The future of payments is here, and it’s built on a foundation of seamless experiences and robust infrastructure. For enterprises, this means leveraging next-generation card payment stacks to not only survive but thrive in today’s competitive landscape. This blog explores how innovative solutions are transforming the card payment journey, from the initial customer interaction to the underlying technology powering these transactions.

Frictionless Card Checkout: The Key to Unmatched Payment Experiences

In the world of online commerce, every click counts.

Imagine a customer eager to complete their purchase, only to be halted by repeated customer-led errors due to an expired card date, a wrong CVV, a typo in their cardholder name, or a misremembered 3D secure password, or mistyping the OTP . Not only does this erode customer experience, but it adversely impacts success rates translating into drop in GMV.

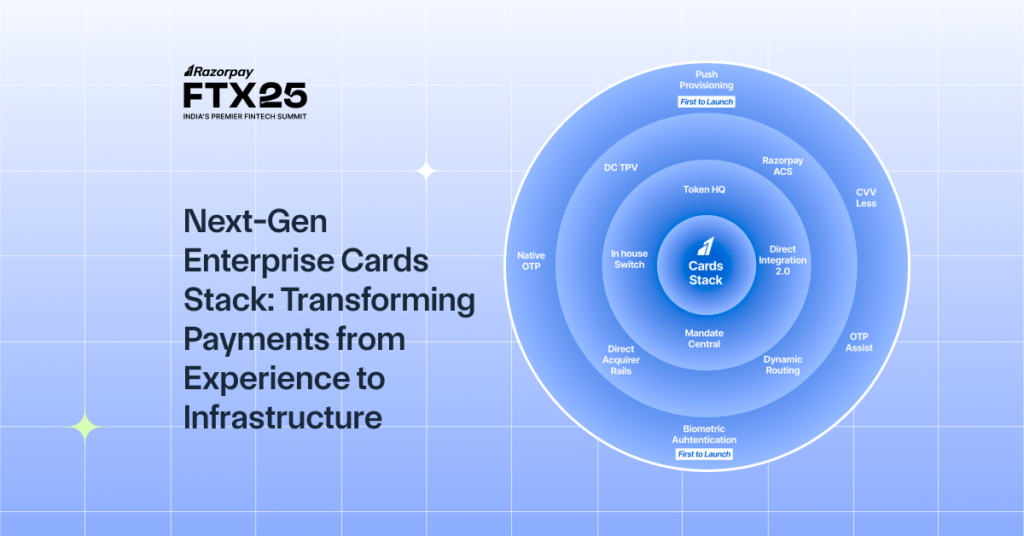

A smooth, error-free checkout process is crucial for maximizing conversions and fostering customer loyalty. Next-gen Razorpay Card Stack addresses common pain points, creating a truly delightful payment experience.

- Push Provisioning: Imagine effortlessly adding your card to multiple platforms with a single, secure process. Push provisioning empowers cardholders to tokenize their cards across various brands through their trusted bank platform, leading to increased conversion rates and higher spending on saved cards.

- CVV-Less Flow: Say goodbye to the frustration of remembering CVV numbers. Tokenization eliminates the need for CVV entry for saved cards, resulting in a significant conversion boost and providing a truly frictionless experience.

- Native OTP: Redirecting to bank OTP pages can be a major source of friction. Native OTP solutions seamlessly integrate the OTP experience within your app, improving success rates and eliminating drop-offs caused by redirection issues.

- OTP Assist: Automating the OTP reading and submission process further streamlines the checkout, reducing user effort and minimizing the risk of errors. This leads to a faster OTP experience and increased conversions.

- Biometric Authentication: The future of authentication is biometric. Solutions like India’s first Biometric Authentication with Mastercard offer OTP-less verification using facial recognition or fingerprint ID, providing a secure and convenient experience for customers.

Building the Infrastructure: Powering India’s Banking Ecosystem

Behind the scenes, a powerful infrastructure is essential to support these seamless payment experiences. Next-gen card stacks are built with scalability, security, and compliance in mind.

- Razorpay TokenHQ: Tokenization is the cornerstone of modern card payments. TokenHQ provides end-to-end control over token creation, ensuring a smooth transition to token-based payments and compliance with the latest RBI PA/PG guidelines. This single token can unlock various possibilities, from push tokenization to biometric authentication and dual tokenization.

- Razorpay ACS & Risk Engine: Authentication is crucial for security. Razorpay’s ACS Stack and Risk Engine disrupt traditional OTP authentication with a CX-first approach. This platform enhances security while minimizing friction, using risk-based flows like biometrics to optimize the authentication process. Features like “Activate Card on the Fly” and personalized EMI options further enhance the customer experience.

- Razorpay Direct Integration 2.0: Direct integration with issuers and networks is essential for speed and efficiency. Razorpay’s Direct Integration 2.0 stack supports network and issuer tokenization, enabling faster payment processing and improved success rates.

- Razorpay InHouse Cards Switch: A robust acquiring solution is crucial for scaling card payment infrastructure. The InHouse Cards Switch maximizes success rates and lowers operational costs through features like dynamic routing, which directs payments to the optimal bank or gateway in real-time.

Leading the Future of Payments

Next-generation enterprise card stacks are revolutionizing the payments landscape. By focusing on both the customer experience and the underlying infrastructure, these solutions empower businesses to scale, innovate, and delight their customers. From frictionless checkouts to robust security measures, the future of payments is being shaped by these cutting-edge technologies. Embrace these advancements and lead the future of payments.