India loves UPI. In June this year, around 9.3 billion transactions were carried out through UPI in India. The future too looks extremely bullish – UPI is expected to account for 90 percent share of retail digital transactions volume in the next five years, up from 75.6 percent in FY23 according to a recent RBI bulletin.

With its meteoric rise and widespread adoption, UPI has become an indispensable tool for merchants across the country. It has not only revolutionised the way payments are made but also redefined the entire landscape of financial transactions.

Accepting payments via UPI should be as seamless as the transaction itself. Merchants understand that in the digital age, the checkout process must be swift, intuitive, and error-free. Customers should not be burdened with multiple clicks, payment failures, or the hassle of remembering complex Virtual Payment Addresses (VPAs).

Paving the Way for Seamless UPI Payments with Razorpay

Razorpay understands that UPI is a rapidly evolving payment ecosystem. Our recent UPI enhancements are designed to cover all possible devices and UPI payment combinations, ensuring that end customers can transact via UPI with ease, regardless of their preferred device or payment method.

More importantly, our solutions require zero to minimal integration efforts for merchants, depending on their current payment gateway integration with Razorpay. This means that businesses can quickly adopt these enhancements without the need for extensive development work, allowing them to start benefiting from the superior UPI payment experience right away.

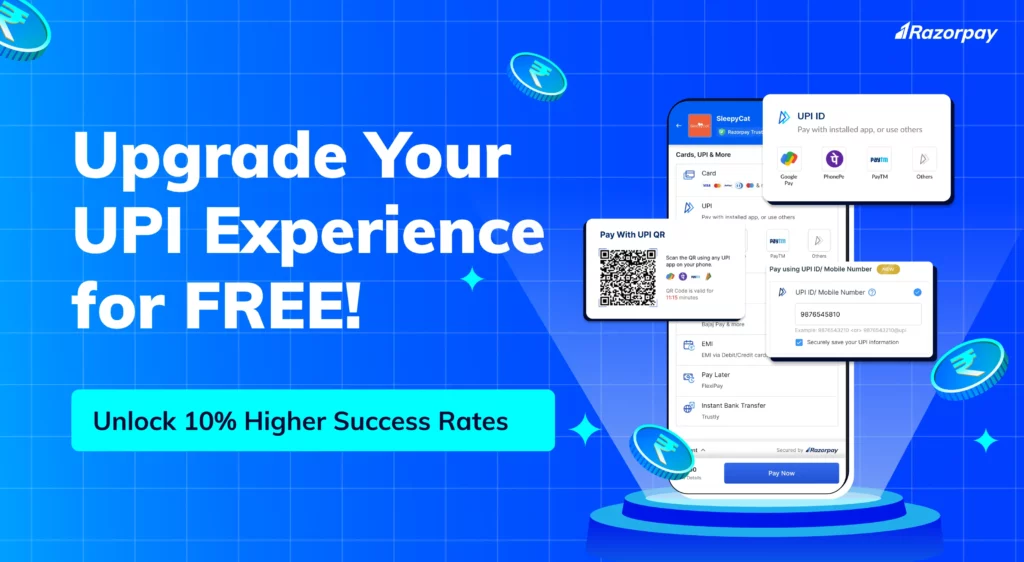

To cater to this demand for a seamless UPI payment experience, Razorpay has introduced a slew of innovative features that promise to elevate the payment journey for both merchants and customers, across all environments – mobile as well as desktop.

UPI Intent on mWeb: This innovation promises to revolutionise the payment landscape by boosting conversion rates by 10%. Customers will enjoy a smoother experience with fewer clicks, reduced chances of payment failures, and lightning-fast payment processing.

QR Codes on dWeb : Another exciting addition, this feature not only enhances the merchant’s conversion rate by 10% but also grants end-users a more intuitive experience. With fewer clicks, reduced payment failure risks, and the ability to execute intentful transactions, both merchants and customers stand to gain.

UPI Number for mWeb & dWeb : Simplifying the payment process, this feature contributes to a 5% increase in conversion rates. Customers will benefit from a smoother experience with fewer clicks and a reduced chance of payment failure. Say goodbye to the hassle of remembering VPAs, as Razorpay’s innovation streamlines payments for a faster and more convenient experience.

These new product features for Razorpay UPI empower both businesses and their customers alike. Businesses are able to generate a substantial hike in conversion rate while customers have a lot more intuitive and hassle-free experience making payments via UPI.

For businesses using Razorpay standard checkout, the above innovations have been made available by default. For businesses using any custom checkout, there is a one time, minimal integration effort required

How Can Razorpay UPI’s Latest Features Help Your Business?

There are substantial advantages for businesses. Razorpay UPI’s latest enhancements will enable you to:

Increase Conversion and Success Rates: One of the most striking advantages of Razorpay’s UPI enhancements is the significant boost in conversion and success rates for businesses. In the fiercely competitive online marketplace, every successful transaction matters. With a 10% increase in success rates, merchants can witness a substantial growth in revenue as more transactions are completed successfully.

Provide Intuitive UPI Payment Experience: In today’s digital era, where 40-50% of online purchases are made via UPI, providing a superior payment experience is paramount for merchants. Razorpay’s innovations ensure that customers enjoy a seamless, hassle-free payment journey, reducing the chances of payment failures and speeding up the payment process. This not only fosters trust but also encourages customers to return for future transactions, ultimately boosting customer retention.

How Can Razorpay UPI’s Latest Features Simplify Payments for Customers?

The benefits of Razorpay UPI’s latest features also translates to happier customers as they can now:

Pay Without VPAs: With the introduction of UPI Number and QR Codes on dWeb, end customers are relieved of the burden of remembering complex Virtual Payment Addresses (VPAs). This simplification of the payment process adds convenience and eliminates the risk of errors due to incorrect VPAs.

Be Free from Push Notification Triggers: Say goodbye to the hassles of relying on push notifications for your UPI payments. Razorpay’s latest UPI innovations liberate you from the need to constantly monitor your device for these notifications. Our streamlined payment process ensures a hassle-free experience, eliminating the necessity for you to click on payment approval requests and allows you to complete your transactions swiftly and effortlessly.

And, we are just getting started…

Razorpay’s commitment to staying at the forefront of the UPI game shines through its recent innovations. As UPI continues to evolve, we remain the leading innovator, dedicated to simplifying and enhancing the payment experience for both businesses and end customers.

India’s love affair with UPI is undeniable, with billions of transactions taking place monthly, and the future looks even brighter. With UPI projected to account for 90% of retail digital transactions, Razorpay’s UPI enhancements couldn’t have come at a better time.

To embrace this transformative UPI experience, reach out to our support team at support@razorpay.com or to your dedicated Razorpay account manager.

Join us in shaping the future of payments, where every transaction is smooth, successful, and hassle-free. Together, we’re making the UPI journey one that both businesses and customers will cherish.