UPI is no longer just a convenience—it’s the infrastructure of India’s digital economy.

Since its launch in 2016, UPI has grown into a force of nature, processing over 18.3 billion transactions worth ₹24.77 lakh crore in a single month—March 2025. And it’s not slowing down. Over 80% of all retail digital payments in India now ride the UPI rails.

But here’s what matters most for businesses: UPI is no longer just a peer-to-peer tool. It’s now predominantly a business-to-consumer engine. In 2025, over 62% of all UPI transactions are P2M (Person-to-Merchant). What started as a consumer convenience has become the backbone of commerce.

Yet the infrastructure hasn’t kept up.

The Razorpay Way: Business UPI, Built Differently

Business UPI is more than just a product—it’s a philosophy. One grounded in three core principles:

- Innovation First

- Frictionless Experiences

- Infrastructure You Can Trust

Let’s break down what that actually means for your business.

Pillar 1: Be First to What’s Next

The payments space moves fast. Blink and there’s a new NPCI protocol or feature. But here’s the catch—most businesses don’t get access to those innovations for months, sometimes a year, after launch.

Why? Because banks and traditional TSPs (Technology Service Providers) take forever to implement them.

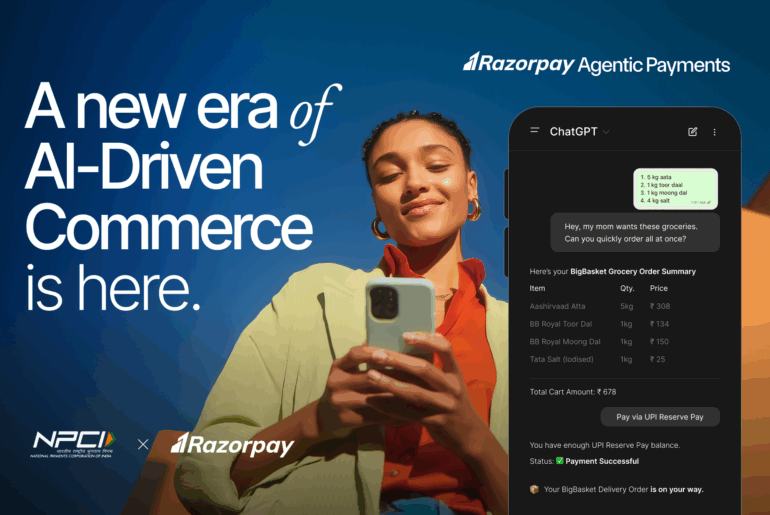

At Razorpay, we decided that wasn’t good enough. So we built an innovation engine—giving businesses first-mover access to the latest UPI capabilities.

Here’s what that looks like:

- RuPay Credit Cards on UPI (Dec 2022): We were the first gateway to support them. Now you can accept credit payments via UPI with no change in UX.

- UPI Credit Lines (Jan 2024): Offer flexible credit without cards. Our merchants saw immediate lifts in average order value.

- Turbo UPI (May 2023): A completely in-app UPI experience. No more switching apps. Just seamless checkouts in under 4 seconds.

- UPI AutoPay (2020): Razorpay was an early partner at launch—enabling recurring billing with minimal effort.

The result? You’re not waiting for the ecosystem to catch up—you’re leading it.

Pillar 2: Frictionless by Design

A payment experience is more than just a transaction—it’s the moment of truth. One glitch, and your customer is gone.

So we redesigned every pixel and protocol of the UPI experience to make it faster, smoother, and more reliable.

⚡ Turbo UPI: Checkout Without Switching Apps

Turbo UPI eliminates the classic friction of redirecting to a UPI app. Instead, customers complete the payment inside your app. It’s 5x faster, improves success rates by ~10%, and gives you full control over the UX.

No drop-offs. No guesswork. Just conversion.

🔁 SR Boosters: For Legacy Flows, Too

Even if you’re on UPI Collect flows (where customers enter their VPA), we’ve built “SR Boosters” that optimize the backend:

- VPA Caching: We validate most VPAs in under 100ms (vs. 10+ seconds on bank systems).

- Saved VPAs: For repeat customers, we eliminate the need to re-enter anything.

- Smart Intent Fallbacks: We route payments intelligently, based on the device and success rate.

Together, these boost reliability—even if you’re not yet on Turbo UPI.

Pillar 3: Infrastructure That Just Doesn’t Break

This is where we go beyond being a payment gateway. Because while most providers are plugging into someone else’s stack, we built our own UPI Switch.

It’s now live at Airtel Payments Bank and Axis Bank, and here’s what it brings to the table:

- <100ms latency: Lightning-fast transaction times.

- 10,000+ TPS: Peak-scale ready.

- +4–5% SR uplift: Compared to industry average.

- 99.99% uptime: Because your business doesn’t take breaks.

And it’s not just about performance—it’s about control.

Because we own the switch, we can:

- Launch new NPCI features 5x faster than industry norms.

- Issue refunds instantly (not 3–5 days).

- Resolve disputes in under 24 hours (vs. 7 days industry average).

That’s not just infrastructure—it’s a competitive advantage.

So What Does This Mean for You?

If you’re a high-growth business, this changes everything.

Instead of treating UPI like a checkbox, you can use it as a growth lever. Faster payments. Fewer drop-offs. More revenue. Better customer experiences.

Whether you’re scaling an e-commerce giant, running a subscription product, or enabling gig economy payouts—Business UPI gives you the infrastructure, features, and reliability to do it better.

No hacks. No compromises. Just outcomes.

The Future is Business-First

UPI is evolving. And with over 62% of all UPI transactions now coming from P2M use cases, the writing is on the wall:

The future of UPI is business-led.

But not all providers are building for that future. Razorpay is.

We’re not just helping you accept payments—we’re helping you convert better, scale faster, and operate smoother. That’s the power of Business UPI.

Ready to Level Up?

If you’re serious about building a business for India’s next billion, it’s time your payments stack kept up.

Business UPI by Razorpay isn’t just an upgrade. It’s a transformation.