Are you an apparel exporter, navigating the complexities of international trade and wondering if you’re making the most of government incentives? If you’re exporting garments from India but aren’t sure if you qualify for all the available benefits, you might be leaving money on the table.

Enter the RoSCTL Scheme, or the Refund of State and Central Taxes & Levies. This is a crucial government initiative designed specifically to support India’s apparel and made-up textile exporters. It refunds the hidden, embedded taxes that aren’t covered by a standard GST refund, directly boosting your profitability and global competitiveness.

This guide will walk you through everything you need to know about the RoSCTL scheme—from its full form and benefits to the eligibility criteria and the step-by-step process to claim your refund.

Key Takeaways

|

What is the RoSCTL Scheme in India?

The full form of RoSCTL is the Refund of State and Central Taxes & Levies. Launched in March 2019 by the Ministry of Textiles, it replaced the older Rebate of State Levies (RoSL) scheme. Its core purpose is to reimburse exporters for those indirect taxes and levies that are incurred during the production process but are not refunded through the GST framework.

Think of taxes like VAT on fuel for transportation, electricity duty, mandi tax, and embedded duties on raw materials. These costs add up and can inflate the final price of your export products. The RoSCTL scheme zeroes in on these specific costs to ensure Indian textile exports aren’t at a disadvantage globally.

The scheme applies to exporters of:

- Garments and Apparel (Chapter 61 & 62)

- Made-up textile articles like bed linens, curtains, and towels (Chapter 63)

| Did You Know?

The RoSCTL scheme was introduced to be compliant with the World Trade Organization (WTO) regulations. It replaced older schemes that faced objections from international trade partners, making it a more stable and sustainable incentive for Indian exporters. |

RoSCTL Scheme Benefits

The scheme offers a powerful financial cushion, helping exporters streamline their operations and grow their business. Here’s a breakdown of the key advantages:

| Benefit | Description |

| Refund of Embedded Taxes | It refunds various state and central levies (like duty on fuel, electricity, etc.) that are not covered under GST refunds, directly lowering your production cost. |

| Improved Cash Flow | Refunds are issued as tradable e-scrips. If you don’t need them for your own import duties, you can sell them to another importer, converting the benefit into liquid cash. |

| Competitive Global Pricing | By reducing the tax burden, the scheme helps you lower the landed cost of your goods for international buyers, making your pricing more competitive. |

| Simplified Claim Process | The application and refund process is integrated with the ICEGATE and DGFT portals, making it a seamless, digital experience for exporters. |

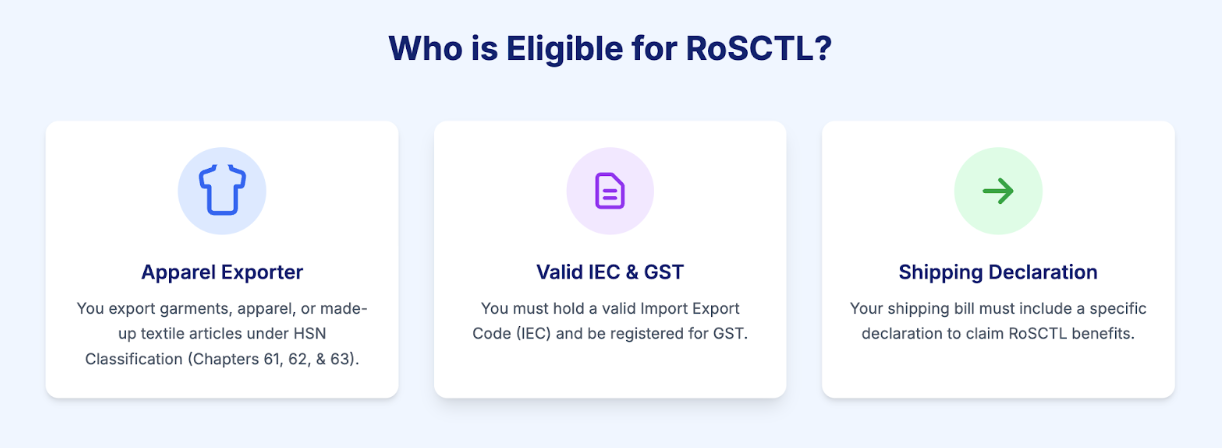

Who is Eligible for RoSCTL?

To take advantage of the RoSCTL scheme, you must meet a few specific criteria. Eligibility is straightforward:

- You must be an exporter of garments, apparel, or made-up textile articles with products specified under Chapters 61, 62, and 63 of the HSN/ITC classification.

- You must have a valid Import Export Code (IEC) and GST registration.

- The claim must be made against a shipping bill that includes a declaration for RoSCTL benefits.

- You must not have claimed benefits under the Duty Drawback scheme for the same central and state levies.

Essentially, if you are a legitimate manufacturer-exporter or merchant-exporter dealing in Indian-made textiles and apparel, you are likely eligible.

Current RoSCTL Claim Rates

The rebate rates under RoSCTL are calculated as a percentage of the Free on Board (FOB) value of your exports. These rates are determined by the government and are updated periodically. While the rates can vary, they generally provide a significant refund.

Here’s an example of what the rates might look like:

| Product Category | Example RoSCTL Rate (% of FOB) |

| Cotton Apparel | 6.05% |

| Made-up Textile Articles | 8.2% |

| Disclaimer: The rates mentioned above are for illustrative purposes. It is crucial to always verify the latest official notifications from the Directorate General of Foreign Trade (DGFT) or the Ministry of Textiles for the most accurate and current rates applicable to your specific products. |

Documentation and Compliance

A smooth claim process hinges on having the right documentation. Thankfully, the process is largely digital. Here is a checklist of the essential documents and details you’ll need:

✅ Shipping Bill: This is the primary document. Ensure it is filed with the RoSCTL declaration.

✅ Valid GST Invoice

✅ Import Export Code (IEC)

✅ DGFT Digital Signature Certificate (DSC): Required for online application submission.

✅ Registration Cum Membership Certificate (RCMC): Proof of registration with a relevant Export Promotion Council.

✅ Bank Realization Certificate (BRC) or e-BRC: Proof of receipt of payment from the overseas buyer.

| Pro Tip: Before filing your shipping bill, double-check that your HS codes are correct and that you have explicitly declared your intent to claim RoSCTL benefits. A simple error here can lead to delays or rejection of your claim. |

How to Apply for RoSCTL?

The application process is handled online through the DGFT portal, making it efficient and transparent. Here are the general steps:

- Declare in Shipping Bill: First and foremost, you must declare your intention to claim RoSCTL in your shipping bill when filing it on the ICEGATE portal.

- Link Your Accounts: Ensure your DGFT account is linked with your IEC and your Digital Signature Certificate is registered.

- Lodge Your Claim: After the export is completed and the shipping bill is processed, log in to the DGFT portal.

- Fill the Application: Navigate to the RoSCTL claim section and fill out the application form (ANF 4R), linking the relevant shipping bills. You can add up to 50 shipping bills in a single application.

- Submit and Track: Submit the application using your Digital Signature Certificate. The system will process your claim.

- Receive E-Scrips: Once approved, the rebate will be issued in the form of e-scrips, which will be credited to your electronic ledger on the DGFT portal. You must file the claim within 12 months from the Let Export Order (LEO) date on the shipping bill.

Accept International Payments Seamlessly with Razorpay

If you’re claiming RoSCTL, you’re already an active exporter. The next logical step is to ensure that getting paid by your overseas buyers is just as streamlined and efficient as your export incentives.

This is where Razorpay International comes in.

Why do smart exporters prefer Razorpay for their international payments?

- Accept Payments Globally: Receive payments in 100+ foreign currencies, including USD, EUR, GBP, and more.

- Hassle-Free Settlements: Get funds settled directly into your Indian bank account in Indian Rupees (INR).

- Automated Compliance: Benefit from auto-generated Foreign Inward Remittance Advice (e-FIRA) with correctly mapped purpose codes, simplifying your compliance burden.

- Exporter-Friendly Invoicing: Generate professional, export-compliant invoices with ease.

- Seamless Integrations: Razorpay works perfectly with Shopify, Amazon Global Selling, WooCommerce, and custom-built websites.

Simplify International Payments with Razorpay

Ready to Grow Your Global Exports?

Conclusion

The RoSCTL scheme is more than just a policy; it’s a powerful tool designed to fuel the growth of India’s textile export industry. By refunding embedded taxes, it directly reduces your costs, enhances your profitability, and makes your products more competitive on the world stage.

For any apparel or made-up textile exporter, understanding and utilizing this scheme is not just an option—it’s a strategic business decision. Ensure your documentation is in order, file your claims promptly, and make RoSCTL a key part of your export finance strategy.

FAQs

-

Is claiming RoSCTL mandatory for garment exporters?

No, it is not mandatory. It is an optional incentive scheme. However, not claiming it means you are missing out on a significant financial benefit that can lower your export costs.

-

Can you claim both a GST refund and RoSCTL?

Yes, you can. The GST refund covers the Goods and Services Tax paid on inputs, while RoSCTL refunds other embedded central and state taxes that are not covered by GST. They are two separate benefits for different types of taxes.

-

What is the deadline for claiming RoSCTL benefits?

You must submit your claim on the DGFT portal within one year (12 months) from the date of the Let Export Order (LEO) issued for your shipping bill.

-

Are services exporters eligible for RoSCTL?

No. The RoSCTL scheme is specifically designed for the export of physical goods, limited to apparel, garments, and made-up textile articles under HSN Chapters 61, 62, and 63.

-

What if an exporter changed their GST number after shipment?

The RoSCTL claim is tied to the GSTIN mentioned in the shipping bill at the time of export. If your GST number changes, you should immediately update your details in your IEC profile on the DGFT portal. For specific cases, it is advisable to consult with a customs house agent or the DGFT helpdesk to ensure a smooth claim process.