PayNearby is India’s leading branchless banking and digital network. PayNearby operates on a B2B2C model,PayNearby, through its tech-led DaaS (Distribution as a Service) network is capable of servicing 93% of Bharat. Through an extensive network of neighbourhood stores and service providers, PayNearby empowers these businesses to embrace cashless solutions and keep pace with a rapidly evolving digital economy. For years, these small business owners relied on familiar cash transactions to serve their communities, but as customer preferences shifted—especially among younger consumers—so did the demand for quick, reliable digital payments.

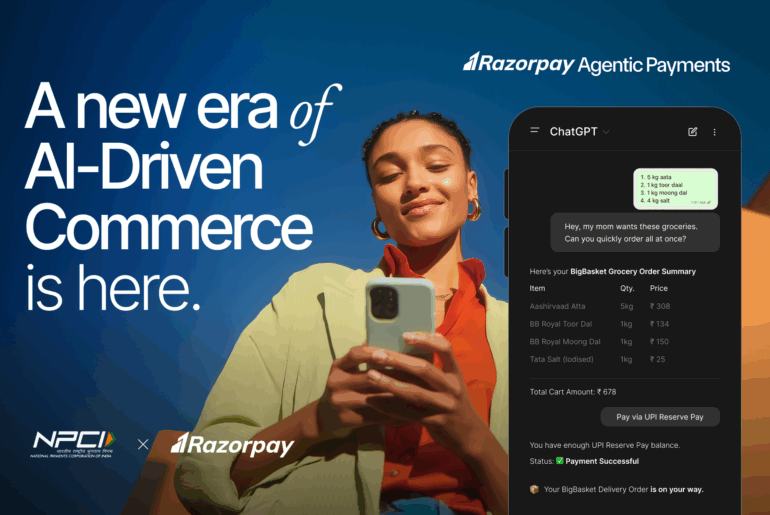

With cash flow crucial to their day-to-day operations, many merchants faced a significant challenge in adapting to this new payment landscape. To meet this need, PayNearby partnered with Razorpay, whose real-time settlements enable merchants to access their funds instantly, ensuring steady cash flow and a frictionless experience.

For PayNearby, the mission to make digital funds available in real-time was key to empowering small businesses—particularly the countless neighborhood retailers who form the backbone of India’s economy. However, integrating digital payment solutions in a landscape deeply rooted in cash transactions came with its own set of challenges.

Bridging the Real-Time Funding Gap

One of the largest hurdles PayNearby faced was ensuring that retailers had real-time access to their funds, especially since cash flow remained the lifeblood of their businesses. For these small retailers, cash flow meant more than just finance—it enabled them to restock inventory, pay suppliers, and keep their operations running smoothly. While some retailers were open to accepting debit and credit cards, most transactions still relied on cash. And cash, while familiar, had its limitations—particularly when they needed immediate access to funds.

In many cases, remote locations made these limitations even more challenging. Retailers in smaller towns and rural areas often relied heavily on public sector banks, where digital infrastructure was underdeveloped. There were instances when banks were closed, cash deposit machines were out of service, or manual processes delayed fund availability.

The challenges didn’t stop there. Refunds, too, posed a significant issue. For retailers used to immediate cash transactions, the delayed processing of digital refunds disrupted their ability to offer prompt customer service. Refunds often took days to clear, leaving retailers managing the operational impact of unresolved payments.

PayNearby’s Retailers Took the Digital Plunge—And Razorpay Made It Easy

After integrating with Razorpay, PayNearby’s retailers swiftly adapted to the ease and efficiency of digital transactions. With real-time settlement in place, these small businesses saw a world of difference in how they operated.

Refunds, which had previously been a major pain point, were now processed seamlessly with Razorpay’s Instant Refunds feature, giving retailers and their customers peace of mind and improving overall satisfaction.

Additionally, Razorpay’s comprehensive dashboard proved invaluable for the PayNearby team. With easy-to-navigate tools for reconciliation, report exports, and chargeback tracking, team members reported a smoother, more efficient operational experience with minimal complaints. This user-friendly interface allowed them to address issues swiftly, manage accounts with ease, and focus on strategic goals rather than day-to-day operational headaches.

Moving from cash to digital payments isn’t just about overcoming a tech barrier; it’s a cultural shift that requires the right support and tools. For PayNearby, partnering with Razorpay has been key in propelling this transformation.

The journey doesn’t stop here—there’s still more to explore, and with brands like PayNearby leading the way, the road ahead looks promising for small businesses adapting to a cashless world.