The start of a business is often envisioned as a series of grand “lightbulb” moments, the kind of scenes that belong in a cinematic montage. Yet, any merchant or small business owner will confess to a different reality. For them, the daily experience is a relentless rhythm of spreadsheets, confusing tax codes, and the sheer mental exhaustion of wrestling to keep finances straight.

For many bright minds, the initial spark of a vision gets muffled, not because the core idea falters, but because of a mountain of messy paperwork and financial grunt work. Whether a founder is just starting or a seasoned entrepreneur is striving to reach the next level, the same crucial question surfaces: Is there a genuine way to manage the money without it consuming one’s life and becoming a tedious, all-consuming burden?

Table of Contents

The Invisible Barrier of Business Arithmetic

In the fledgling stages of a business, every single rupee often feels like a critical pivot point, doesn’t it? The entrepreneur is constantly juggling countless responsibilities, and then, suddenly, essential financial tasks like accurately calculating the right Equated Monthly Installment (EMI) for a business loan, truly internalizing the long-term ripple effect of compound interest, or even figuring out precise profit margins can consume an inordinate amount of time, a truly relentless mathematical hurdle.

The difficult truth is that errors in these fundamental calculations are far from minor inconveniences; they tend to spiral into things like mispriced products, unsustainable debt, or even create awkward, professional friction with valued clients. This state of affairs is precisely why the timely emergence of specialized digital tools has utterly revolutionized the playing field for the modern business owner. Many have quietly found a silent, yet supremely reliable, partner in Razorpay, a payment gateway platform that has meticulously built an incredibly helpful ecosystem of free, accessible tools expressly designed to strip away the inherent complexity of this necessary business math.

Starting with a Name, Growing with a Strategy

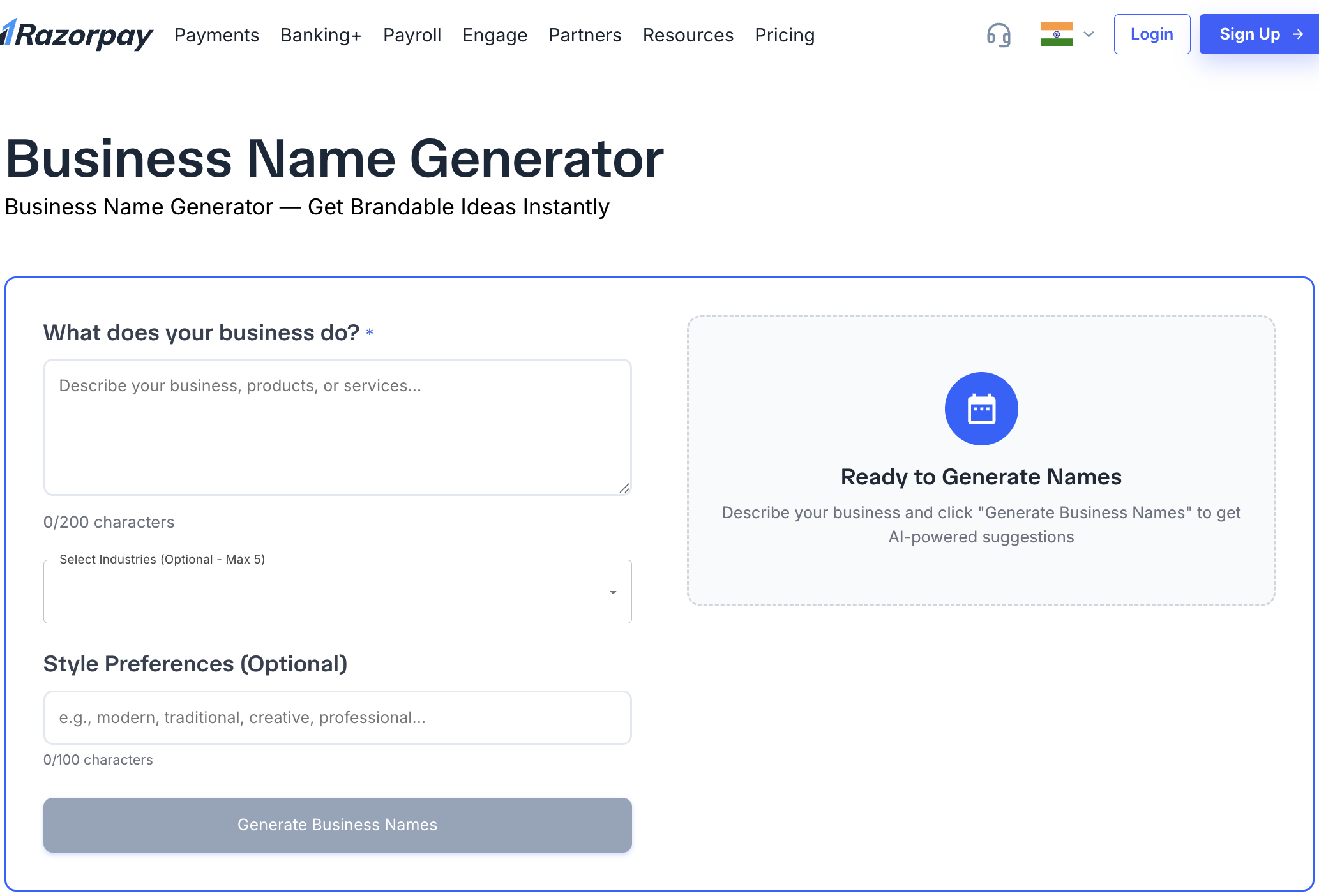

Every amazing business starts with a name, right? But seriously, how many founders get totally stuck trying to come up with one? Weeks can go by! That’s why tools like Razorpay’s Business Name Generator are so handy. They help you skip the “idea” phase and jump

Okay, so you have a name. What’s next? Money stuff, of course! This is where things can feel a little heavy for business owners. To make that part easier, we now have tons of smart calculators. They’re super important for making good decisions in today’s business world.

Okay, so you have a name. What’s next? Money stuff, of course! This is where things can feel a little heavy for business owners. To make that part easier, we now have tons of smart calculators. They’re super important for making good decisions in today’s business world.

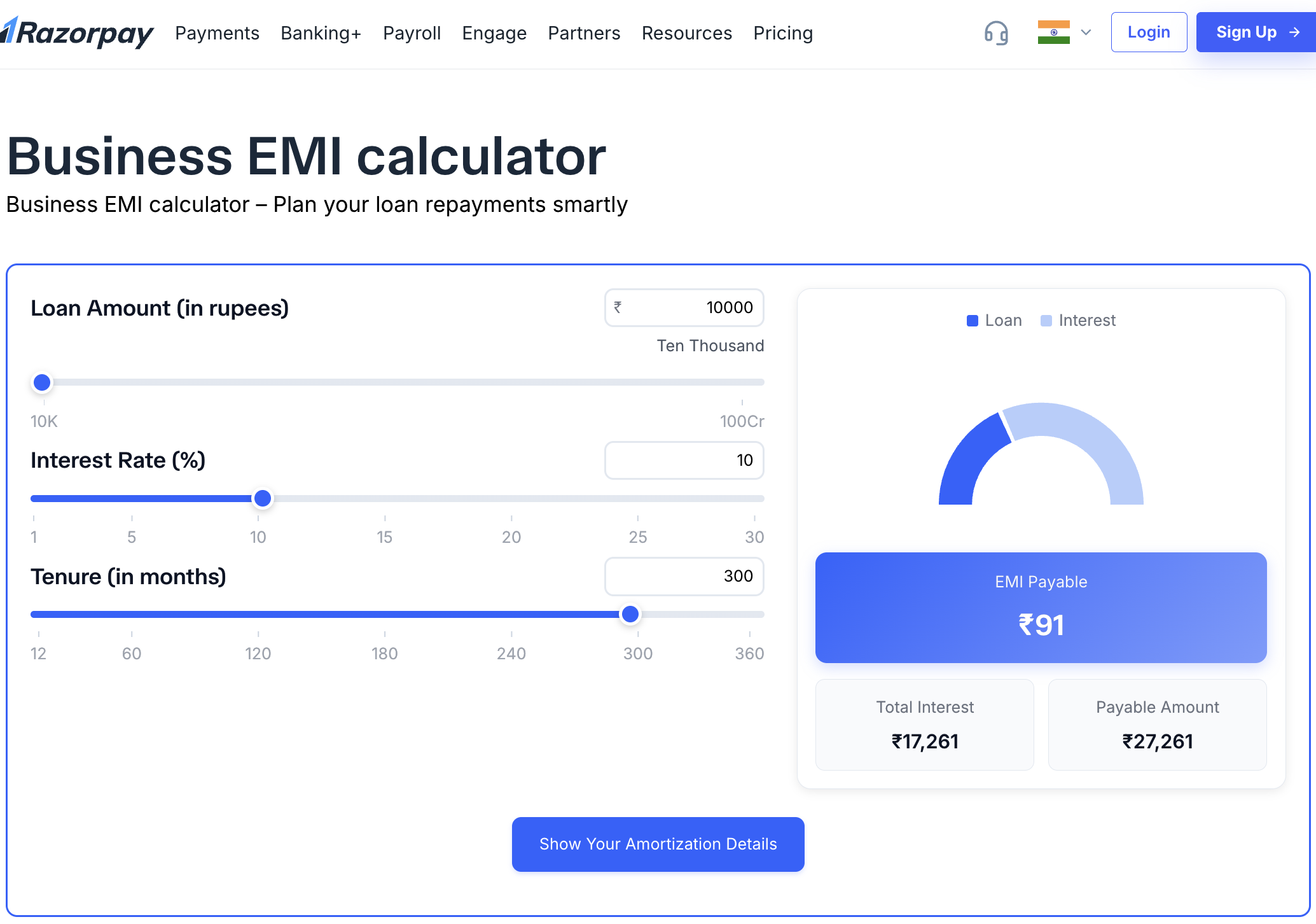

- Got Debt on Your Mind? Before you take out a loan, you need to know exactly what you’re signing up for. Tools like the Business EMI Calculator and the regular EMI Calculator are lifesavers. They let you see your monthly repayment schedule ahead of time, so there are no nasty surprises.

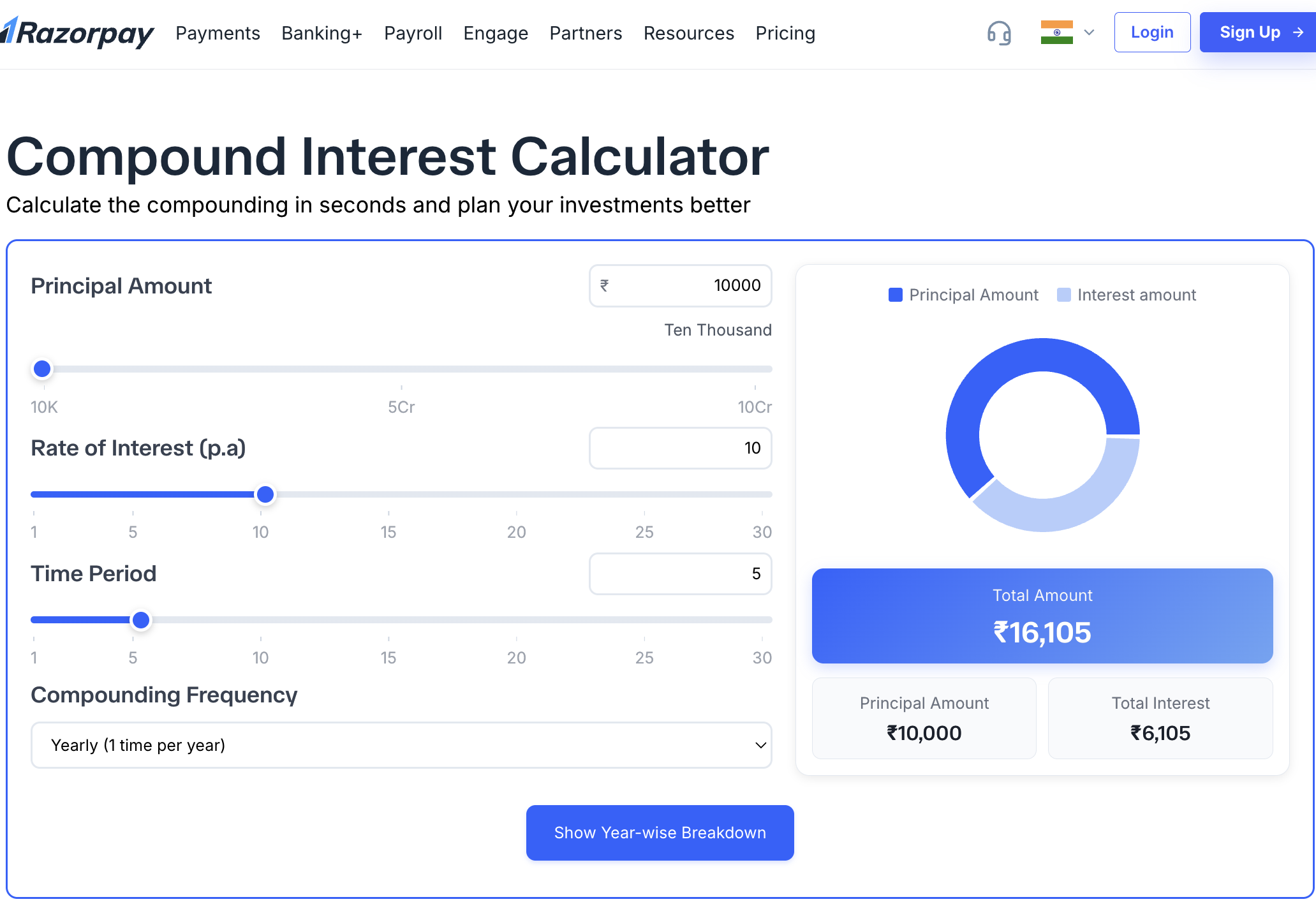

- Want to See Your Money Grow? Stop guessing about your growth! The Compound Interest Calculator and the Interest Rate Calculator show you exactly how your capital increases, or how costs pile up, over time. It’s like switching from blurry “guesstimates” to a crystal-clear, data-backed strategy.

The Professionalism of the “Paper Trail”

The Professionalism of the “Paper Trail”

As a business begins to breathe, it must interact with the world. For a merchant, the way they present a price or a bill is a direct reflection of their brand’s integrity. Manual Word documents and messy Excel sheets are being replaced by streamlined, professional generators.

When a potential client asks for a price, the Quotation Maker ensures the first impression is polished. Once the deal is closed, the Invoice Generator and Receipt Generator automate the “boring” parts of the sale, ensuring that GST and other variables are handled accurately. This level of professionalism was once reserved for large corporations with dedicated accounting departments; today, it’s available to a freelancer working from a coffee shop.

Protecting the Bottom Line

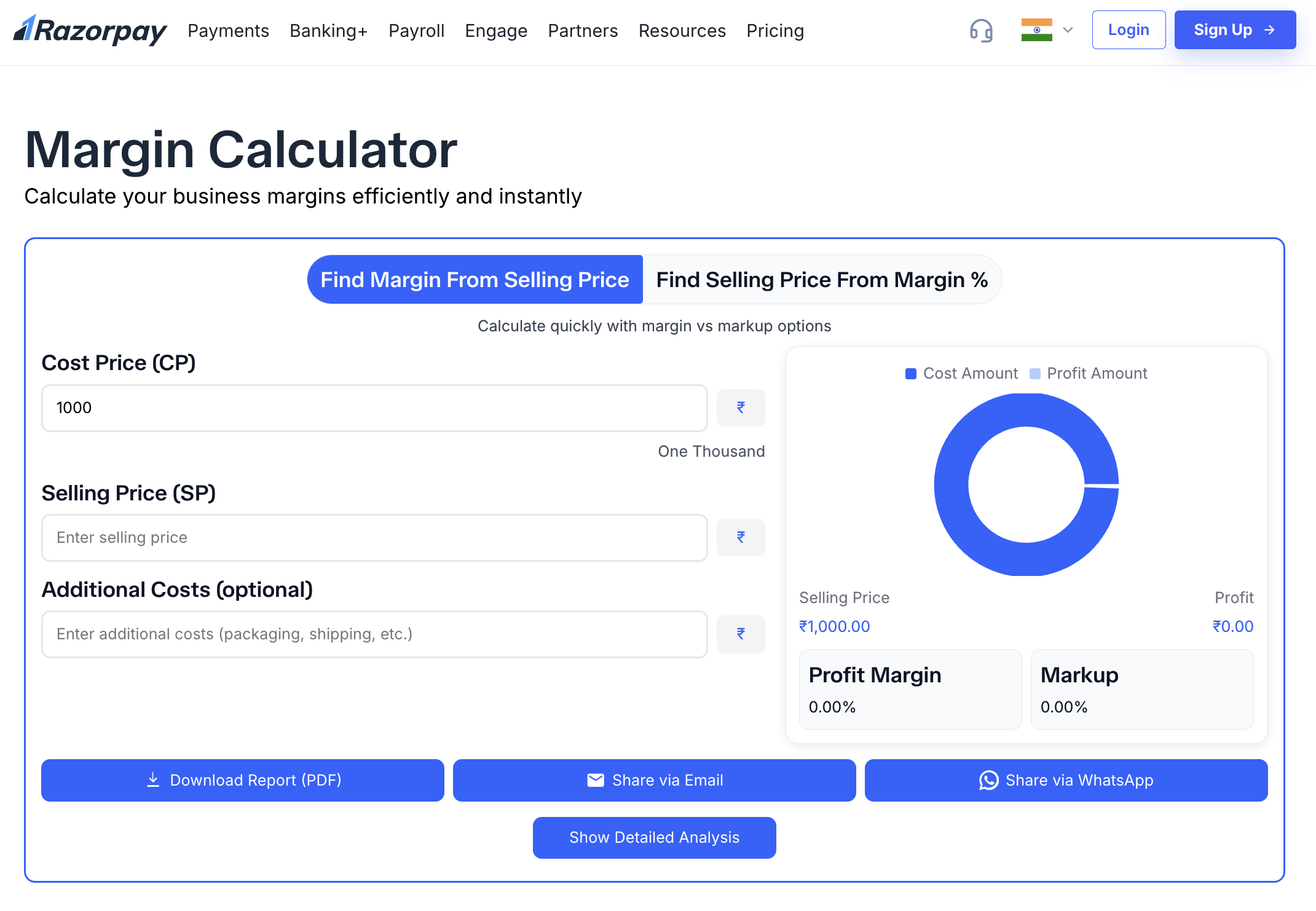

Perhaps the most important number for any business person is the margin. It’s that tiny line that separates a fun hobby from a real, lasting business. By using a Business Margin Calculator, you can make sure you’re not just “selling things,” but you’re actually making money (profit!).

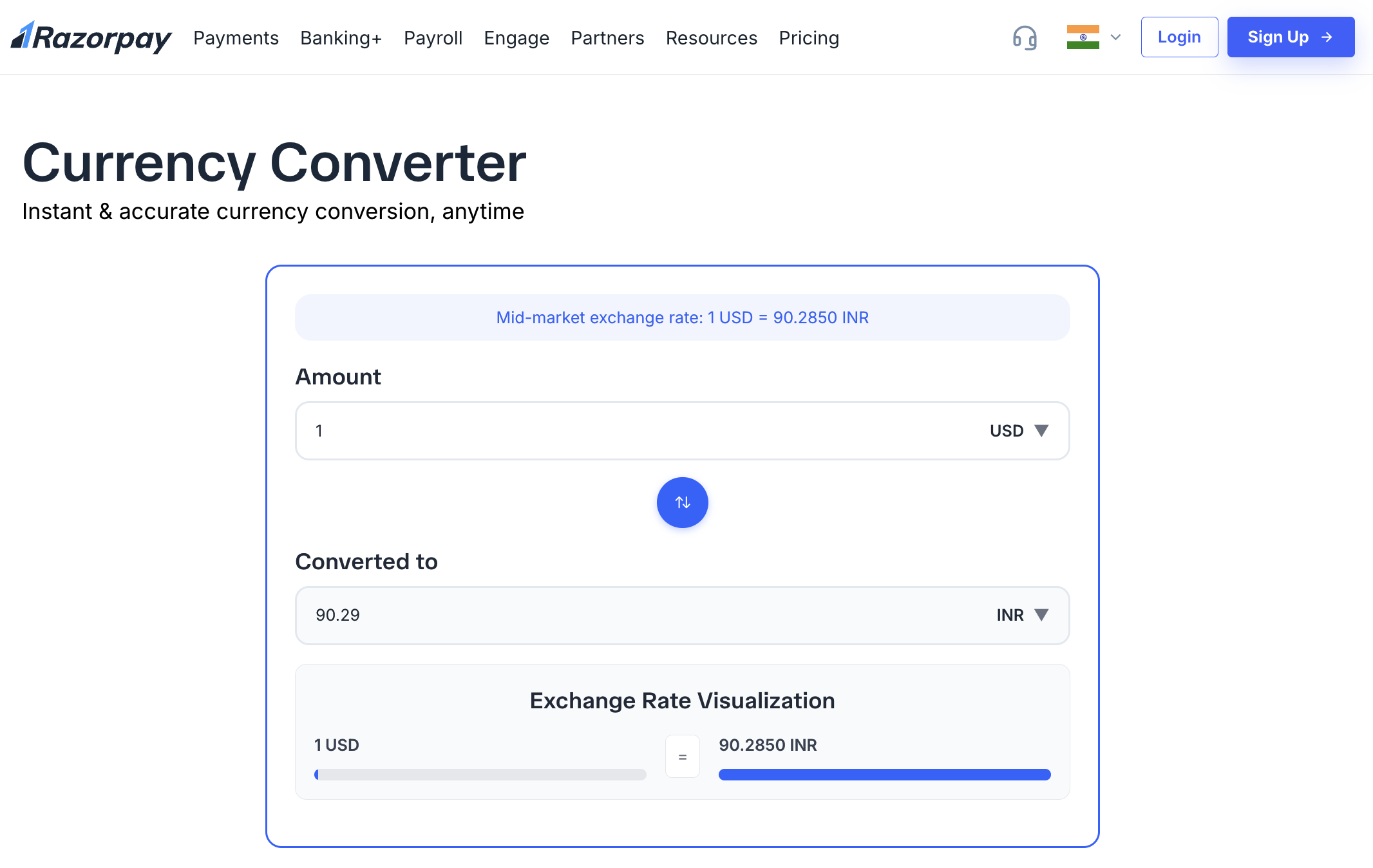

And for those who sell things to people in other countries, the Currency Converter is a must-have tool. Since the world is so connected now, knowing exactly how much a payment from a foreign country is worth right now is not just a nice-to-have; it’s necessary to keep your business going.

And for those who sell things to people in other countries, the Currency Converter is a must-have tool. Since the world is so connected now, knowing exactly how much a payment from a foreign country is worth right now is not just a nice-to-have; it’s necessary to keep your business going.

Ready to optimise how your business accepts payments?

One Razorpay setup for secure checkout and fast settlements-cards, UPI, wallets, plus smart routing, reconciliation, and a single dashboard.

Education Through Utility

Okay, let’s be real for a second. That dizzying feeling you get when you look at a spreadsheet full of numbers? Every entrepreneur has been there. Finance, for many, is the “scary” part of building a business, a dense, intimidating language spoken only by accountants.

But what if I told you that Razorpay has essentially created a universal translator for business finance?

That’s the genius of their new suite of tools. They aren’t just free (which, let’s be honest, is amazing for a growing business). They’re educational. They don’t just do the math; they empower entrepreneurs and merchants to understand it. They take a concept that used to require a degree and turn it into an interactive lesson. It’s like they’re saying, “Hey, we know you’re a hustler, but you deserve harmony, too.”

The journey from being a struggling merchant trying to keep the lights on to a confident CEO charting their future often boils down to this: having the right tools in your corner. By centralizing these resources, Razorpay has effectively ripped down the velvet ropes around serious entrepreneurship. They’ve made it human, accessible, and frankly, less terrifying.

The clear message here? You don’t need to be a math genius to build a legacy. You just need to know where to find the answers, and right now, those answers are waiting for you at Razorpay. It’s a game-changer, and honestly, a huge high-five to them for making finance finally feel friendly.