Using data-backed approaches helps us take an informed call while offering our Capital products to our customers.

Put a stop to delayed payments with Razorpay Instant Settlements. Get your customer payments settled within an hour, any time of the day.

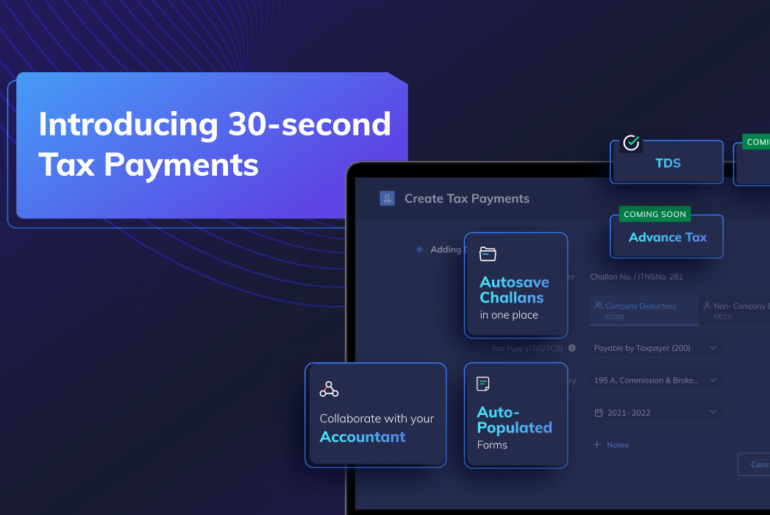

Struggling to make TDS payments for your business? Read on to know how you can pay TDS in just 30 seconds with RazorpayX.

Find out how neobanks came into existence, what they hold in the future, and get other valuable insights from leading fintech experts.

Banking as we know it has come a long way. On International Day of Banks 2020, we explore why neobanks will be the future of banking post COVID-19.

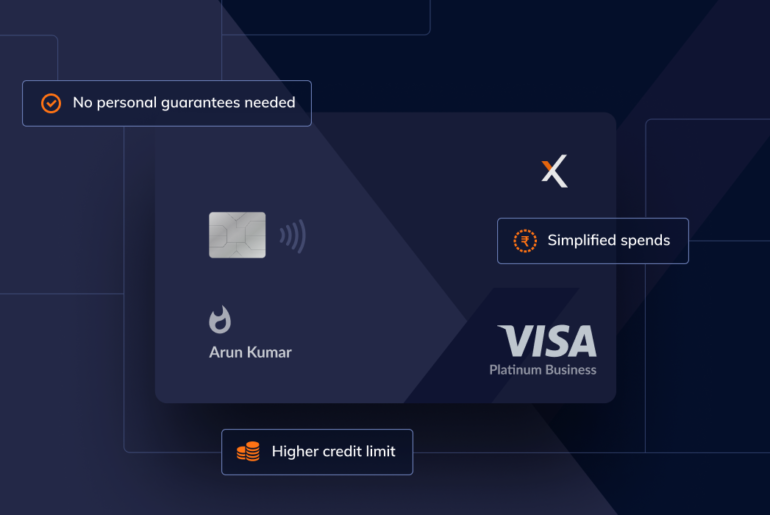

RazorpayX Corporate Card is not just smarter than an average card but also carries the logo of your business in all its glory. Learn more.

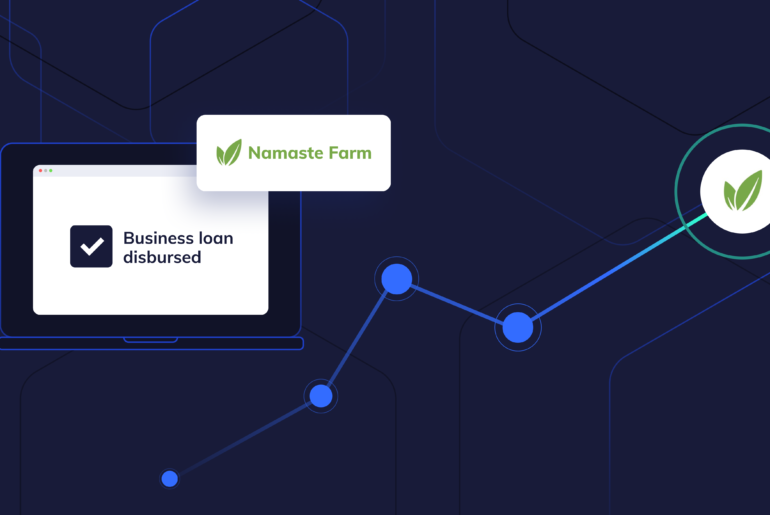

Razorpay’s Working Capital Loans helped Namaste Farm onboard small-scale vendors and grow their supply chain to provide fresh produce to customers.

Read how Razorpay Capital solved cash flow challenges for Decor Wise this festive season through instant settlements and quick business loans.

RazorpayX empowers thousands of businesses by simplifying business banking. Read how Vedika streamlined her money movement during the festive season.

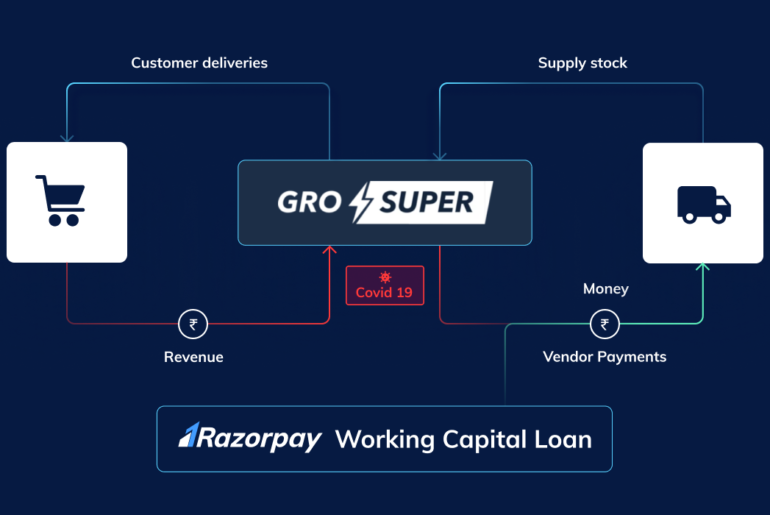

GroSuper was able to grow its business by 2X amidst Covid-19 with the help of instant working capital loans by Razorpay Capital. Read more to know how.