods such as – forwarding invoices via email, letting vendors add invoices directly using a vendor portal, importing invoices from accounting tools you use

- Seamless auto-reconciliation

Moreover, you have to simply add the TDS category to your vendors and it auto-calculates, deducts and pays TDS for every invoice.

Don’t believe us? Hear what Chetan Mahajan, Founder and CEO of The Mavericks India has to say about RazorpayX Vendor Payments:

We now receive all invoices directly on the dashboard, and they are ready with details pre-filled. It takes just a few clicks to stay on top of our vendor payments.

FAQs

How many billing addresses for a customer can be utilised in an invoice?

For a single customer ID, a business can add a maximum of three billing addresses.

What is the difference between an invoice and a receipt?

An invoice is a formal payment request, whereas the receipt is legal proof of that payment.

Why should a business raise an invoice?

An invoice can be a legal tool for businesses to enforce an agreement which prevents the scope of delinquencies on the part of a buyer. Please read the blog post for more details.

Why do MSMEs opt for invoice financing?

As small businesses lack collateral and asset, traditional financiers may deem them, high-risk borrowers. So, they can use unpaid invoices as collateral for fundraising.