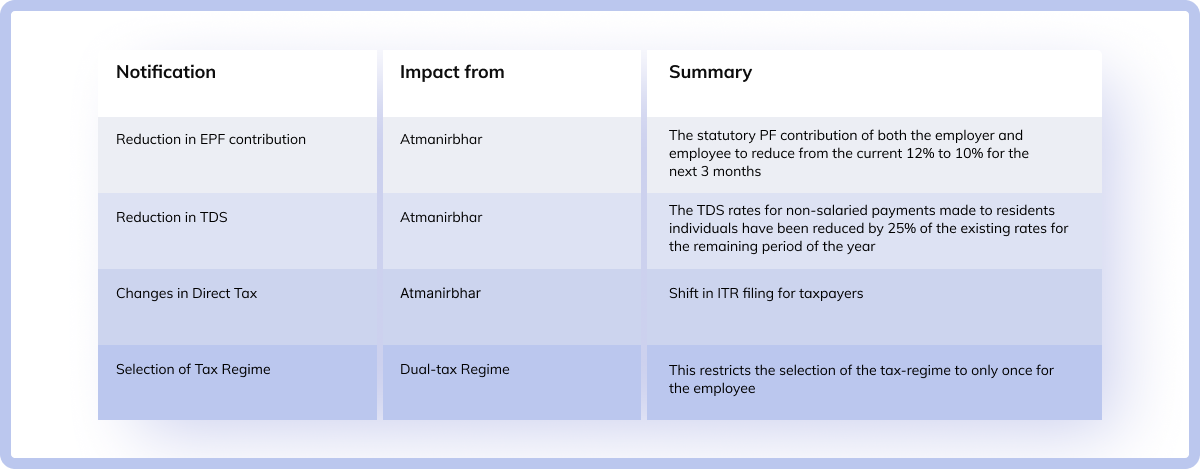

Recently, the Atmanirbhar Bharat Abhiyaan package made headlines all across the country. The government announced major steps that will be taken to alleviate some of the impacts of the pandemic on the economy.

The package involves fiscal policy and relief measures for various industries as the economic ramifications of the pandemic have left no sector untouched.

Read more: Highlights from the Atmanirbhar Package

How does Atmanirbhar prompt payroll changes?

As a part of the relief package, the government also introduced a few measures that will change payroll processing to an extent. Here are the major payroll changes in effect.

- Reduction in EPF contribution

- Minimised TDS rates

- Changes in Direct Tax (ITR filing deadline)

- Selection of tax regime (Dual Tax Regime)

EPF contribution rate

Under the Atmanirbhar package, the EPF contribution rate of both employer and employee is reduced to 10% from the previous 12%. This is for all categories of businesses that come under the EPF & MP Act, 1952.

This payroll change is introduced to aid both employers and employees of over 6 lakh businesses manage funds in a slightly relaxed manner.

As a result of the reduction in the EPF contribution rate, employees will have access to higher liquid funds because of higher take-home pay. This also helps lower the liabilities of employers to a certain extent.

This payroll change is applicable for the months of May, June, and July.

Note: The reduced EPF contribution rate is the minimum number for the period mentioned above. However, employers and employees can make higher contributions.

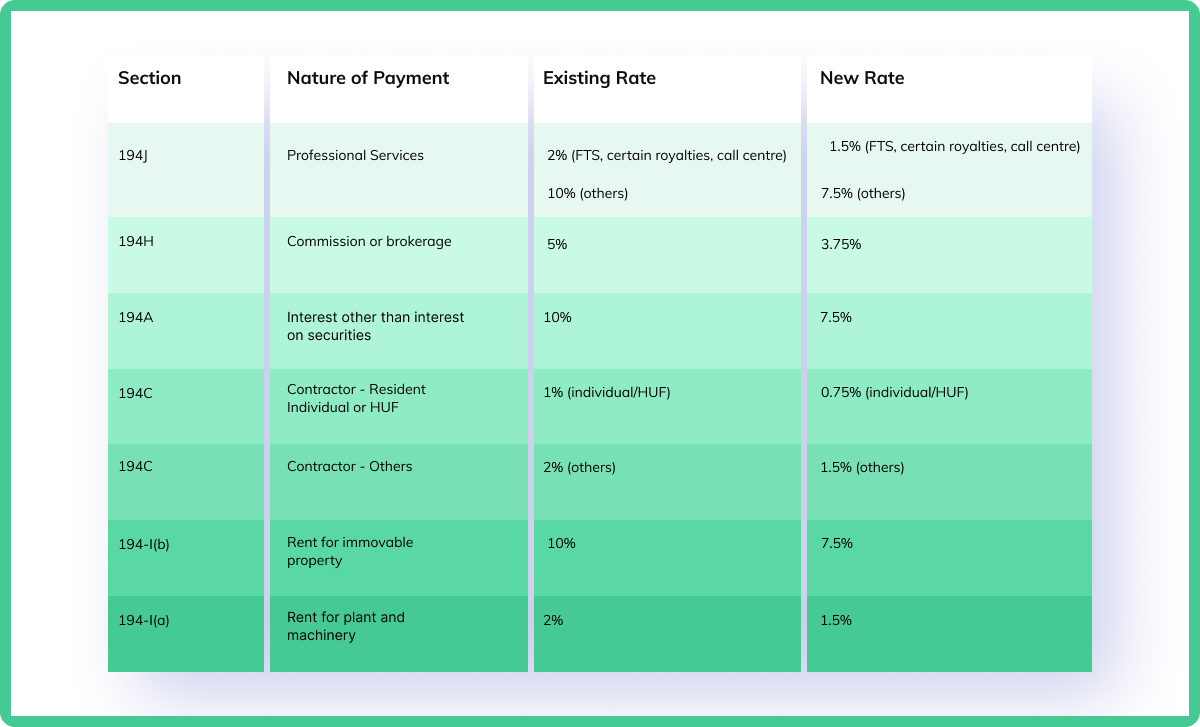

New TDS rates

During the Atmanirbhar package announcement, the government also called forth the new TDS rates.

According to the announcement, there is a reduction in the tax deducted at source by 25% for all non-salaried payments. Dividend Income, interest on Fixed Deposit, and more fall under the category and the TDS rates are applicable at different levels.

The new TDS rates have come to effect as of May 14th 2020 and will continue to be applicable for the financial year 2020-21.

ITR filing deadline

The Atmanirbhar relief package also pushed forward a change in filing Income Tax Returns.

The government announced that there would be an extension for ITR filing deadline. Earlier, the ITR filing deadline was July 31st 2020, from which the due date is pushed to December 31st 2020.

The extension in the deadline is a part of the earlier extension made for receiving Form 16 from March 31st 2020 to June 30th 2020. This is to ease some burden on the taxpayers for the financial year.

Tax regime selection (Dual Tax Regime)

Although not a part of the Atmanirbhar package, the Dual Tax Regime has also resulted in payroll changes. The regime brings prevalent changes in the way taxes are calculated from the financial year 2020-21. As opposed to the higher tax slabs with benefits and exemptions, the new tax regime is all about lower tax slabs, but without the benefits and exemptions.

- The new income tax for employees whose income lies between ₹5 lakh and ₹7.5 lakh is 10% whereas according to the old regime, the income tax is 20%

- The next slab is for the range between ₹7.5 lakh and ₹10 lakh, where the tax is 15% while the tax is 20% in the old regime

- Employees with income between ₹ 10 lakh and ₹ 12.5 lakh would pay 20% tax, which is reduced from 30% in the old regime

- Finally, for income over ₹ 15 lakh, the tax is 30%

Payroll changes – how to be compliant

Since there are multiple changes in payroll, it is absolutely important for businesses to be compliant.

If you are dealing with payroll using spreadsheets or an outdated payroll software, it can set you back in more ways than one. Change management is one of the biggest troubles if you have to implement every single one of the payroll changes. This can limit your productivity since payroll processing is laborious and time-consuming.

Next, your HR team will have to spend long hours every month to keep up.

If you are wondering how you can manage payroll with minimum impact while being compliant, we have a solution for you.

RazorpayX Payroll is 100% compliant with payroll changes

RazorpayX Payroll is compliant with all the new regulations that have come about as a part of the Atmanirbhar relief package. You don’t have to worry about dealing with compliance ever again!

It is also compliant with the Dual Tax Regime, allowing employees to choose their preferred regime during the time of their investment declaration for the financial year.

Employees can see their projected taxes for the year based on their income and regime so that they can make an informed decision keeping their tax liabilities and savings in mind.

Further, you completely automate your payroll process without any manual intervention.

Don’t rely on outdated payroll software while you can carry out your payroll operations without any interruptions. Stay up-to-the-minute with changing regulations and compliance with RazorpayX Payroll while it does all the hard work for you.