The Indian FinTech landscape is extremely hot right now with the likes of Google, Facebook, Amazon trying to grab a share of the pie, apart from the homegrown PhonePe, BHIM and others. Their entry point? UPI.

Back when UPI was launched in April 2016, there was a general anticipation around how this would affect the Indian payments ecosystem. Our stance from day one has been that this is the future of how payments will work in India. In fact, we were the first to launch UPI acceptance for businesses in 2016 and we now power it across the likes of IRCTC, CureFit, ZestMoney etc.

We are now happy to announce the general availability of UPI payments through the native intent flow for all our merchants.

How Merchant Payments on UPI Have Worked So Far

P2M payments (customer to merchant) were supported through the collect flow until now. Here’s how that worked:

- The customer selects UPI as the payment mode in merchant app/website

- They then enter their VPA made on any UPI application

- A collect request is sent to this VPA by Razorpay

- The customer receives a push notification and/or SMS for the collect request

- They accept the collect request by entering their UPI PIN

- Customer goes back to merchant app/website to get confirmation of the payment being successful

This is a very long process for the customer. At a technical level, the number of background API calls involved is high, leading to a higher number of failure points as well.

We have also seen push and SMS notifications delivery being erratic and this part of the flow is specific to each application. The net result has been a sub-optimal user experience for the end customer and an increased probability of payment failures.

Related read: Types of UPI frauds and how to stay safe

Understanding The UPI Intent Flow

This flow solves some of these issues, making the overall process significantly smoother. Here’s the flow:

- The customer selects UPI as the payment mode in merchant app/website

- Then they are shown the list of UPI apps installed on their phone that supports the intent flow

- Customers select their preferred application

- The application is directly opened with the payment details filled already

- Customer completes the payment by entering their UPI PIN

- The app automatically sends the customer back to merchant app for payment completion

This has some obvious benefits, such as:

- Customers no longer need to handle push/SMS notifications

- They don’t need to juggle 3 applications to complete a payment either (merchant, SMS, app)

- They don’t need to remember their VPA

These benefits lead to a higher conversion rate, decrease in abandoned carts and a decrease in time to complete the payment. It’s also a much better user experience for your customers.

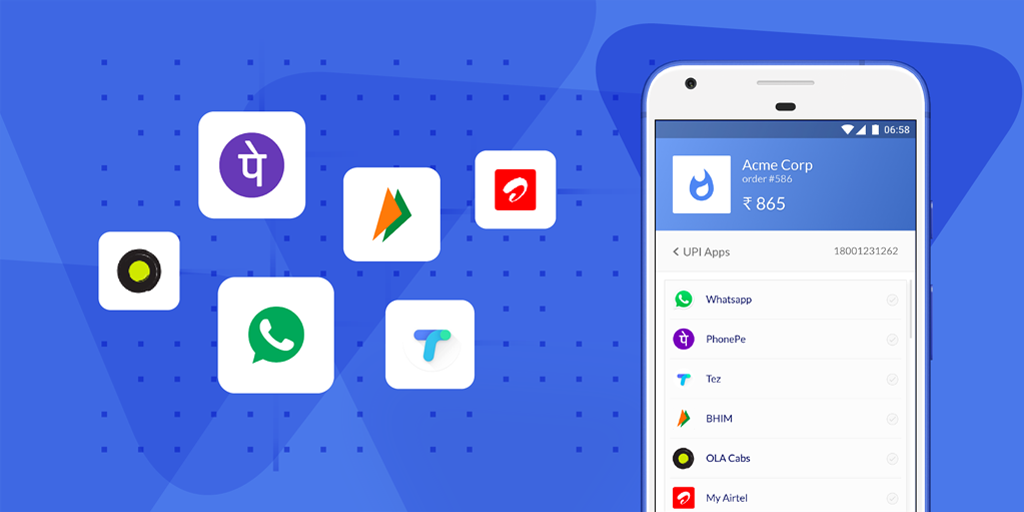

Apps That Support Intent Flow

Most of the apps have added support for intent flow, including BHIM, PhonePe, Tez etc. WhatsApp is currently in the process of rolling it out for all their users.

Adding Support for UPI Intent In Your Application

Currently, only the Android devices support the intent flow. The best part? You don’t need to write a single line of extra code to add support for this! If you are already using Razorpay’s Android SDK then you just need to update the SDK version and you’re good to go.

If you are new to our Android SDK, you can get started here. This SDK, with a single integration, provides support for accepting credit/debit cards, net banking, wallets, and UPI.

As always, feel free to write to us at integrations@razorpay.com if you face any issue or have any feedback on our product. Happy payments!

![[Live Updates] Razorpay’s Biggest Product Launches at GFF 2024 GFF](https://d6xcmfyh68wv8.cloudfront.net/blog-content/uploads/2024/08/GFF-1-770x515.png)