Updated on 16th January, 2025

Table of Contents

What is Cash on Delivery?

Cash on delivery (COD) is a payment method where customers pay for their online purchases at the time of delivery, rather than in advance. It is popular in regions with low trust in online payments or limited access to digital payment options. While cash on delivery offers convenience to customers, it also increases operational costs and poses return-to-origin (RTO) risks for businesses.

Why do Indian Shoppers Prefer Cash on Delivery?

Cash on delivery remains the most popular payment method for online orders in India. In fact, 65% of Indian shoppers prefer cash on delivery over digital payments like credit/debit cards, net banking, and e-wallets, which account for only 30% of online purchases.

Here are the key reasons why:

- Trust Issues: Many shoppers worry about fraudulent transactions when shopping online.

- Easy and Familiar: Paying with cash is straightforward and familiar to most people.

- Quick and Hassle-Free: There are no additional steps like entering card details.

- Post-Purchase Concerns: Customers prefer cash on delivery to avoid potential refund issues.

- Limited Digital Payment Use: In Tier 2 and Tier 3 cities, cash is more widely accepted.

-

Product Inspection: Cash on delivery allows customers to inspect the product before making payment.

For example, when Flipkart introduced the COD payment option in 2010, it revolutionized e-commerce in India, allowing even customers without bank accounts to shop online. This accessibility helped make Flipkart a household name.

How Cash on Delivery in India

- Customer Places Order: The customer selects products and adds them to their cart.

- Customer Chooses COD: At checkout, the customer selects the “Cash on Delivery” option.

- Order Processing and Shipping: The business processes and ships the order.

- Delivery and Payment: The delivery agent collects payment in cash or via digital means, such as UPI.

- Order Completion: Once payment is received, the order is considered complete.

Cash on Delivery: Pros and Cons

| Pros | Cons |

|

Increased Customer Trust |

Higher Operational Costs |

|

Expanded Customer Base |

Restricted Cash Flow |

|

Boosted Impulse Buying |

Increased Risk of Fraud |

|

Reduced Cart Abandonment |

Higher Return Rates |

|

Enhanced Market Reach |

Complex Refund Process |

|

Improved Customer Satisfaction |

Operational Challenges |

Cash on Delivery vs. Cash in Advance

- Cash on Delivery (COD) allows customers to pay at the time of delivery, reducing the perceived risk of online fraud but increasing business costs.

- Cash in Advance requires customers to pay upfront, ensuring immediate payment but potentially deterring hesitant customers.

What Are Examples of Cash on Delivery?

Common examples of Cash on Delivery in India include:

- E-commerce Deliveries: Online orders from platforms like Amazon, Flipkart, and local stores where customers pay in cash or via digital payment upon delivery.

- Food Delivery Services: Ordering meals from restaurants or food delivery apps like Zomato and Swiggy, where payment is made at the time of delivery.

-

Grocery Deliveries: Purchasing groceries from local vendors or online grocery stores that allow cash payment upon receiving the order.

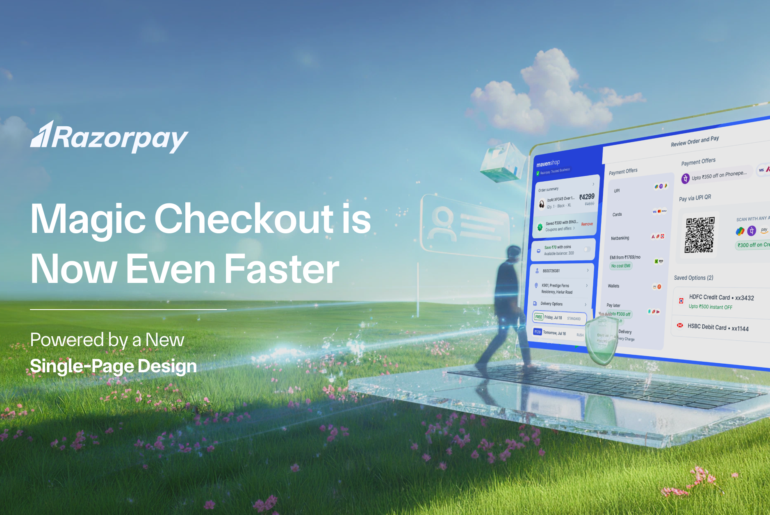

Offer Cash on Delivery Confidently With Magic Checkout

While cash on delivery offers significant benefits, it also presents challenges like fraudulent orders, incorrect addresses, and high return rates. Razorpay’s Magic Checkout helps businesses combat these issues with advanced COD features and analytics.

Additionally, if you have a store on Shopify, you can now configure COD settings directly from the Razorpay dashboard. This upgrade eliminates the need for Shopify’s ACOD app and other cash on delivery plugins, allowing for a seamless and efficient setup directly through Razorpay. Save time and streamline your operations with our integrated solution.

COD Intelligence (Smart COD)

COD Intelligence is powered by billions of data points and trained on extensive shopping patterns. Its sole mission is to protect businesses from high-risk COD orders. Here’s how it works:

At checkout, COD Intelligence analyzes the risk level of each shopper in real-time.

Based on this analysis, it can dynamically decide to:

- Enable cash on delivery for low-risk shoppers.

- Disable cash on delivery for high-risk shoppers.

- Offer partial cash on delivery as a middle ground for medium-risk shoppers.

This advanced decision-making capability ensures businesses can minimize RTO costs while maintaining a seamless shopping experience for customers.

RTO Analytics Dashboard

The RTO Analytics Dashboard transforms raw RTO data into actionable insights, empowering businesses to optimize their operations.

The dashboard provides a clear overview of RTO performance over the past 90 days, highlighting:

Total Orders: The overall number of orders processed.

High-Risk Orders: Orders identified as having a high probability of being returned.

Low-Risk Orders: Orders deemed unlikely to be returned.

Gain valuable insights into the factors contributing to high-risk order designations:

Address Validation: Identify patterns in incorrect or incomplete addresses.

Order Behavior Analysis: Detect unusual purchasing patterns indicative of potential RTOs.

Use data-driven recommendations to minimize RTOs:

Identify Problem Areas: Pinpoint specific regions or customer segments with higher RTO rates.

Analyze Customer Behavior: Uncover trends in customer actions that lead to returns.

Implement Targeted Strategies: Develop and execute plans to address identified issues.

By combining sophisticated analytics with proactive RTO prevention, Magic Checkout helps businesses increase revenue, improve efficiency, and enhance the customer experience.

RTO Protection

Razorpay provides e-commerce stores with RTO protection on all Magic Checkout fulfilled orders. Razorpay wants E-commerce businesses to incur less loss, and that’s why Magic Checkout is here to absorb the RTO costs. It can help E-commerce businesses overcome RTO losses and boost growth.

Advanced COD Controls

- Flexible Slab Configurations: Businesses can create multiple COD eligibility slabs based on cart value, enabling tailored COD options for different customer segments.

- Geographic & Product-Level Controls: Easily sync your shipping profiles, zones, and methods from Shopify to configure COD accordingly. This feature allows you to set COD preferences at the product, geographic, and shipping method levels, offering greater flexibility and precision.

- Advanced Blocking Options: For enhanced security and control, block COD for specific pin codes, customer phone numbers, email addresses, and IP addresses directly from the Razorpay dashboard.

- Enhanced Product Category Management: The Advanced COD version introduces product categories, enabling businesses to set unique COD rules and rates for each category. This allows for granular control over the shopping experience, ensuring customized configurations for diverse product offerings.

All these advanced COD settings are seamlessly integrated into the “COD Settings” tab on the Razorpay dashboard. Enabling the COD feature is as simple as toggling a switch, allowing you to configure the settings as per your business requirements.

COD to Prepaid Conversion

One effective strategy involves targeted outreach to customers who opt for cash on delivery orders. Through personalized WhatsApp messages, businesses can incentivize customers to convert their COD orders to prepaid by offering discounts or incentives. These messages include a Razorpay payment link, enabling customers to make prepayments and streamline the transaction process conveniently. Additionally, merchants can consider implementing an extra COD fee as a deterrent for COD orders, encouraging customers to choose prepaid options and further optimizing their payment processes.

By prioritizing prepaid orders and leveraging the capabilities of Magic Checkout, businesses can enhance their cash flow, reduce return rates, and simplify operational processes.

Multiple Payment Options

In the past, customers had to choose between cash on delivery and online payments, each in its own category. Online payment methods like cards and UPI were listed separately. Now, with Magic Checkout, all payment options, including COD, appear together in one view. This simplifies the process for customers, allowing them to easily select their preferred payment method and place an order without any confusion.

Wrapping Up

While cash on delivery is popular in India, it doesn’t have to be a business risk. Magic Checkout empowers businesses to leverage COD while minimizing costs and operational challenges. By optimizing RTO management and offering advanced COD controls, businesses can enhance their customer experience and drive profitability.

Get Started with Magic Checkout today to reduce RTO losses and streamline your COD payment processes.