Landing a high-paying client in the US or Europe is a big win. But the excitement fades when the payment hits your bank account because a chunk of it is already deducted as tax abroad. Then comes the real worry: the Indian Income Tax Department may ask you to pay tax on that same income again.

This is exactly where the Foreign Tax Credit (FTC) comes into play. It allows you to claim credit for the tax already paid overseas, so you don’t get taxed twice. However, this isn’t automatic. To claim this benefit, you must file Form 67. This form is the official way to prevent double taxation and stay compliant with Indian regulations.

Key Takeaways

- If you earn from foreign clients, you must file Form 67 before your ITR to claim the Foreign Tax Credit no exceptions.

- Keep all supporting documents ready: invoices, tax withholding proof, and bank/FIRC records of foreign payments.

- Missing or late Form 67 will lead to FTC rejection and possible tax demand with interest.

- One Form 67 is enough for multiple countries just report each one separately within the form.

- Using a compliant payment gateway like Razorpay can simplify documentation and FIRCs, making FTC filing easier.

What is Foreign Tax Credit, and Why is Form 67 Crucial?

Understanding Foreign Tax Credit

Think of it like paying for a movie ticket. If you’ve already bought the ticket at the counter, you shouldn’t have to pay again when entering the theatre. The same principle applies to taxes on foreign income you shouldn’t pay tax twice for the same earnings.

That’s exactly what the FTC protects you from. If tax has already been deducted in the US, UK, or any other country, it allows you to claim credit for that amount while filing taxes in India.

The Role of Form 67

Form 67 plays a crucial role in the FTC in India. If you’ve paid taxes in a foreign country and want to claim credit against your Indian tax liability, filing this form is mandatory.

As per compliance norms, a resident taxpayer must submit Form 67 before the due date of filing the ITR, and it has to be filed electronically through the Income Tax Department’s e-filing portal. Only after filing Form 67 can you proceed to claim FTC in your ITR.

Are You Eligible to Claim Foreign Tax Credit?

To claim FTC, you must be a Resident of India for the financial year. This is the primary conditionif you are treated as a Non-Resident Indian (NRI) or Resident but Not Ordinarily Resident (RNOR), you cannot claim Foreign Tax Credit.

You can claim the FTC if you have paid tax abroad on income earned from foreign sources, such as:

- Payments received from international clients for freelancing or project-based work.

- Sales made on global platforms like Amazon, Etsy, or Shopify.

- Export of SaaS products, IT services, or digital subscriptions.

- Professional or contractual work performed for overseas businesses.

Step-By-Step Process to File Form 67 and Claim Foreign Tax Credit

Filing Form 67 is not complicated but it needs to be done correctly and in the right order. You cannot claim the FTC in your ITR unless this form is submitted first. To make the process easier, start by keeping all documents ready and then follow the step-by-step online filing process on the Income Tax Department’s official portal.

Document checklist

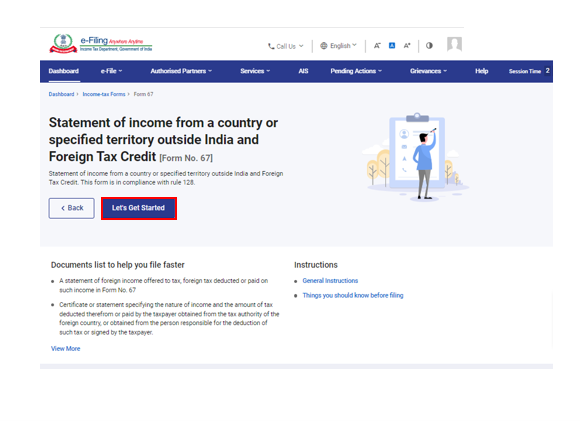

Keep the following documents ready before you start filing Form 67:

- A statement showing foreign income earned and tax paid or deducted on it.

- Proof of tax payment abroad, such as the tax return acknowledgement from the foreign country.

- A certificate or statement confirming the nature of income and tax deducted, issued by the foreign tax authority or the payer.

- Proof of receipt of funds, such as the Foreign Inward Remittance Certificate (FIRC) or similar document validating foreign currency received.

The Online Filing Process

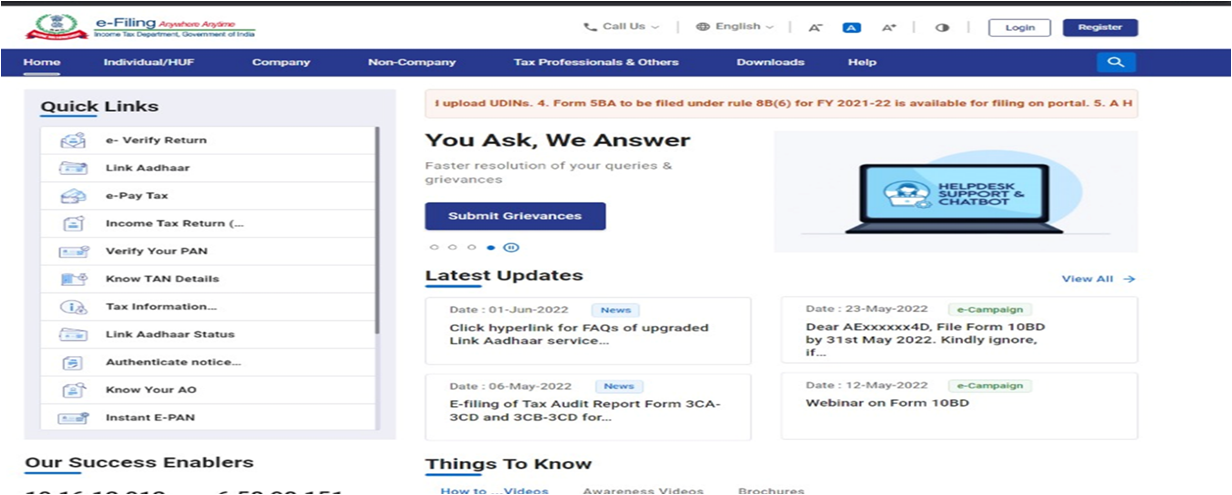

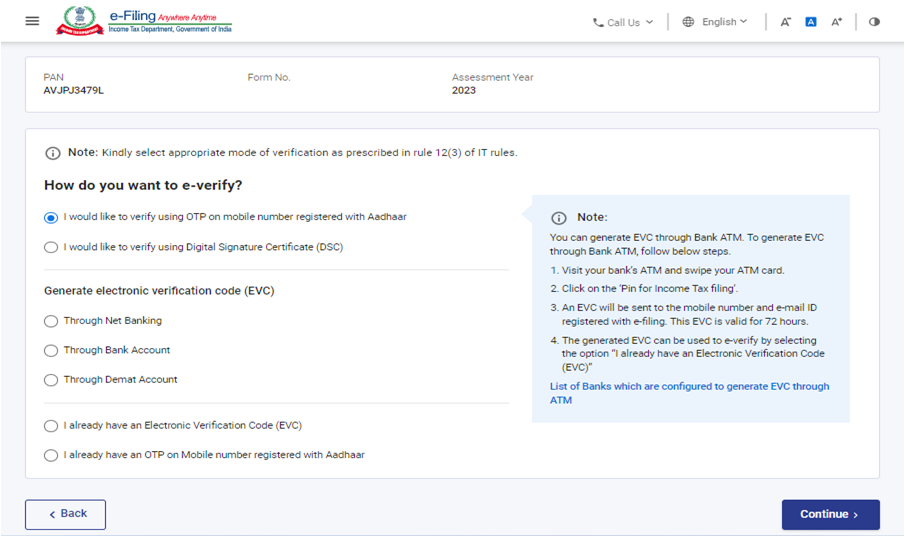

1, Log in to the Portal: Visit the Income Tax e-filing portal and log in using your valid credentials.

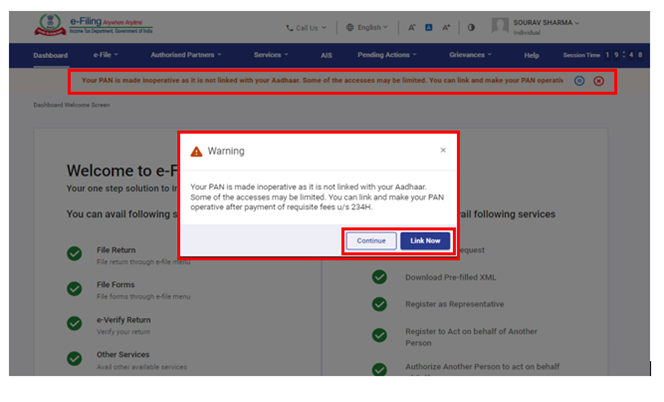

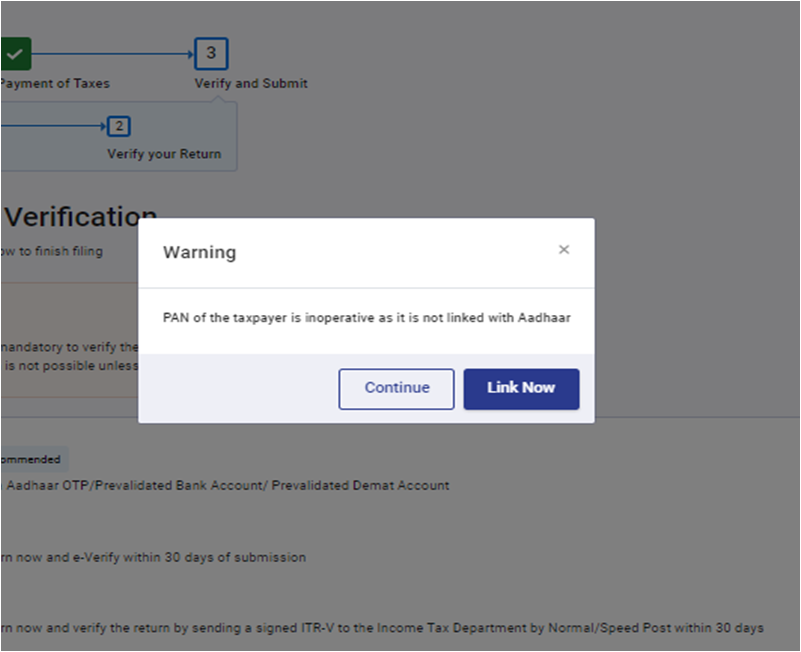

If your PAN is not linked with Aadhaar, a pop-up will appear showing that your PAN is inoperative. Click Link Now to complete the process, or click Continue to proceed.

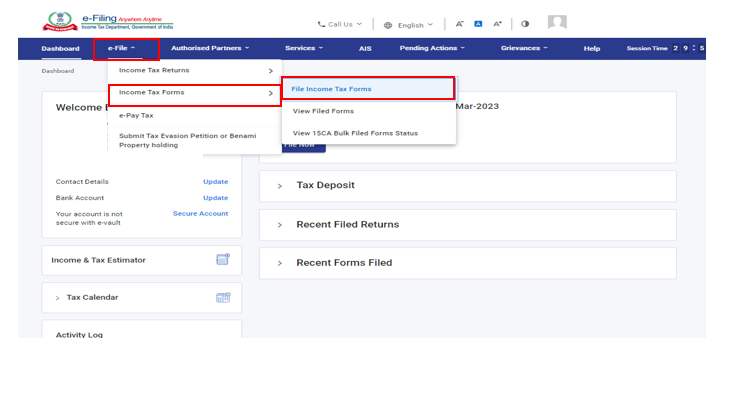

2, Go to Form 67: From the dashboard, navigate to e-File → Income Tax Forms → File Income Tax Forms and select Form 67.

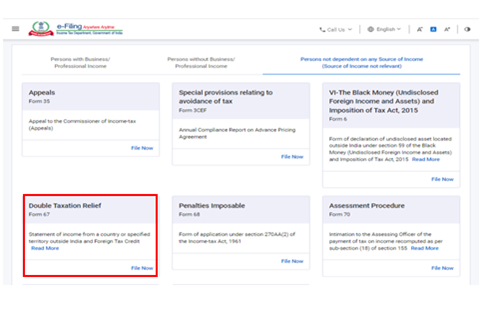

3, Select Form 67: On the forms page, select Form 67, or simply type “Form 67” in the search box to find it quickly.

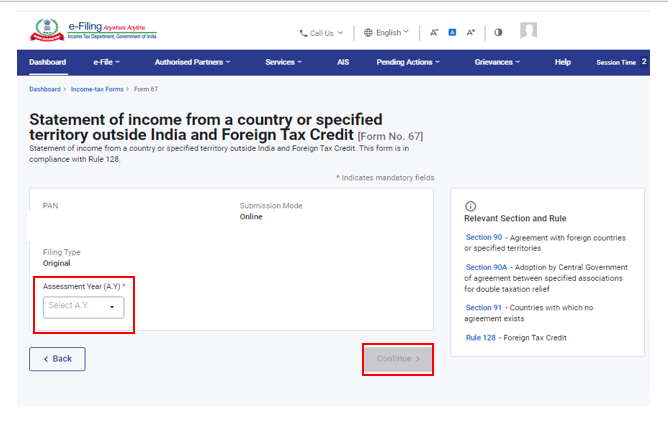

4, Select the Assessment Year (AY): Choose the relevant Assessment Year for which you want to claim FTC and click Continue.

5, Click “Let’s Get Started”: On the instruction page, click to begin filling the form.

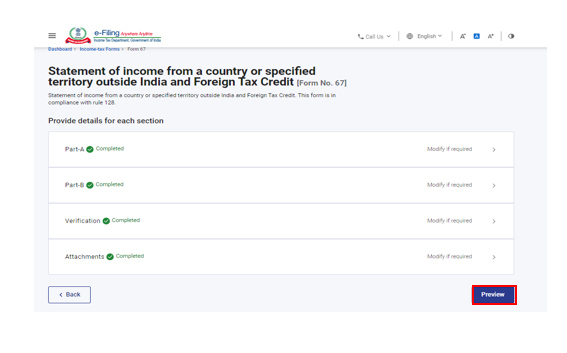

6, Fill the Form: Form 67 will now open. Enter all required details and click Preview.

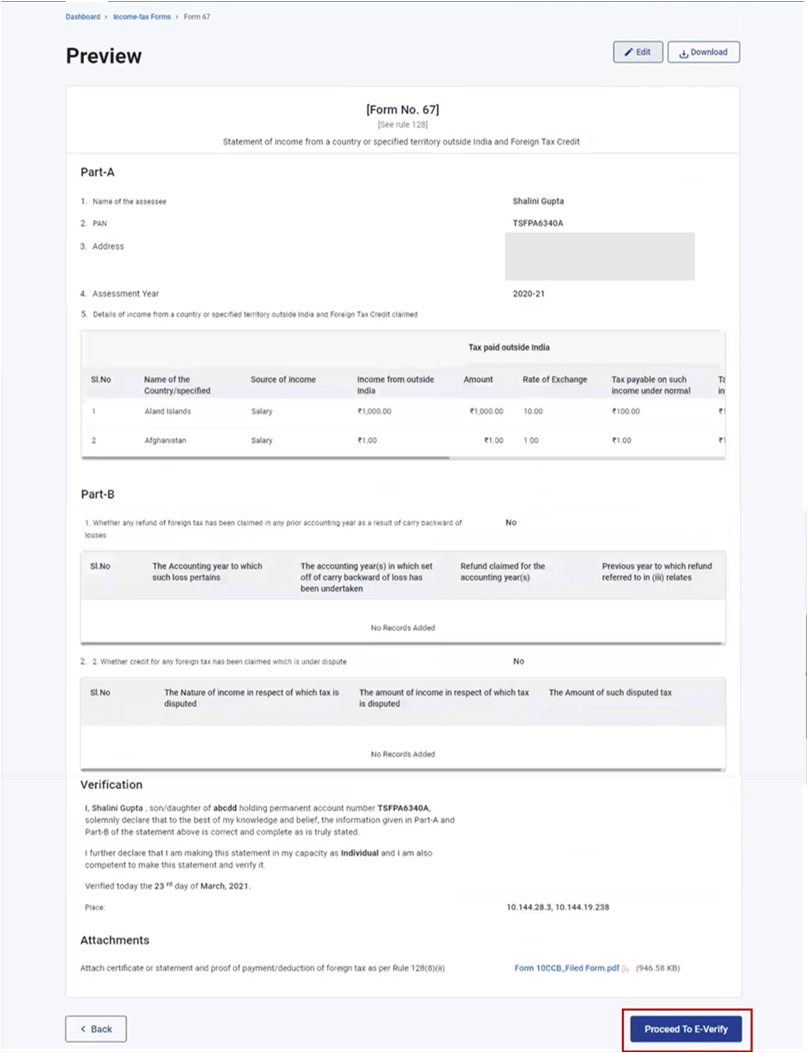

7, Review Your Details: Verify the details carefully on the Preview page and click Proceed to e-Verify.

8, Confirm e-Verification: Click Yes to continue with the e-Verification process.

9, e-Verify and Submit: You will be redirected to the e-Verify page.

If PAN is still inoperative, a warning will appear again. You can link it via Link Now or click Continue.

Once e-Verification is successful, you will receive a Transaction ID and Acknowledgement Number. Save them for your records. A confirmation will also be sent to your registered email ID.

Pro Tip: Store your FIRCs, invoices, and foreign tax proofs in one dedicated folder this makes ITR filing faster and hassle-free during audits.

Explore Razorpay’s Global Payment Solutions

Deadlines, Penalties, and Common Mistakes to Avoid

When it comes to claiming Foreign Tax Credit, most businesses lose money simply because they miss timelines or submit incomplete documents. The Income Tax Department treats Form 67 as a non-negotiable compliance step, and any delay or error can result in full disallowance of the FTC claim even if taxes were genuinely paid abroad.

The good news? You can avoid all complications by following a few simple rules.

The Golden Rule: Filing Deadline

Form 67 must be filed before the due date of your Income Tax Return (ITR). If you file Form 67 after submitting your ITR, your Foreign Tax Credit claim will not be accepted, even if all other details are correct.

Think of it like boarding a flight once the gate closes, your ticket doesn’t matter anymore.

Key reminder:

- File Form 67 first, then submit your ITR.

- Late submission = automatic rejection of FTC claim.

- It applies to both individuals and businesses earning overseas.

Pro Tip: Set a calendar reminder a week before the ITR deadline. It’s the simplest way to protect lakhs in the eligible tax credit.

Common Pitfalls to Sidestep

- Many filings get rejected because taxpayers do not provide proper proof of foreign tax paid, such as a tax invoice, withholding statement, or Form 1042-S in the case of US clients.

- Income must always be converted into INR using the RBI-prescribed exchange rate; failing to do so may lead to discrepancies and rejection of the FTC claim.

- Uploading incomplete or mismatched documents often triggers scrutiny or delays during processing.

- Declaring income under the wrong ITR schedule is a common mistake that can affect your eligibility for FTC.

- Inconsistencies between figures reported in Form 67 and the ITR can result in rejection of the claim.

- Some taxpayers forget to mention the country and tax identification number (TIN) of the foreign payer, which is mandatory for reporting foreign income.

- Form 67 is not optional even if the foreign tax amount is small, it must be filed to claim FTC.

Understanding the Struggles of International Tax Filing

Claiming Foreign Tax Credit sounds like a relief and it is. But the real challenge lies in the paperwork that comes before it. Most freelancers, SaaS founders, and online exporters don’t struggle with earning from abroad; they struggle with documenting each international payment correctly.

To successfully claim FTC, every foreign payment must be backed by proof. That means:

- Foreign Inward Remittance Certificates

- Invoices and tax withholding documents from the client

- Bank statements showing foreign payment credit

This becomes difficult when payments come from multiple countries, platforms, or marketplaces. Many end up chasing banks for FIRCs or trying to match invoices with credits during the last week of filing. Errors, mismatched figures, or missing documents can delay or cancel your FTC claim even if the money was genuinely earned.

How Razorpay Simplifies International Payments

As already discussed, receiving money from global clients is not the issue tracking every transaction, getting FIRCs on time, and ensuring compliance for Form 67 is the real challenge. This is exactly where Razorpay helps streamline the process. Here are the key features it offers:

- Built for Global Business: Razorpay enables Indian freelancers, SaaS startups, and exporters to accept payments from 180+ countries and in 130+ currencies, using a single platform.

- Instant Digital FIRC for Form 67 Compliance: One of the biggest hurdles in claiming FTC is collecting FIRCs for every international payment. Razorpay solves this with automated FIRCs available within a single click, compared to manual bank processes that often take weeks.

- Single Dashboard for Documentation: All payments, currencies, and FIRCs are tracked in one dashboard making it easier to match invoices, maintain records, and stay audit-ready when filing Form 67.

Simplify International Payments and Compliance

Track global payments, generate instant FIRCs, and manage documentation seamlessly with a compliance-ready international payment solution.

FAQs

1. Is it mandatory to attach proof of foreign tax paid with Form 67?

Yes. You must attach valid proof of foreign tax payment such as tax deduction certificates when filing Form 67, as it serves as evidence to claim Foreign Tax Credit in India.

2. What happens if I forget to file Form 67 but claim FTC in my ITR?

If Form 67 is not filed, your FTC claim may be rejected during processing. The Income Tax Department may disallow the credit, which could increase your tax liability in India.

3. Do I need a separate Form 67 for income from different countries?

No, you don’t need separate forms. Form 67 allows you to report income from multiple countries in one filing, as long as each country’s details are provided separately within the form.

4. What documents are needed to support my Form 67 claim?

You need documents that prove both the income earned abroad and the tax paid on it. This usually includes the invoice, tax deduction or withholding proof from the client and bank statement or FIRC showing the funds received.

5. Can freelancers claim Foreign Tax Credit if they receive payments via online gateways?

Yes. Freelancers can claim Foreign Tax Credit even when payments come through online gateways, as long as they have proper documents like invoices, FIRC/bank proof of payment received, and tax withholding details to support the Form 67 claim.