Renting (goods and services) has become a huge part of Indian consumerism, especially over the last few years. This shift is a result of consumers, millennials in specific, choosing customised products and services on demand, over shorter periods of time, over making a purchase.

And, this has resulted in the Indian renting economy to become one of the biggest in the country, at an estimated $1.5 billion.

While rental companies provide tailor-made products and services to today’s demanding customers, they don’t fail to see their fair share of challenges.

Meet Furlenco.

Furlenco is India’s leading, top-rated furniture and appliance rental company that makes luxury affordable in a credit-strapped economy. The company provides their customers with access to premium furniture and appliances at affordable pricing, while giving them the flexibility of renting products for as short or long as they would prefer, without having to commit to buying anything.

Over the years, having serviced over 2,50,000 customers across the country, Furlenco has become a significant contributor for “rent” to win in the battle of “rent vs buy.”

As we speak, the company has over 50,000 active customers on the platform, across Bangalore, Mumbai, Pune, Delhi, Gurugram, Noida, Hyderabad, and Chennai.

The big “refunds” problem

Unlike e-commerce companies that make refunds on nearly 30% of their orders, rental companies end up making refunds on all of their orders – security deposit.  When a customer rents a product on Furlenco, they also make a security deposit, which is worth a single month’s rent. And, this security deposit is fully refunded when the customer cancels the subscription of the product.

When a customer rents a product on Furlenco, they also make a security deposit, which is worth a single month’s rent. And, this security deposit is fully refunded when the customer cancels the subscription of the product.

This refund isn’t that big of a problem when the duration of the subscription is short; Furlenco can simply refund the deposit to the source of payment.

But, a typical rental subscription tenure on the platform is at least 18 months. This makes it unfeasible for the team to track a transaction made over 18 months ago to reverse a payment.

How Furlenco dealt with refunds

Apart from refunding security deposits, Furlenco also had to deal with rental refunds when a customer would cancel their subscription midway, after paying rent for the entire tenure.

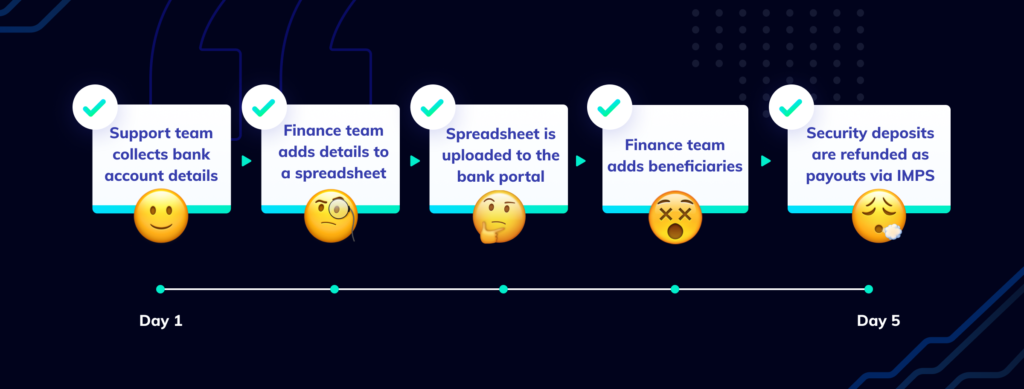

Since reversing these payments was not an option for Furlenco, they would collect the bank account details of their customers, while the Finance team would create a spreadsheet with all the details. This spreadsheet would be uploaded to the bank portal. Next, they would add beneficiaries and wait out the cooling period. Finally, the security deposits were refunded as payouts via IMPS.

This was clearly a short-term fix since it wasn’t a closed system. The whole process would go through multiple touchpoints, right from the Support team collecting customer details to the Finance team dealing with payouts. Also, the refunds were not real-time.

Besides, there were several times when their customers would not provide their bank account details on time, or provide erroneous details to them. And, validation of bank account details also became a hurdle for Furlenco.

On the other hand, their customers had to wait for 3 to 5 business days for refunds. This also increased complaints, while lowering customer satisfaction.

This is when they realised they had to streamline the whole process of refunds.

The breakthrough

Furlenco adopted a payouts solution that helped streamline refunds from their earlier process. But, because of recurring stability issues, the process was not as seamless as they wanted it to be.

This is when they turned to RazorpayX.

Razorpay was no stranger to Furlenco. While they have been using Razorpay – the best payment gateway in India, to accept payments on their platform, they had not integrated with Razorpay’s neobanking platform, RazorpayX, which enables payouts and banking.

Furlenco adopted RazorpayX Payout Links to solve their problem. And within no time, they experienced a massive change.

After the integration, from an engineering point of view, RazorpayX Payout Links was a much better solution in terms of stability, design, and ease of use. And, RazorpayX became our primary mode of making payouts.

With Payout Links, Furlenco was able to build a set of robust processes, which helped them eliminate the multiple touchpoints throughout making refunds.

Faster refunds: Before RazorpayX Payout Links, refunds would typically take a span of 5 to 7 business days. Since payouts made via RazorpayX are API driven, Furlenco was able to automate their process, while ensuring the refunds were under 20 seconds. This increased their customer happiness, loyalty and trust.

Seamless user experience: With unlimited auto-retries, Payout Links also significantly decreased the failure of payouts, while ensuring real-time refunds. This further reduced the number of tickets raised with support by 70%, thereby increasing customer satisfaction.

Reduced manual effort: From the earlier Support and Finance teams going back and forth in order to get all the required customer details to make refunds, to automating the process, Furlenco reduced the number of touchpoints and manual work by 77%.

With RazorpayX, Furlenco was able to optimise and streamline their entire refunds process by reducing manual efforts and automating refunds. This led to happier customers and a better experience for the Furlenco team. A win-win situation!