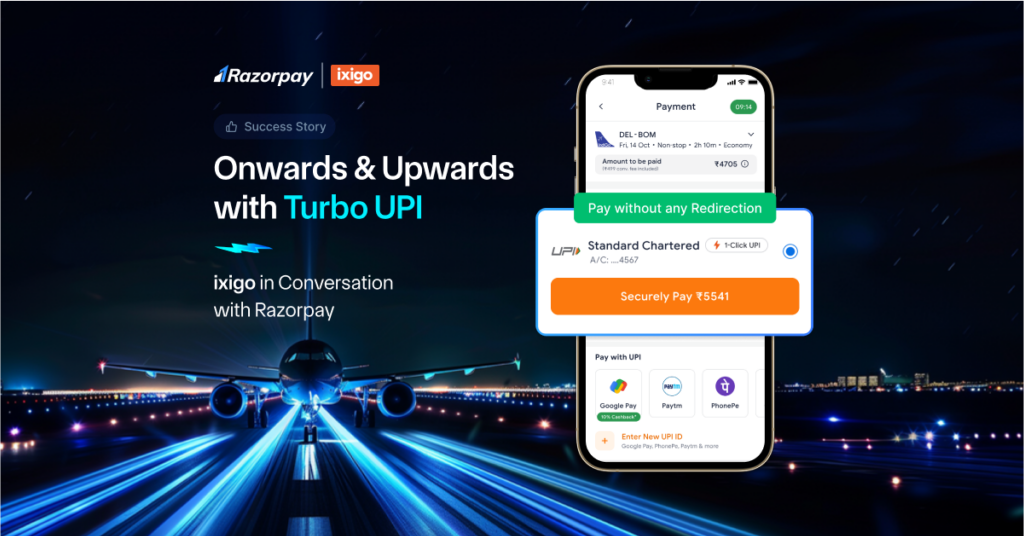

In the dynamic landscape of digital payments, innovation is the key driver propelling businesses to new heights. Razorpay, a leading payments solution provider, recently unveiled Turbo UPI, a cutting-edge in-app UPI payments product designed to elevate user experience and streamline transactions.

In an exclusive interview with ixigo, one of India’s leading travel platforms, we sit down with Ameya Sood, AVP – Product (Payments), to delve into the details of ixigo’s choice to adopt Turbo UPI which is called “1-Click UPI” on the ixigo apps. Join us as we unravel the journey of this transformative collaboration, exploring the impact of Turbo UPI on travel payments and the broader implications for the digital payments ecosystem.

Could you tell us about the brand & how critical UPI payments are to ixigo?

ixigo’s evolution has been nothing short of extraordinary, starting with flight bookings early on and subsequently expanding to include train bookings in 2017, we’re now positioned as the second-largest Online Travel Agency (OTA). Beyond ticket booking, our focus has always been on enhancing travel experiences.

What truly complements the significance of our operations is the indispensable role played by UPI. It has emerged as the primary payment method for a staggering 80% of our user base. The recent introduction of features like Credit Lines on UPI, UPI Mandates, and UPI Lite is poised to further solidify UPI’s dominance in our payment landscape.

At the core of our success is an unwavering commitment to continuous innovation, with a particular focus on enhancing the payment experience for our users. UPI, with its widespread adoption and transformative features, stands as a cornerstone in our journey towards providing seamless and enriched travel transactions.

What excites you about the Turbo UPI value proposition, and how do you see it shaping the payment experience for ixigo?

What intrigues us most about the value proposition of this product is its ability to revolutionize the conventional five-step UPI process into a seamless one-step, in-app payment experience, and hence our motivation to call it 1-Click UPI. Transactions that previously took 18-20 seconds can now be effortlessly completed in under 4 seconds, epitomizing simplicity.

Addressing customer drop-offs, a persistent challenge for us, also becomes more manageable with 1-Click UPI. The elimination of the need for users to switch between UPI apps provides us with enhanced visibility into the payment journey, helping us better understand and mitigate potential obstacles.

In the travel industry, where customers are trying to book tickets in a race to the finish line, these benefits can be an absolute game changer, and our goal is to delight our customers.

Which performance metrics are crucial for ixigo, and how does Turbo UPI align with them?

At ixigo, our primary focus in payment is centered around success rates, and this product seamlessly supports this objective. By expediting the checkout process and delivering a smooth user experience, it’s poised to not only increase successful transactions but also cut down the time to completion for payments making it super fast..

With a reduction in reliance on third-party apps and the facilitation of in-app payments, 1-Click UPI has the potential to significantly enhance the success rates and consequently, improve our conversion rate. This streamlined approach perfectly aligns with our broader business strategy, emphasizing efficiency gains and heightened customer satisfaction—crucial metrics for assessing the overall business impact.

How would you describe the experience of onboarding with the Razorpay team and integrating with Turbo UPI?

Razorpay has been our trusted payment partner for years, fostering a collaborative and mutually beneficial learning experience. For a customer-centric company like ours, this partnership holds immense value.

What distinguishes Razorpay is their promptness in addressing any issues our team encounters. Considering this is a 0 to 1 product, the team has been very proactive & worked in sync collaboratively. The team is also always open & receptive to feedback, which has been crucial. Their dedication to innovation and prioritizing customer satisfaction has made our integration journey exceptionally smooth.

How do you envision the role of Turbo UPI in shaping ixigo’s future payment journeys?

The meteoric rise of UPI payments has reshaped digital transactions in India. As we embrace this trend, it’s not just about keeping up, but aligning with our users preferences. At ixigo, user experience is something that is valued more than anything else and providing a faster payment experience is something that we strive to deliver as a payments team. We are dedicated to delivering seamless, secure and swift payment solutions which makes UPI a pivotal payment method for us.

When it comes to new innovations on UPI, we view them with great enthusiasm and a forward-looking perspective. UPI has already revolutionized digital payments not only in India but around the world, and its continuous evolution is something we closely monitor and actively embrace. We see new innovations in UPI as opportunities to enhance user experiences, simplify transactions, and improve the overall efficiency of our payment systems. These innovations align perfectly with ixigo’s commitment to staying at the forefront of technology to offer our users the best possible services.

Our adoption of 1-Click UPI resonates with our dedication to innovate and enhance user experience. Users can seamlessly link their bank accounts on the ixigo app and thereafter transact at a blazing fast pace and this will accelerate our journey towards elevated payment experience & heightened customer satisfaction which is directly proportional to higher conversions and Happy Travelers!

Moreover, beyond the enhanced in-app payment journey, we are eager to leverage new features soon to come on the 1-Click UPI experience such as Credit Lines on UPI, AutoPay & Mandates etc. These functionalities will serve to address various use cases, broadening the scope of user interactions on ixigo.

Would you recommend this product to other businesses?

While it’s early days, and we’re still waiting for the results to come in, we are most definitely optimistic about this product. For businesses who prioritize user experience, and have high repeat transactions on UPI, the 1-Click UPI experience definitely holds value. It is, after all, the future of P2M UPI payments.

ixigo is ready to take off with Razorpay Turbo UPI. Are you?